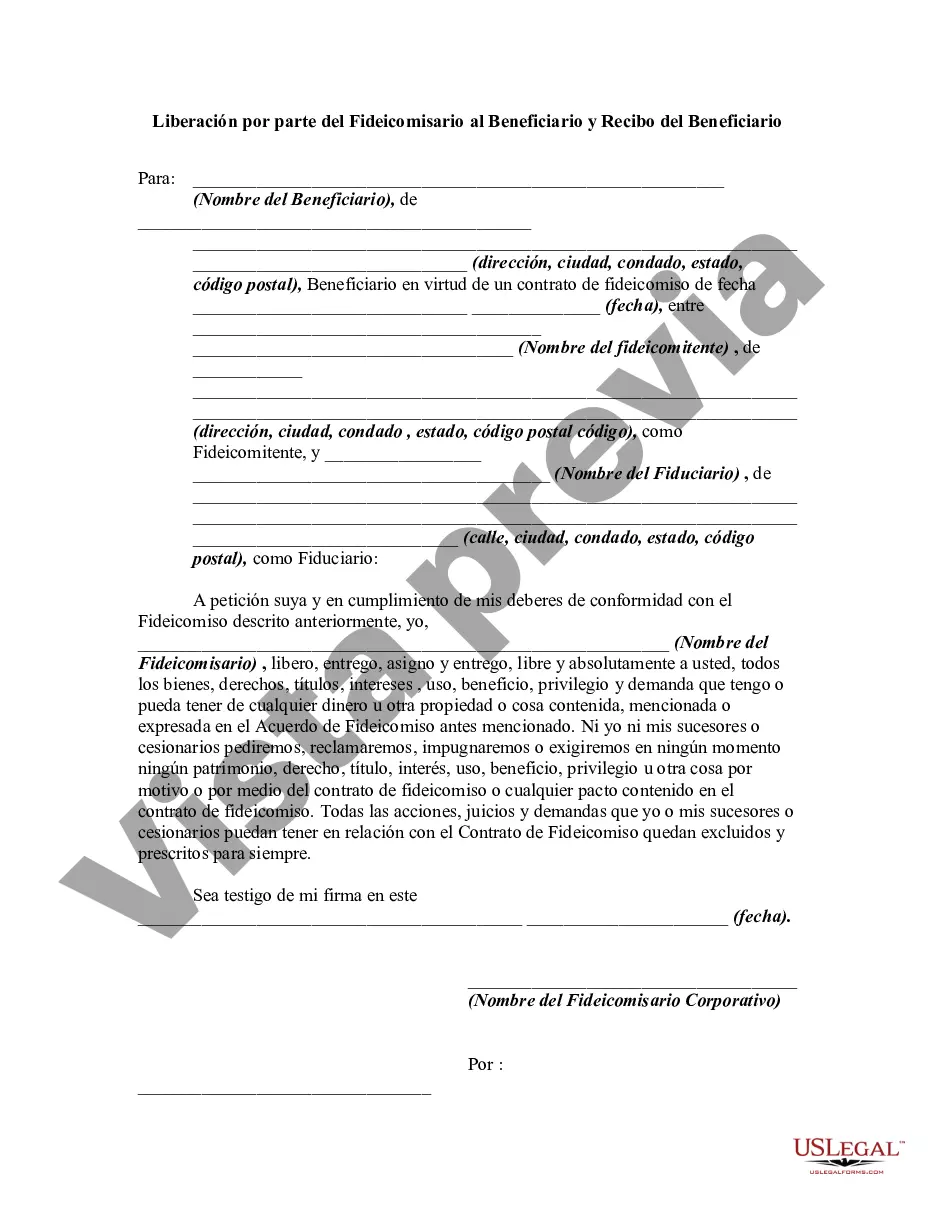

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wake North Carolina Release by Trustee to Beneficiary is a legal document that confirms the transfer of specific assets or property held in trust to the beneficiaries. It serves as evidence that the trustee is releasing their control and distributing the trust's assets according to the terms outlined in the trust agreement. The Wake North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary is an essential part of the trust administration process. The release document typically contains various important information, including the names and contact details of the trustee(s) and beneficiary(IES), the date of release, and a detailed description of the assets being transferred. Specific information regarding the trust, such as the trust name, the date of creation, and any relevant trust identification numbers, may also be included. In Wake North Carolina, there may be different types of Release by Trustee to Beneficiary and Receipt from Beneficiary, which may vary based on the nature and purpose of the trust. These can include: 1. Testamentary Trust Release: This involves a trustee releasing assets from a testamentary trust, which is established through a will upon the death of the testator. 2. Revocable Living Trust Release: In this case, the trustee distributes assets from a revocable living trust, which allows the granter to retain control over the trust during their lifetime. 3. Irrevocable Trust Release: An irrevocable trust release involves the trustee distributing assets from an irrevocable trust, which typically cannot be altered or revoked without the consent of the beneficiaries. 4. Special Needs Trust Release: This type of release involves the trustee distributing assets from a trust specifically established to benefit individuals with special needs, ensuring their financial support and well-being. 5. Charitable Trust Release: A trustee releases assets from a charitable trust, which is created to support charitable organizations or causes. It is essential to consult with legal professionals or an estate planning attorney to ensure the Wake North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary is drafted accurately and complies with all relevant state laws. The release document should be signed and executed by both the trustee(s) and the beneficiary(IES) involved, providing a clear record of the asset distribution and finalizing the trustee's obligations.Wake North Carolina Release by Trustee to Beneficiary is a legal document that confirms the transfer of specific assets or property held in trust to the beneficiaries. It serves as evidence that the trustee is releasing their control and distributing the trust's assets according to the terms outlined in the trust agreement. The Wake North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary is an essential part of the trust administration process. The release document typically contains various important information, including the names and contact details of the trustee(s) and beneficiary(IES), the date of release, and a detailed description of the assets being transferred. Specific information regarding the trust, such as the trust name, the date of creation, and any relevant trust identification numbers, may also be included. In Wake North Carolina, there may be different types of Release by Trustee to Beneficiary and Receipt from Beneficiary, which may vary based on the nature and purpose of the trust. These can include: 1. Testamentary Trust Release: This involves a trustee releasing assets from a testamentary trust, which is established through a will upon the death of the testator. 2. Revocable Living Trust Release: In this case, the trustee distributes assets from a revocable living trust, which allows the granter to retain control over the trust during their lifetime. 3. Irrevocable Trust Release: An irrevocable trust release involves the trustee distributing assets from an irrevocable trust, which typically cannot be altered or revoked without the consent of the beneficiaries. 4. Special Needs Trust Release: This type of release involves the trustee distributing assets from a trust specifically established to benefit individuals with special needs, ensuring their financial support and well-being. 5. Charitable Trust Release: A trustee releases assets from a charitable trust, which is created to support charitable organizations or causes. It is essential to consult with legal professionals or an estate planning attorney to ensure the Wake North Carolina Release by Trustee to Beneficiary and Receipt from Beneficiary is drafted accurately and complies with all relevant state laws. The release document should be signed and executed by both the trustee(s) and the beneficiary(IES) involved, providing a clear record of the asset distribution and finalizing the trustee's obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.