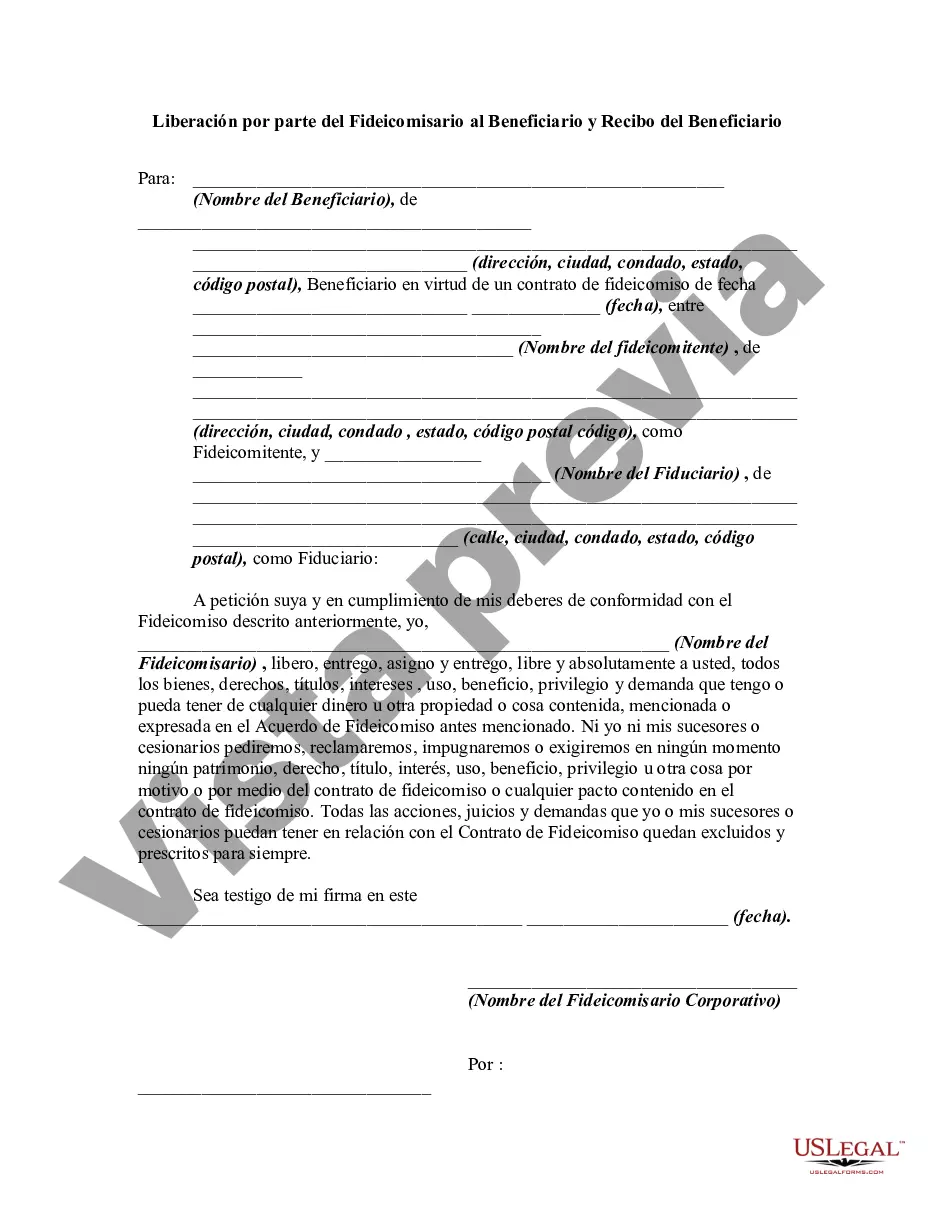

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal process that entails the transfer of assets, financial instruments, or property from a trust to its designated beneficiaries. This procedure is usually accompanied by relevant documentation to acknowledge the completion of the transfer and the recipient's acceptance. It is essential to highlight that different types of releases and receipts exist within the context of Travis Texas trusts. Let's delve into this topic further by exploring the key features of Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary: 1. Definition: A Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document executed by the trustee, signifying the final distribution of trust assets to the beneficiaries. This release and receipt act as a formal acknowledgment of the trustee's fulfillment of their fiduciary duty and the beneficiaries' satisfaction with the distributed assets. 2. Purpose: The main objective of executing a Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is to facilitate the smooth transfer of trust assets, ensuring that both parties involved are in agreement with the distribution. It serves as tangible evidence to protect the trustee from potential liability claims and grants the beneficiaries the assurance that they have received their rightful entitlements. 3. Types of Releases and Receipts: a. Full Release: A Full Release is the most comprehensive type of release, wherein the trustee transfers all the assets specified in the trust to the beneficiaries. It signifies the completion of the trustee's duties and absolves them of any further responsibilities. b. Conditional Release: In certain cases, a trustee may opt for a Conditional Release, which is contingent upon specific requirements or conditions stated in the trust document. The trustee must ensure that these conditions are met before the assets can be released to the beneficiaries. c. Partial Release: A Partial Release occurs when only a portion of the trust assets is distributed to the beneficiaries, while the remaining assets may be retained or withheld by the trustee for various reasons, such as ongoing legal obligations or pending administrative tasks. d. Lump Sum or Periodic Release: Depending on the terms of the trust, the Release by Trustee to Beneficiary may result in either a lump sum distribution of assets or periodic disbursements over a defined period. This distinction is crucial as it determines the timing and frequency of asset transfers. 4. Contents: A typical Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary includes several key elements. These may encompass: a. Identification: The names and contact information of the trustee(s) and beneficiary(IES) involved in the distribution. b. Trust Details: The name of the trust, its creation date, and any relevant trust identification numbers. c. Asset Description: A comprehensive list or description of the assets being transferred, including their values and any accompanying legal documentation. d. Release Clauses: Clear statements confirming that the trustee has met all obligations and is releasing the assets to the beneficiaries. e. Acknowledgment: The beneficiary's acceptance and confirmation of the receipt of assets, accompanied by their signature and the date. f. Notary and Witness: If required by Texas state law, the release and receipt may need to be notarized and witnessed by impartial parties. In conclusion, the Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a vital legal process that ensures the smooth transfer of trust assets to beneficiaries. By executing the appropriate documentation, trustees and beneficiaries can formalize the distribution, safeguard their interests, and fulfill their legal obligations. Understanding the different types of releases, such as Full Releases, Conditional Releases, Partial Releases, and Lump Sum or Periodic Releases, assists in determining the specific terms and conditions of asset transfers.Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal process that entails the transfer of assets, financial instruments, or property from a trust to its designated beneficiaries. This procedure is usually accompanied by relevant documentation to acknowledge the completion of the transfer and the recipient's acceptance. It is essential to highlight that different types of releases and receipts exist within the context of Travis Texas trusts. Let's delve into this topic further by exploring the key features of Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary: 1. Definition: A Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document executed by the trustee, signifying the final distribution of trust assets to the beneficiaries. This release and receipt act as a formal acknowledgment of the trustee's fulfillment of their fiduciary duty and the beneficiaries' satisfaction with the distributed assets. 2. Purpose: The main objective of executing a Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is to facilitate the smooth transfer of trust assets, ensuring that both parties involved are in agreement with the distribution. It serves as tangible evidence to protect the trustee from potential liability claims and grants the beneficiaries the assurance that they have received their rightful entitlements. 3. Types of Releases and Receipts: a. Full Release: A Full Release is the most comprehensive type of release, wherein the trustee transfers all the assets specified in the trust to the beneficiaries. It signifies the completion of the trustee's duties and absolves them of any further responsibilities. b. Conditional Release: In certain cases, a trustee may opt for a Conditional Release, which is contingent upon specific requirements or conditions stated in the trust document. The trustee must ensure that these conditions are met before the assets can be released to the beneficiaries. c. Partial Release: A Partial Release occurs when only a portion of the trust assets is distributed to the beneficiaries, while the remaining assets may be retained or withheld by the trustee for various reasons, such as ongoing legal obligations or pending administrative tasks. d. Lump Sum or Periodic Release: Depending on the terms of the trust, the Release by Trustee to Beneficiary may result in either a lump sum distribution of assets or periodic disbursements over a defined period. This distinction is crucial as it determines the timing and frequency of asset transfers. 4. Contents: A typical Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary includes several key elements. These may encompass: a. Identification: The names and contact information of the trustee(s) and beneficiary(IES) involved in the distribution. b. Trust Details: The name of the trust, its creation date, and any relevant trust identification numbers. c. Asset Description: A comprehensive list or description of the assets being transferred, including their values and any accompanying legal documentation. d. Release Clauses: Clear statements confirming that the trustee has met all obligations and is releasing the assets to the beneficiaries. e. Acknowledgment: The beneficiary's acceptance and confirmation of the receipt of assets, accompanied by their signature and the date. f. Notary and Witness: If required by Texas state law, the release and receipt may need to be notarized and witnessed by impartial parties. In conclusion, the Travis Texas Release by Trustee to Beneficiary and Receipt from Beneficiary is a vital legal process that ensures the smooth transfer of trust assets to beneficiaries. By executing the appropriate documentation, trustees and beneficiaries can formalize the distribution, safeguard their interests, and fulfill their legal obligations. Understanding the different types of releases, such as Full Releases, Conditional Releases, Partial Releases, and Lump Sum or Periodic Releases, assists in determining the specific terms and conditions of asset transfers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.