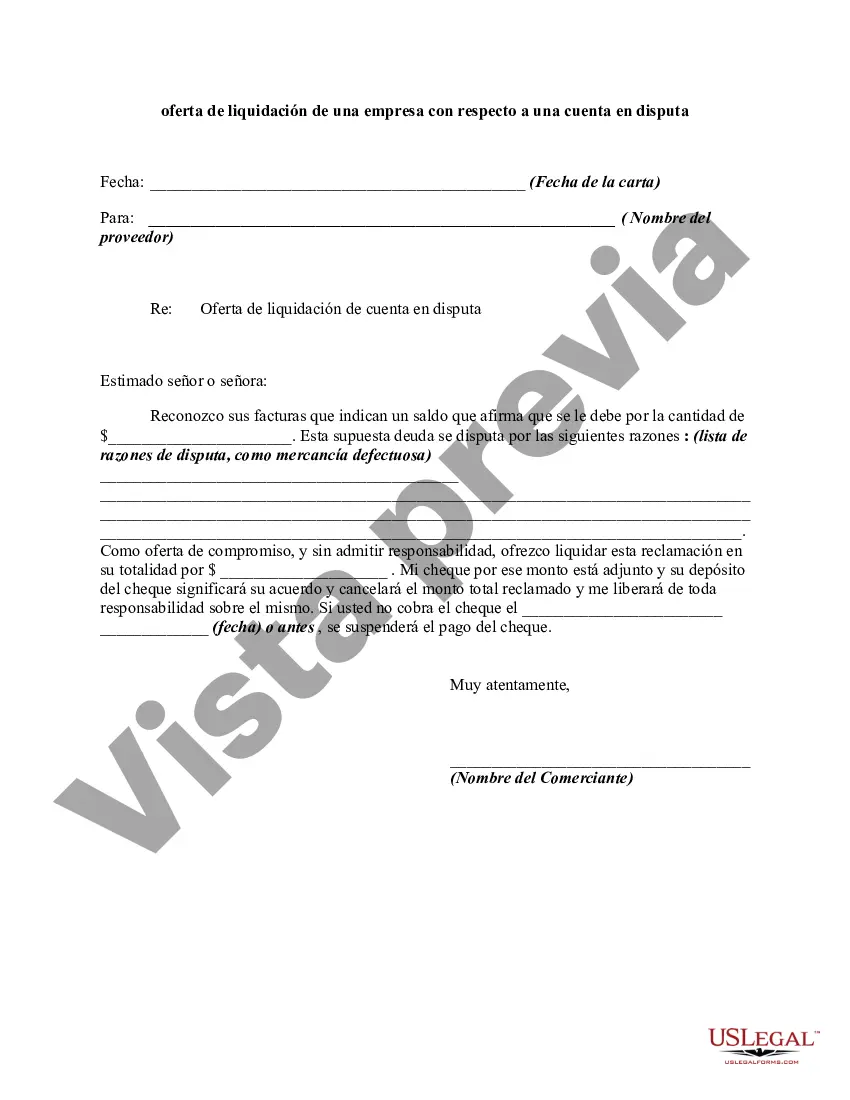

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

Contra Costa California is a county located in the state of California, known for its diverse population and vibrant business environment. Settlement offer letters from businesses regarding disputed accounts are common in this region, as companies strive to resolve any financial discrepancies and maintain positive relationships with their clients. A Contra Costa California settlement offer letter typically serves as a formal communication from a business to a customer, outlining a proposed resolution for a disputed account. These letters are designed to address any outstanding issues, establish a mutually agreeable settlement, and prevent legal action or credit damage. Key elements in a Contra Costa California settlement offer letter include: 1. Introduction: The letter commences with a professional salutation, followed by a statement of the purpose of the communication, which is to resolve a dispute involving a certain account. 2. Account Details: The letter provides specific information about the disputed account, such as the account number, outstanding balance, and a summary of the disputed charges or discrepancies. 3. Explanation of Dispute: A detailed explanation of the disputed charges or discrepancies is provided, outlining the customer's concerns and any supporting documentation. 4. Proposed Settlement: The business presents its proposed settlement offer to the customer. This may include a reduced amount owed, a payment plan, or an alternative arrangement to resolve the dispute. 5. Deadline: A deadline is specified by which the customer must respond to the settlement offer. This allows for timely negotiations and prevents further complications. 6. Contact Information: The letter concludes with the business's contact information, including the name of a designated representative or department, phone number, and email address. This ensures easy communication in case of any questions or counteroffers. Different types of Contra Costa California settlement offer letters from businesses regarding disputed accounts can be categorized based on the nature of the dispute, such as: a. Billing Dispute Settlement Offer Letter: This type of letter addresses discrepancies in billing statements, disputed charges, or inaccuracies in the account balance. b. Collection Dispute Settlement Offer Letter: This letter is used when a business asserts its claim for a debt that the customer contests or questions. c. Service Dispute Settlement Offer Letter: This letter resolves disputes arising from the quality or delivery of services provided by a business. d. Credit Dispute Settlement Offer Letter: This type of letter focuses on resolving discrepancies related to credit reports, incorrect credit scores, or disputed credit accounts. Settlement offer letters are crucial in Contra Costa California, as they facilitate transparent and amicable resolutions to financial disputes. By promptly addressing such issues, businesses demonstrate their commitment to customer satisfaction, foster positive relationships, and uphold their professional integrity within the