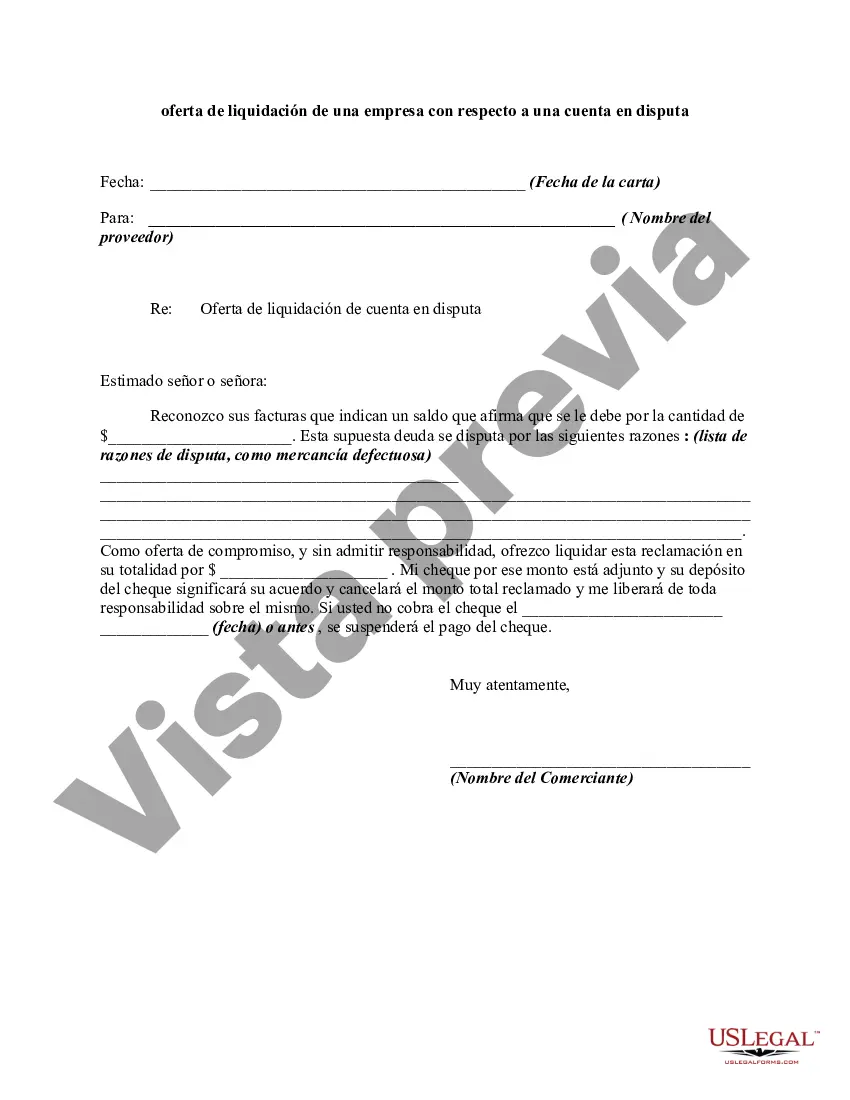

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

Title: Chicago, Illinois Settlement Offer Letter from a Business Regarding a Disputed Account: Exploring Types and Detailed Descriptions Introduction: A Chicago, Illinois settlement offer letter from a business regarding a disputed account is a formal communication sent by a company to a customer in order to resolve a disagreement or dispute related to a financial account. This letter outlines a proposed settlement agreement and aims to resolve the issues amicably. Types of Chicago, Illinois Settlement Offer Letters from a Business Regarding a Disputed Account: 1. Full and Final Settlement Offer: In cases where the business is willing to accept a lesser amount than originally owed, a full and final settlement offer may be made. This offer highlights the reduced payment amount and the terms of acceptance to fully settle the disputed account. 2. Extended Payment Plan Offer: If the customer is unable to pay the disputed amount in full, the business may propose an extended payment plan offer. This offer comprises a structured schedule for repayment, allowing the customer to resolve the account gradually over an agreed period of time. 3. Deletion of Negative Credit Reporting: When a disputed account has impacted the customer's credit score, the business may provide a settlement offer addressing the removal of the negative credit reporting. This offer aims to resolve the account while helping restore the customer's credit credibility. Detailed Description of a Chicago, Illinois Settlement Offer Letter from a Business Regarding a Disputed Account: [Opening Paragraph] The letter begins with a formal salutation and introduces the sender, usually a representative of the business, and acknowledges the disputed nature of the account. It may briefly summarize the background of the dispute, including account details and any relevant conversations or correspondence. [Explanation of Settlement Proposal] The body of the letter provides a detailed account of the settlement proposal being offered. It clearly outlines the terms and conditions of the settlement, including the proposed settlement amount, any discounts or waivers applied, and the payment options available to the customer. [Legal Validity and Confidentiality] To ensure the credibility of the settlement offer, the letter may mention the legal validity and enforceability of the proposed agreement. Confidentiality clauses may also be included to protect both parties' privacy and prevent any dissemination of sensitive information. [Resolution Deadline] The letter specifies a deadline by which the customer must respond to the settlement offer. The deadline allows for a reasonable amount of time for the customer to consider the proposal and provide a preferred course of action. [Instructions for Acceptance or Counteroffer] Instructions for acceptance of the settlement agreement or presenting a counteroffer are provided in this section. The customer is usually required to respond in writing or contact a designated representative to finalize the settlement. [Closing] The letter concludes with a professional closing, reiterating the business's aim to resolve the dispute amicably. Contact details of the business representative handling the settlement may also be included for ease of communication. Conclusion: Chicago, Illinois settlement offer letters from a business regarding a disputed account provide a comprehensive framework for resolving financial disputes. The detailed content and proposed settlement types help establish a mutually agreeable solution while maintaining a positive