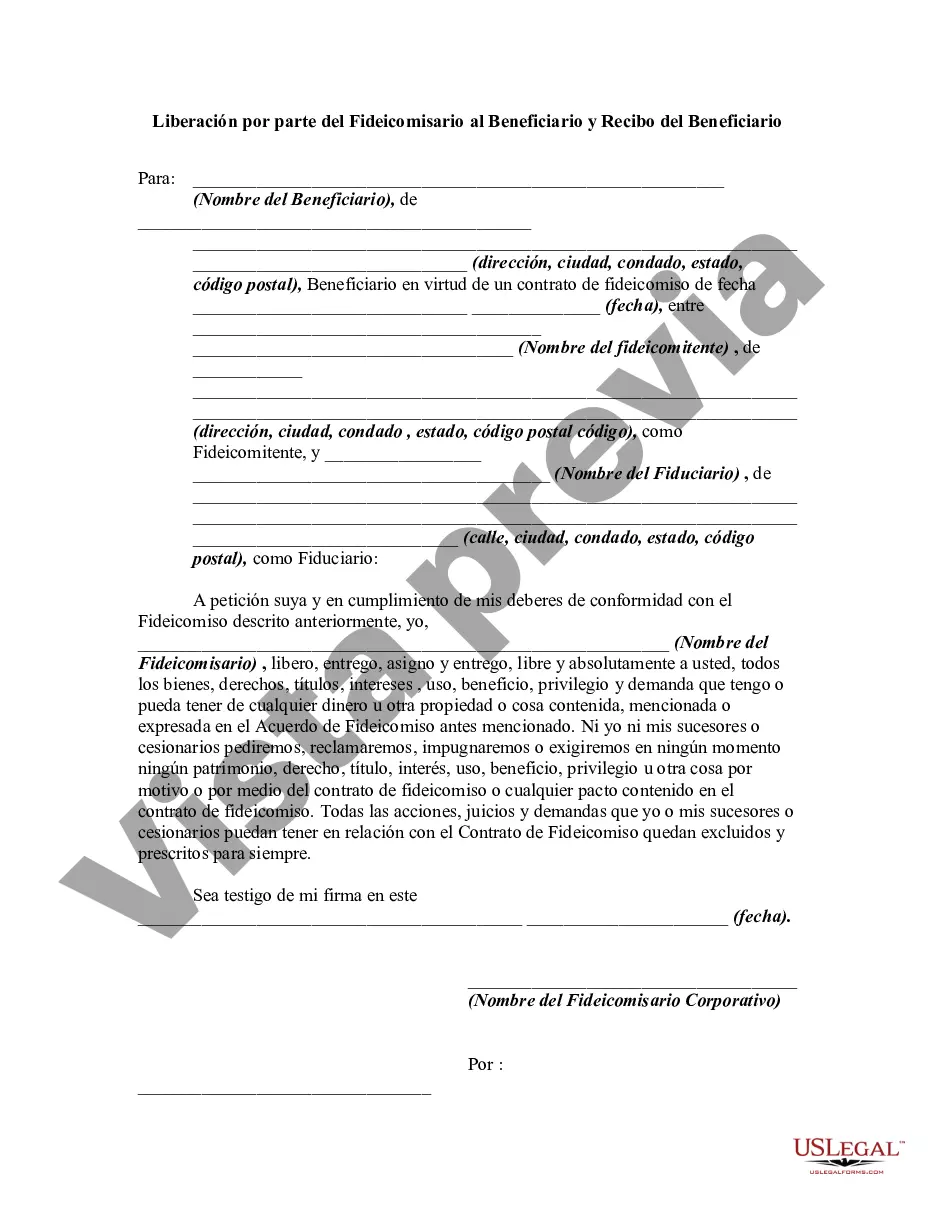

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal process that occurs when a trustee agrees to transfer assets or property to a beneficiary, signifying the completion of their duties and obligations. This document serves as an evidence of the transaction and protects the trustee from any future claims by the beneficiary. In the context of trust administration, the Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary acknowledges the release and receipt of assets from the trustee to the beneficiary, ensuring a smooth transition of ownership. The terms of this document may vary depending on the specific trust agreement and type of assets involved. Some common types of Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary include: 1. Real Estate Transfer: This type of release occurs when the trustee transfers ownership of real estate or property to the beneficiary. It outlines the legal description of the property, the names of the parties involved, and any conditions or restrictions associated with the transfer. 2. Financial Account Transfer: In this type of release, the trustee transfers funds or financial assets to the beneficiary. It typically includes details such as the account number, the name and address of the financial institution, and any necessary signatures for authorization. 3. Personal Property Transfer: This release is used when the trustee transfers personal belongings, such as vehicles, jewelry, or artwork, to the beneficiary. It specifies the nature of the property, its estimated value, and any additional terms or conditions for the transfer. 4. Business Asset Transfer: If the trust includes a business, this type of release documents the transfer of ownership or control from the trustee to the beneficiary. It may include details about shares or stocks, partnership agreements, or any necessary licenses or permits. Regardless of the specific type, the Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a vital legal document that ensures the proper transfer of assets and finalizes the trustee's duties. It provides both parties with a clear understanding of the completed transaction and helps protect their respective rights and interests.Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal process that occurs when a trustee agrees to transfer assets or property to a beneficiary, signifying the completion of their duties and obligations. This document serves as an evidence of the transaction and protects the trustee from any future claims by the beneficiary. In the context of trust administration, the Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary acknowledges the release and receipt of assets from the trustee to the beneficiary, ensuring a smooth transition of ownership. The terms of this document may vary depending on the specific trust agreement and type of assets involved. Some common types of Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary include: 1. Real Estate Transfer: This type of release occurs when the trustee transfers ownership of real estate or property to the beneficiary. It outlines the legal description of the property, the names of the parties involved, and any conditions or restrictions associated with the transfer. 2. Financial Account Transfer: In this type of release, the trustee transfers funds or financial assets to the beneficiary. It typically includes details such as the account number, the name and address of the financial institution, and any necessary signatures for authorization. 3. Personal Property Transfer: This release is used when the trustee transfers personal belongings, such as vehicles, jewelry, or artwork, to the beneficiary. It specifies the nature of the property, its estimated value, and any additional terms or conditions for the transfer. 4. Business Asset Transfer: If the trust includes a business, this type of release documents the transfer of ownership or control from the trustee to the beneficiary. It may include details about shares or stocks, partnership agreements, or any necessary licenses or permits. Regardless of the specific type, the Harris Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a vital legal document that ensures the proper transfer of assets and finalizes the trustee's duties. It provides both parties with a clear understanding of the completed transaction and helps protect their respective rights and interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.