local business community.Contra Costa California is a county located in the state of California, known for its diverse population and vibrant business environment. Settlement offer letters from businesses regarding disputed accounts are common in this region, as companies strive to resolve any financial discrepancies and maintain positive relationships with their clients. A Contra Costa California settlement offer letter typically serves as a formal communication from a business to a customer, outlining a proposed resolution for a disputed account. These letters are designed to address any outstanding issues, establish a mutually agreeable settlement, and prevent legal action or credit damage. Key elements in a Contra Costa California settlement offer letter include: 1. Introduction: The letter commences with a professional salutation, followed by a statement of the purpose of the communication, which is to resolve a dispute involving a certain account. 2. Account Details: The letter provides specific information about the disputed account, such as the account number, outstanding balance, and a summary of the disputed charges or discrepancies. 3. Explanation of Dispute: A detailed explanation of the disputed charges or discrepancies is provided, outlining the customer's concerns and any supporting documentation. 4. Proposed Settlement: The business presents its proposed settlement offer to the customer. This may include a reduced amount owed, a payment plan, or an alternative arrangement to resolve the dispute. 5. Deadline: A deadline is specified by which the customer must respond to the settlement offer. This allows for timely negotiations and prevents further complications. 6. Contact Information: The letter concludes with the business's contact information, including the name of a designated representative or department, phone number, and email address. This ensures easy communication in case of any questions or counteroffers. Different types of Contra Costa California settlement offer letters from businesses regarding disputed accounts can be categorized based on the nature of the dispute, such as: a. Billing Dispute Settlement Offer Letter: This type of letter addresses discrepancies in billing statements, disputed charges, or inaccuracies in the account balance. b. Collection Dispute Settlement Offer Letter: This letter is used when a business asserts its claim for a debt that the customer contests or questions. c. Service Dispute Settlement Offer Letter: This letter resolves disputes arising from the quality or delivery of services provided by a business. d. Credit Dispute Settlement Offer Letter: This type of letter focuses on resolving discrepancies related to credit reports, incorrect credit scores, or disputed credit accounts. Settlement offer letters are crucial in Contra Costa California, as they facilitate transparent and amicable resolutions to financial disputes. By promptly addressing such issues, businesses demonstrate their commitment to customer satisfaction, foster positive relationships, and uphold their professional integrity within the local business community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.