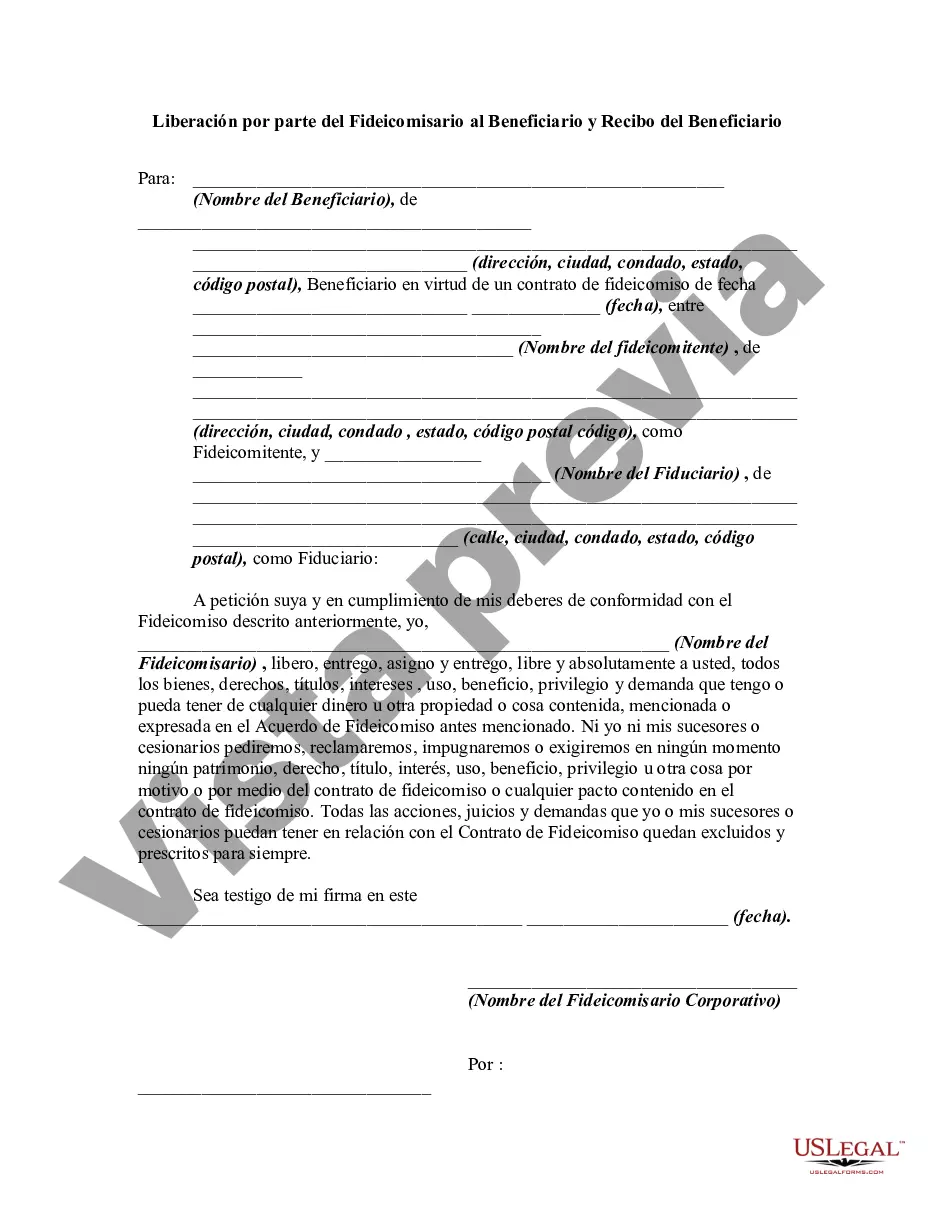

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oakland Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that outlines the process of transferring property or assets from a trustee to a beneficiary. This document serves as both a release and a receipt, ensuring that the transfer is properly documented and acknowledged. In Oakland County, Michigan, there are different types of releases by trustees to beneficiaries, depending on the specific circumstances of the transfer. Some common types include: 1. Real Estate Release: This type of release is used when real estate property is being transferred from a trustee to a beneficiary. It outlines the property details, any outstanding debts or liens, and confirms the beneficiary's receipt of ownership rights. 2. Financial Asset Release: When financial assets such as stocks, bonds, or bank accounts are being transferred, a specific release form is used. It identifies the assets being transferred, the financial institutions involved, and certifies that the beneficiary has received control and ownership of these assets. 3. Personal Property Release: For the transfer of personal belongings like vehicles, jewelry, or household items, a personal property release form is utilized. It details the specific items being transferred, their condition, and any relevant information to ensure a smooth transfer. Regardless of the type, the Release by Trustee to Beneficiary and Receipt from Beneficiary document typically includes the following essential information: — Identification of the trustee: The legal name and contact information of the trustee responsible for transferring the assets. — Identification of the beneficiary: The legal name and contact information of the individual or entity receiving the assets. — Detailed description of the assets: Specific details about the property or assets being transferred, including any distinguishing features, serial numbers, or relevant documentation. — Conditions of the release: Any conditions or prerequisites for the release of the assets, such as the payment of outstanding debts or the fulfillment of certain obligations. — Acknowledgment of receipt: A clause where the beneficiary confirms receipt of the assets in good condition, without any disputes or claims. — Signatures and notarization: The trustee and beneficiary must sign the document, and often it requires notarization to ensure its legal validity. It is crucial for both trustees and beneficiaries in Oakland County, Michigan, to have a thorough understanding of the specific release by trustee to beneficiary form applicable to their situation. Consulting with an attorney who specializes in trust and estate matters can provide guidance and ensure compliance with relevant laws and regulations.Oakland Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that outlines the process of transferring property or assets from a trustee to a beneficiary. This document serves as both a release and a receipt, ensuring that the transfer is properly documented and acknowledged. In Oakland County, Michigan, there are different types of releases by trustees to beneficiaries, depending on the specific circumstances of the transfer. Some common types include: 1. Real Estate Release: This type of release is used when real estate property is being transferred from a trustee to a beneficiary. It outlines the property details, any outstanding debts or liens, and confirms the beneficiary's receipt of ownership rights. 2. Financial Asset Release: When financial assets such as stocks, bonds, or bank accounts are being transferred, a specific release form is used. It identifies the assets being transferred, the financial institutions involved, and certifies that the beneficiary has received control and ownership of these assets. 3. Personal Property Release: For the transfer of personal belongings like vehicles, jewelry, or household items, a personal property release form is utilized. It details the specific items being transferred, their condition, and any relevant information to ensure a smooth transfer. Regardless of the type, the Release by Trustee to Beneficiary and Receipt from Beneficiary document typically includes the following essential information: — Identification of the trustee: The legal name and contact information of the trustee responsible for transferring the assets. — Identification of the beneficiary: The legal name and contact information of the individual or entity receiving the assets. — Detailed description of the assets: Specific details about the property or assets being transferred, including any distinguishing features, serial numbers, or relevant documentation. — Conditions of the release: Any conditions or prerequisites for the release of the assets, such as the payment of outstanding debts or the fulfillment of certain obligations. — Acknowledgment of receipt: A clause where the beneficiary confirms receipt of the assets in good condition, without any disputes or claims. — Signatures and notarization: The trustee and beneficiary must sign the document, and often it requires notarization to ensure its legal validity. It is crucial for both trustees and beneficiaries in Oakland County, Michigan, to have a thorough understanding of the specific release by trustee to beneficiary form applicable to their situation. Consulting with an attorney who specializes in trust and estate matters can provide guidance and ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.