This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Miami-Dade Florida Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that outlines the transfer of assets or property held in trust by a trustee to the designated beneficiary. This transaction signifies the completion of the trust and ensures that the beneficiary receives their entitlements as stated in the trust agreement. Keywords: Miami-Dade Florida, release, trustee, beneficiary, receipt, assets, property, trust agreement, completion. There are a few different types of Release by Trustee to Beneficiary and Receipt from Beneficiary commonly used in Miami-Dade County, Florida. Some variations include: 1. Absolute Release: This type of release signifies the full and final transfer of all assets or property from the trustee to the beneficiary. It confirms that the trustee has fulfilled their obligations and the beneficiary has received their complete entitlement. 2. Partial Release: In some cases, the trust agreement may dictate the release of only a portion of the assets or property to the beneficiary. A partial release enables the trustee to transfer a specified portion while retaining the remainder in the trust. 3. Conditional Release: A conditional release may be utilized when certain conditions or requirements need to be satisfied before the assets or property can be transferred to the beneficiary. Once these conditions are met, the trustee releases the assets to the beneficiary as per the terms outlined in the trust agreement. 4. Interim Release: When there is a need for immediate access to some or all of the assets or property held in trust, an interim release can be requested. This type of release grants the beneficiary temporary control over the specified assets until a permanent transfer is possible. Completing a Miami-Dade Florida Release by Trustee to Beneficiary and Receipt from Beneficiary involves careful attention to detail, adherence to legal procedures, and may require the involvement of legal professionals or notaries. It is crucial for both trustees and beneficiaries to understand their respective rights and responsibilities to ensure a seamless transfer of assets while safeguarding the integrity of the trust.Miami-Dade Florida Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that outlines the transfer of assets or property held in trust by a trustee to the designated beneficiary. This transaction signifies the completion of the trust and ensures that the beneficiary receives their entitlements as stated in the trust agreement. Keywords: Miami-Dade Florida, release, trustee, beneficiary, receipt, assets, property, trust agreement, completion. There are a few different types of Release by Trustee to Beneficiary and Receipt from Beneficiary commonly used in Miami-Dade County, Florida. Some variations include: 1. Absolute Release: This type of release signifies the full and final transfer of all assets or property from the trustee to the beneficiary. It confirms that the trustee has fulfilled their obligations and the beneficiary has received their complete entitlement. 2. Partial Release: In some cases, the trust agreement may dictate the release of only a portion of the assets or property to the beneficiary. A partial release enables the trustee to transfer a specified portion while retaining the remainder in the trust. 3. Conditional Release: A conditional release may be utilized when certain conditions or requirements need to be satisfied before the assets or property can be transferred to the beneficiary. Once these conditions are met, the trustee releases the assets to the beneficiary as per the terms outlined in the trust agreement. 4. Interim Release: When there is a need for immediate access to some or all of the assets or property held in trust, an interim release can be requested. This type of release grants the beneficiary temporary control over the specified assets until a permanent transfer is possible. Completing a Miami-Dade Florida Release by Trustee to Beneficiary and Receipt from Beneficiary involves careful attention to detail, adherence to legal procedures, and may require the involvement of legal professionals or notaries. It is crucial for both trustees and beneficiaries to understand their respective rights and responsibilities to ensure a seamless transfer of assets while safeguarding the integrity of the trust.

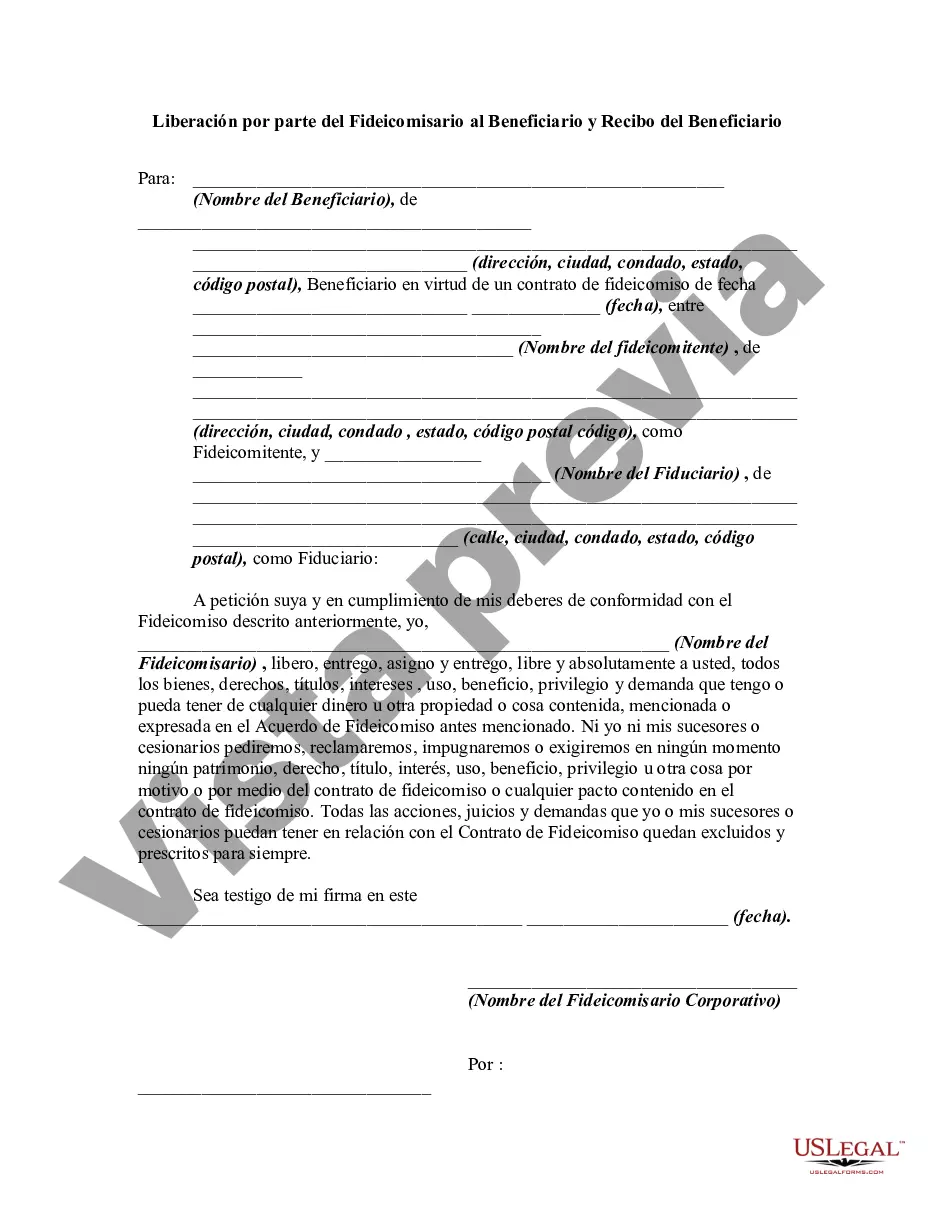

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.