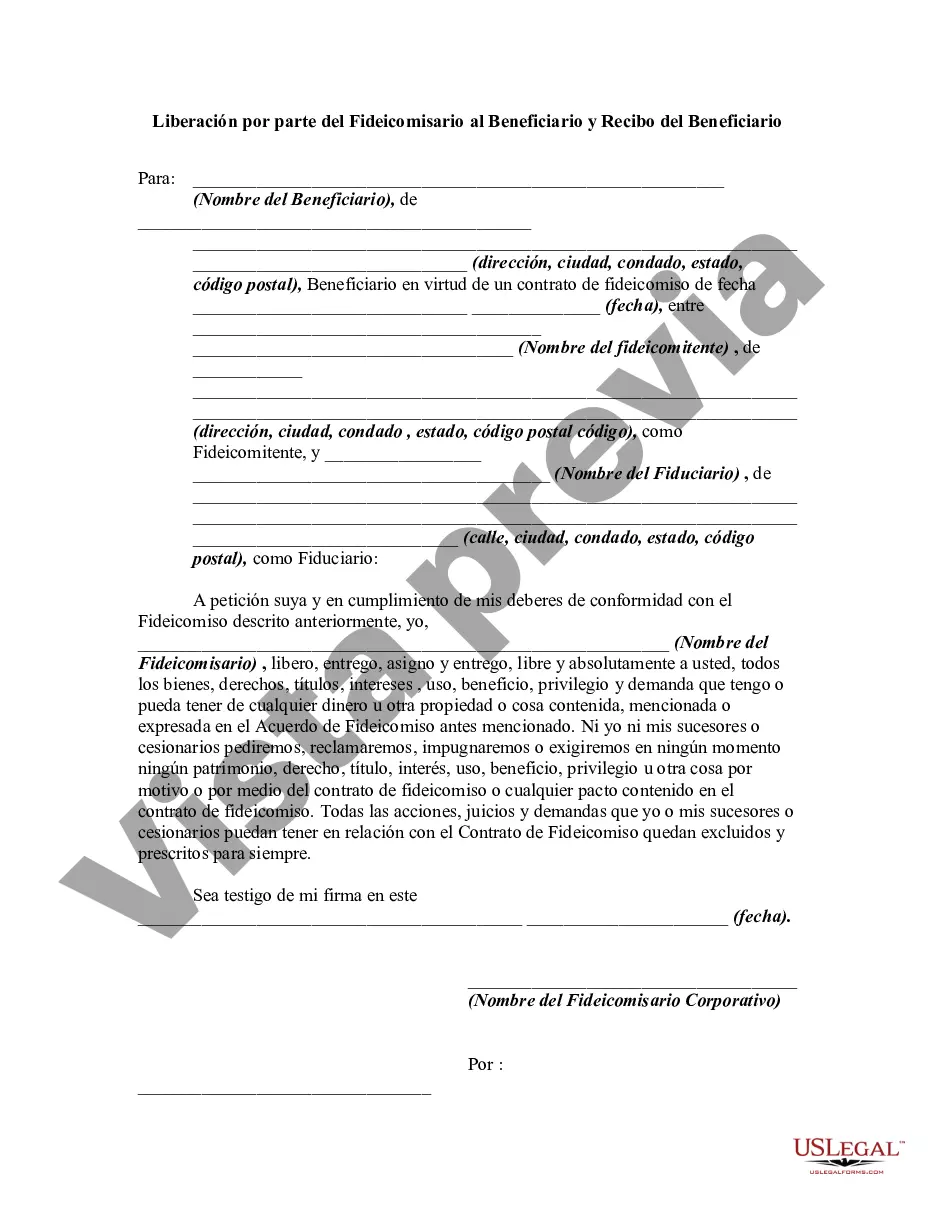

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Antonio, Texas: Providing Clarity on Release by Trustee to Beneficiary and Receipt from Beneficiary In the vast landscape of estate planning and trust management, a crucial aspect revolves around the Release by Trustee to Beneficiary and Receipt from Beneficiary. This process ensures a smooth transfer of assets, responsibilities, and legal obligations between the trustee and the beneficiaries. In the vibrant city of San Antonio, Texas, this procedure gains prominence due to the city's thriving real estate market and an increasing number of trusts being established. A Release by Trustee to Beneficiary is an essential legal document that typically confirms the trustee's fulfillment of their duties towards the beneficiaries. It acts as evidence of the trustee's compliance with the terms and conditions specified in the trust instrument, serving as a proof of the trustee's successful administration of the trust assets. In San Antonio, Texas, these releases are commonly utilized for various trusts, including living trusts, testamentary trusts, charitable trusts, and special needs trusts. 1. Living Trusts: Also known as inter vivos trusts, these trusts are established during an individual's lifetime to hold and manage their assets. The Release by Trustee to Beneficiary and Receipt from Beneficiary is crucial when the granter, who initially established the trust, passes away, and the beneficiary receives their rightful inheritance. 2. Testamentary Trusts: Created within a person's will, testamentary trusts come into effect upon the granter's death. Here, the Release by Trustee to Beneficiary and Receipt from Beneficiary enables the smooth transfer of the assets held within the trust to the designated beneficiaries, as per the granter's wishes. 3. Charitable Trusts: San Antonio, Texas, exhibits a commendable philanthropic spirit, leading to the establishment of numerous charitable trusts. These trusts have specific charitable objectives and are guided by the Release by Trustee to Beneficiary and Receipt from Beneficiary to ensure the proper utilization of their assets and donations. 4. Special Needs Trusts: Often set up for individuals with disabilities or special needs, these trusts require careful management. The Release by Trustee to Beneficiary and Receipt from Beneficiary plays a critical role in outlining the disbursement of funds and ensuring protection of the beneficiary's eligibility for government benefits. San Antonio, Texas, known for its rich history, cultural heritage, and vibrant economy, witnesses numerous trustees and beneficiaries seeking clarity through the Release by Trustee to Beneficiary and Receipt from Beneficiary process. Whether it be transferring property titles, investments, or monetary assets, these documents provide a legal framework guaranteeing a smooth transition of trust responsibilities. It is imperative for individuals in San Antonio, Texas, engaging in estate planning and trust management, to work closely with experienced attorneys or legal advisors specializing in trust law. These professionals possess a deep understanding of the complexities involved in the Release by Trustee to Beneficiary and Receipt from Beneficiary process, ensuring compliance with state laws and safeguarding the interests of both trustees and beneficiaries. In conclusion, the Release by Trustee to Beneficiary and Receipt from Beneficiary process plays a vital role in San Antonio, Texas, where trusts are prevalent. This procedure ensures a seamless transfer of assets and responsibilities, allowing the beneficiaries to receive their rightful inheritance while fulfilling the trust's objectives. Whether dealing with living trusts, testamentary trusts, charitable trusts, or special needs trusts, understanding and complying with the Release by Trustee to Beneficiary and Receipt from Beneficiary process is essential for all parties involved in trust management