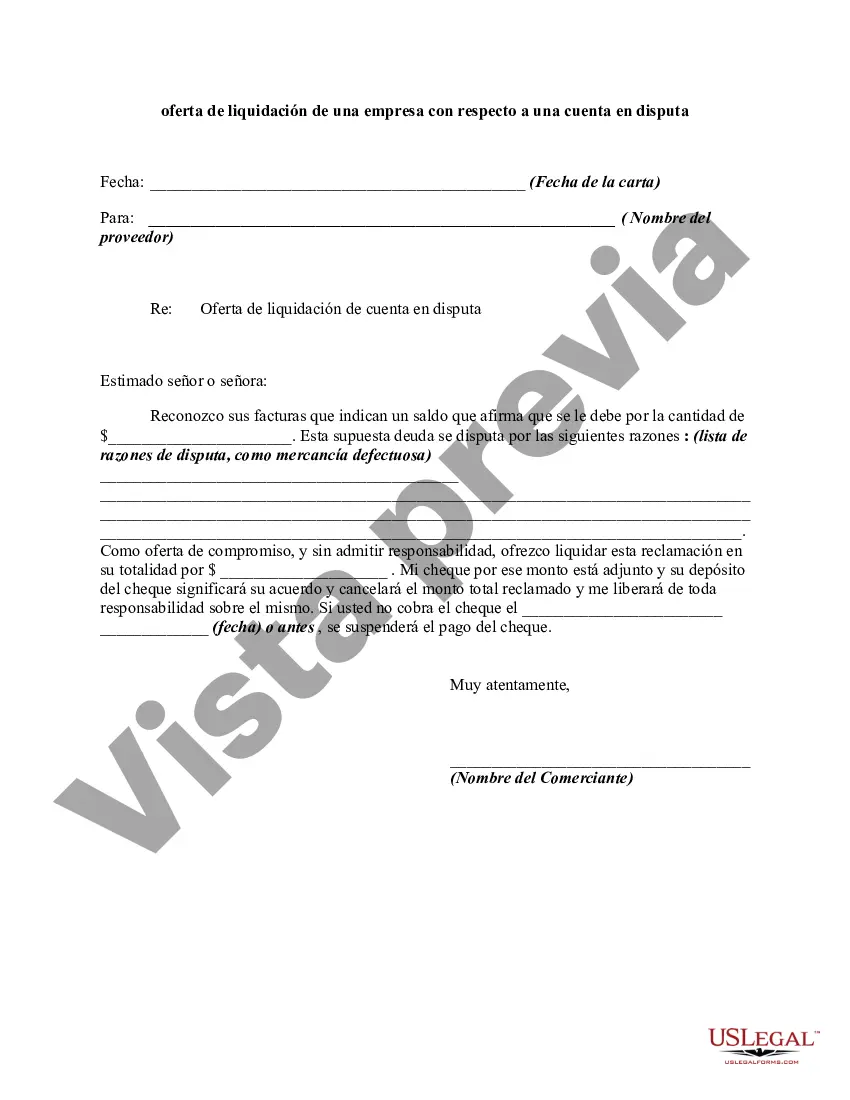

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

Alameda California is a city located in the San Francisco Bay Area, known for its rich history, diverse community, and beautiful waterfront. This bustling city is home to various businesses, including legal firms, financial institutions, and commercial enterprises. A settlement offer letter from a business in Alameda California regarding a disputed account is a crucial document that outlines the terms and conditions proposed by the business to resolve a financial disagreement with a customer or client. This letter serves as an official communication, putting forth a settlement offer and seeking resolution to avoid further legal actions or complications. When it comes to different types of settlement offer letters from businesses in Alameda California regarding disputed accounts, they can be categorized based on the nature of the dispute or the specific industry involved. Some common types of settlement offer letters include: 1. Banking Dispute Settlement Offer Letter: This type of letter is typically issued by a bank or financial institution, addressing a dispute related to loans, credit cards, mortgages, or any other financial services provided by the bank. The letter may outline proposed payment plans, interest rate adjustments, or debt forgiveness programs to resolve the dispute amicably. 2. Legal Services Dispute Settlement Offer Letter: This letter is usually sent by law firms or attorneys based in Alameda California to settle disputes arising from legal services provided to clients. It may propose reduced fees, extended payment deadlines, or alternative dispute resolution methods such as mediation or arbitration. 3. Consumer Dispute Settlement Offer Letter: Many businesses in Alameda California that offer consumer goods or services may face disputes with customers regarding product quality, contracts, or warranty claims. The settlement offer letter in this case may offer compensation, product replacement, or discounted services to resolve the dispute. 4. Commercial Dispute Settlement Offer Letter: Businesses involved in B2B transactions may encounter dispute situations relating to the supply of goods, services, or contractual disagreements. The settlement offer letter regarding a commercial dispute may outline proposed resolutions, such as revisions to contract terms, financial compensations, or renegotiation of terms. In each of these settlement offer letter types, it is crucial to include relevant keywords such as "dispute resolution," "negotiations," "compensation," "proposed terms," "amicable resolution," "legal obligations," and "contractual agreements." These keywords ensure that the content is optimized for search engines while effectively conveying the purpose and objectives of the letter.Alameda California is a city located in the San Francisco Bay Area, known for its rich history, diverse community, and beautiful waterfront. This bustling city is home to various businesses, including legal firms, financial institutions, and commercial enterprises. A settlement offer letter from a business in Alameda California regarding a disputed account is a crucial document that outlines the terms and conditions proposed by the business to resolve a financial disagreement with a customer or client. This letter serves as an official communication, putting forth a settlement offer and seeking resolution to avoid further legal actions or complications. When it comes to different types of settlement offer letters from businesses in Alameda California regarding disputed accounts, they can be categorized based on the nature of the dispute or the specific industry involved. Some common types of settlement offer letters include: 1. Banking Dispute Settlement Offer Letter: This type of letter is typically issued by a bank or financial institution, addressing a dispute related to loans, credit cards, mortgages, or any other financial services provided by the bank. The letter may outline proposed payment plans, interest rate adjustments, or debt forgiveness programs to resolve the dispute amicably. 2. Legal Services Dispute Settlement Offer Letter: This letter is usually sent by law firms or attorneys based in Alameda California to settle disputes arising from legal services provided to clients. It may propose reduced fees, extended payment deadlines, or alternative dispute resolution methods such as mediation or arbitration. 3. Consumer Dispute Settlement Offer Letter: Many businesses in Alameda California that offer consumer goods or services may face disputes with customers regarding product quality, contracts, or warranty claims. The settlement offer letter in this case may offer compensation, product replacement, or discounted services to resolve the dispute. 4. Commercial Dispute Settlement Offer Letter: Businesses involved in B2B transactions may encounter dispute situations relating to the supply of goods, services, or contractual disagreements. The settlement offer letter regarding a commercial dispute may outline proposed resolutions, such as revisions to contract terms, financial compensations, or renegotiation of terms. In each of these settlement offer letter types, it is crucial to include relevant keywords such as "dispute resolution," "negotiations," "compensation," "proposed terms," "amicable resolution," "legal obligations," and "contractual agreements." These keywords ensure that the content is optimized for search engines while effectively conveying the purpose and objectives of the letter.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.