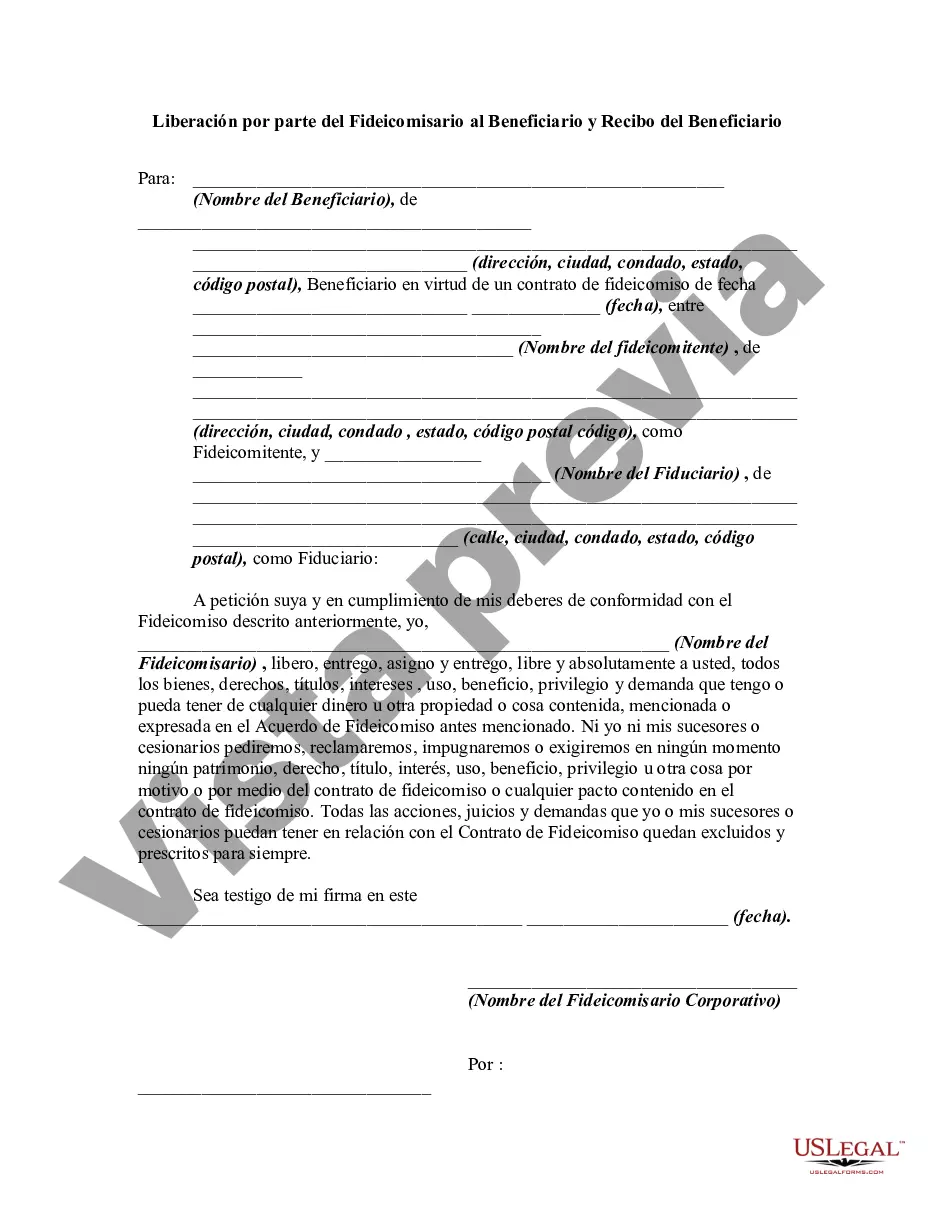

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary: Types and Detailed Description In Mecklenburg County, North Carolina, a Release by Trustee to Beneficiary and Receipt from Beneficiary is a legally binding document that solidifies the termination of a trust arrangement and ensures the smooth transfer of assets to the intended beneficiary. This document serves as evidence that the trustee has fulfilled their duties and obligations, allowing the beneficiary to receive their rightful ownership of the trust assets. There are various types of Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary, which include: 1. Revocable Living Trust Release and Receipt: This type of release occurs when a trustee, who has been managing a revocable living trust on behalf of the granter, transfers the trust assets and property to the designated beneficiary, as stated in the trust agreement. The beneficiary then acknowledges the receipt of these assets, affirming the successful completion of the trust administration. 2. Irrevocable Trust Release and Receipt: This release pertains to an irrevocable trust, which means the trust terms cannot be modified or revoked without the consent of all involved parties. Once the trustee fulfills their obligations and distributes the assets to the beneficiary according to the trust agreement, the beneficiary acknowledges receiving the assets through a Release and Receipt document. 3. Testamentary Trust Release and Receipt: A testamentary trust is created upon the death of the granter, as specified in their will. After the trustee fulfills their responsibilities and disburses the trust assets according to the trust provisions, the beneficiary provides a Receipt and Release to acknowledge the receipt of their inherited assets from the trust. The detailed description of Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary typically includes the following key elements: 1. Trust Identifier: The document should include details about the trust, such as the name of the trust and its date of creation, to ensure proper identification. 2. Names and Contact Information: The full legal names, addresses, and contact information of both the trustee and the beneficiary need to be included. 3. Date of Distribution: The specific date when the trustee transfers the trust assets to the beneficiary should be clearly mentioned. 4. Description of Assets: A comprehensive list and description of the assets being distributed, including real estate properties, financial accounts, investments, personal belongings, or any other assets held in the trust, should be provided. 5. Acknowledgment of Receipt: The beneficiary explicitly acknowledges in writing that they have received the assets and that they are satisfied with the distribution. 6. Release of Trustee: The beneficiary releases the trustee from any further obligations or claims concerning the trust after the assets' transfer. 7. Notarization and Witness: The document may require notarization to enhance its legal validity. Furthermore, having witnesses sign the document can provide additional evidentiary support if needed. When executing a Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary, it is crucial to consult with an attorney experienced in trust law to ensure compliance with local regulations and to protect the rights of all parties involved.Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary: Types and Detailed Description In Mecklenburg County, North Carolina, a Release by Trustee to Beneficiary and Receipt from Beneficiary is a legally binding document that solidifies the termination of a trust arrangement and ensures the smooth transfer of assets to the intended beneficiary. This document serves as evidence that the trustee has fulfilled their duties and obligations, allowing the beneficiary to receive their rightful ownership of the trust assets. There are various types of Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary, which include: 1. Revocable Living Trust Release and Receipt: This type of release occurs when a trustee, who has been managing a revocable living trust on behalf of the granter, transfers the trust assets and property to the designated beneficiary, as stated in the trust agreement. The beneficiary then acknowledges the receipt of these assets, affirming the successful completion of the trust administration. 2. Irrevocable Trust Release and Receipt: This release pertains to an irrevocable trust, which means the trust terms cannot be modified or revoked without the consent of all involved parties. Once the trustee fulfills their obligations and distributes the assets to the beneficiary according to the trust agreement, the beneficiary acknowledges receiving the assets through a Release and Receipt document. 3. Testamentary Trust Release and Receipt: A testamentary trust is created upon the death of the granter, as specified in their will. After the trustee fulfills their responsibilities and disburses the trust assets according to the trust provisions, the beneficiary provides a Receipt and Release to acknowledge the receipt of their inherited assets from the trust. The detailed description of Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary typically includes the following key elements: 1. Trust Identifier: The document should include details about the trust, such as the name of the trust and its date of creation, to ensure proper identification. 2. Names and Contact Information: The full legal names, addresses, and contact information of both the trustee and the beneficiary need to be included. 3. Date of Distribution: The specific date when the trustee transfers the trust assets to the beneficiary should be clearly mentioned. 4. Description of Assets: A comprehensive list and description of the assets being distributed, including real estate properties, financial accounts, investments, personal belongings, or any other assets held in the trust, should be provided. 5. Acknowledgment of Receipt: The beneficiary explicitly acknowledges in writing that they have received the assets and that they are satisfied with the distribution. 6. Release of Trustee: The beneficiary releases the trustee from any further obligations or claims concerning the trust after the assets' transfer. 7. Notarization and Witness: The document may require notarization to enhance its legal validity. Furthermore, having witnesses sign the document can provide additional evidentiary support if needed. When executing a Mecklenburg North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary, it is crucial to consult with an attorney experienced in trust law to ensure compliance with local regulations and to protect the rights of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.