in San Antonio, Texas.San Antonio, Texas: Providing Clarity on Release by Trustee to Beneficiary and Receipt from Beneficiary In the vast landscape of estate planning and trust management, a crucial aspect revolves around the Release by Trustee to Beneficiary and Receipt from Beneficiary. This process ensures a smooth transfer of assets, responsibilities, and legal obligations between the trustee and the beneficiaries. In the vibrant city of San Antonio, Texas, this procedure gains prominence due to the city's thriving real estate market and an increasing number of trusts being established. A Release by Trustee to Beneficiary is an essential legal document that typically confirms the trustee's fulfillment of their duties towards the beneficiaries. It acts as evidence of the trustee's compliance with the terms and conditions specified in the trust instrument, serving as a proof of the trustee's successful administration of the trust assets. In San Antonio, Texas, these releases are commonly utilized for various trusts, including living trusts, testamentary trusts, charitable trusts, and special needs trusts. 1. Living Trusts: Also known as inter vivos trusts, these trusts are established during an individual's lifetime to hold and manage their assets. The Release by Trustee to Beneficiary and Receipt from Beneficiary is crucial when the granter, who initially established the trust, passes away, and the beneficiary receives their rightful inheritance. 2. Testamentary Trusts: Created within a person's will, testamentary trusts come into effect upon the granter's death. Here, the Release by Trustee to Beneficiary and Receipt from Beneficiary enables the smooth transfer of the assets held within the trust to the designated beneficiaries, as per the granter's wishes. 3. Charitable Trusts: San Antonio, Texas, exhibits a commendable philanthropic spirit, leading to the establishment of numerous charitable trusts. These trusts have specific charitable objectives and are guided by the Release by Trustee to Beneficiary and Receipt from Beneficiary to ensure the proper utilization of their assets and donations. 4. Special Needs Trusts: Often set up for individuals with disabilities or special needs, these trusts require careful management. The Release by Trustee to Beneficiary and Receipt from Beneficiary plays a critical role in outlining the disbursement of funds and ensuring protection of the beneficiary's eligibility for government benefits. San Antonio, Texas, known for its rich history, cultural heritage, and vibrant economy, witnesses numerous trustees and beneficiaries seeking clarity through the Release by Trustee to Beneficiary and Receipt from Beneficiary process. Whether it be transferring property titles, investments, or monetary assets, these documents provide a legal framework guaranteeing a smooth transition of trust responsibilities. It is imperative for individuals in San Antonio, Texas, engaging in estate planning and trust management, to work closely with experienced attorneys or legal advisors specializing in trust law. These professionals possess a deep understanding of the complexities involved in the Release by Trustee to Beneficiary and Receipt from Beneficiary process, ensuring compliance with state laws and safeguarding the interests of both trustees and beneficiaries. In conclusion, the Release by Trustee to Beneficiary and Receipt from Beneficiary process plays a vital role in San Antonio, Texas, where trusts are prevalent. This procedure ensures a seamless transfer of assets and responsibilities, allowing the beneficiaries to receive their rightful inheritance while fulfilling the trust's objectives. Whether dealing with living trusts, testamentary trusts, charitable trusts, or special needs trusts, understanding and complying with the Release by Trustee to Beneficiary and Receipt from Beneficiary process is essential for all parties involved in trust management in San Antonio, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.