business-customer relationship.Title: Chicago, Illinois Settlement Offer Letter from a Business Regarding a Disputed Account: Exploring Types and Detailed Descriptions Introduction: A Chicago, Illinois settlement offer letter from a business regarding a disputed account is a formal communication sent by a company to a customer in order to resolve a disagreement or dispute related to a financial account. This letter outlines a proposed settlement agreement and aims to resolve the issues amicably. Types of Chicago, Illinois Settlement Offer Letters from a Business Regarding a Disputed Account: 1. Full and Final Settlement Offer: In cases where the business is willing to accept a lesser amount than originally owed, a full and final settlement offer may be made. This offer highlights the reduced payment amount and the terms of acceptance to fully settle the disputed account. 2. Extended Payment Plan Offer: If the customer is unable to pay the disputed amount in full, the business may propose an extended payment plan offer. This offer comprises a structured schedule for repayment, allowing the customer to resolve the account gradually over an agreed period of time. 3. Deletion of Negative Credit Reporting: When a disputed account has impacted the customer's credit score, the business may provide a settlement offer addressing the removal of the negative credit reporting. This offer aims to resolve the account while helping restore the customer's credit credibility. Detailed Description of a Chicago, Illinois Settlement Offer Letter from a Business Regarding a Disputed Account: [Opening Paragraph] The letter begins with a formal salutation and introduces the sender, usually a representative of the business, and acknowledges the disputed nature of the account. It may briefly summarize the background of the dispute, including account details and any relevant conversations or correspondence. [Explanation of Settlement Proposal] The body of the letter provides a detailed account of the settlement proposal being offered. It clearly outlines the terms and conditions of the settlement, including the proposed settlement amount, any discounts or waivers applied, and the payment options available to the customer. [Legal Validity and Confidentiality] To ensure the credibility of the settlement offer, the letter may mention the legal validity and enforceability of the proposed agreement. Confidentiality clauses may also be included to protect both parties' privacy and prevent any dissemination of sensitive information. [Resolution Deadline] The letter specifies a deadline by which the customer must respond to the settlement offer. The deadline allows for a reasonable amount of time for the customer to consider the proposal and provide a preferred course of action. [Instructions for Acceptance or Counteroffer] Instructions for acceptance of the settlement agreement or presenting a counteroffer are provided in this section. The customer is usually required to respond in writing or contact a designated representative to finalize the settlement. [Closing] The letter concludes with a professional closing, reiterating the business's aim to resolve the dispute amicably. Contact details of the business representative handling the settlement may also be included for ease of communication. Conclusion: Chicago, Illinois settlement offer letters from a business regarding a disputed account provide a comprehensive framework for resolving financial disputes. The detailed content and proposed settlement types help establish a mutually agreeable solution while maintaining a positive business-customer relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.