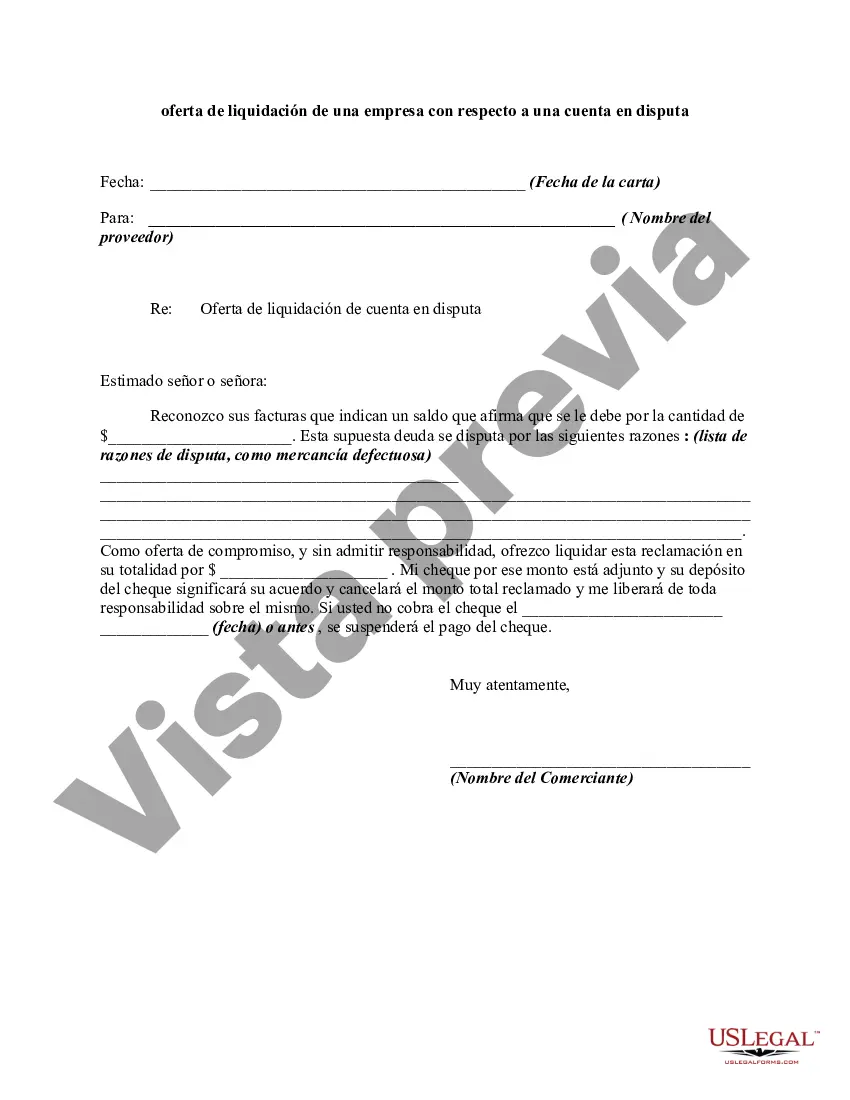

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

A Houston Texas Settlement Offer Letter from a Business Regarding a Disputed Account is a formal communication sent by a business entity based in Houston, Texas, to address a dispute or disagreement regarding an account with a customer. This letter typically outlines the proposed settlement terms to resolve the issue and reach a mutually agreeable resolution. By using appropriate keywords, here is a detailed description of the different types of Houston Texas Settlement Offer Letters from a Business Regarding a Disputed Account: 1. Houston Texas Settlement Offer Letter — Standard Dispute Resolution: This type of letter is sent when a business wishes to resolve a dispute with a customer regarding an account smoothly and efficiently. It may detail the specific issue, provide an explanation, and propose a settlement offer based on the business's policy and the customer's circumstances. The settlement offer could include options like a partial payment, a revised payment plan, or potential discounts to fully resolve the disputed account. 2. Houston Texas Settlement Offer Letter — Forgiveness of Outstanding Debt: This particular letter is used when a business wants to extend generosity to its customers by forgiving a part or all of the outstanding debt. It acknowledges the disputed account, expresses the business's willingness to resolve the matter out of goodwill, and proposes a settlement offer that involves forgiving a certain portion of the debt or waiving late fees. The letter aims to rebuild trust and maintain customer loyalty. 3. Houston Texas Settlement Offer Letter — Implementing Revised Terms: When a customer disputes an account due to dissatisfaction with the initial terms, a business may opt to modify the terms to resolve the issue. This letter would address the concerns raised by the customer, propose revised terms, and offer an updated settlement agreement that aligns with both the customer's requirements and the business's policies. The revised terms could include adjustments to payment amounts, interest rates, or extended payment periods. 4. Houston Texas Settlement Offer Letter — Compensation for Errors or Unfair Practices: If a customer disputes an account due to errors, unfair practices, or undue charges, a business may issue this type of letter to address those concerns and offer compensation as a settlement. The letter would acknowledge the mistake or unfair treatment, express apologies, and propose a compensation amount or alternative compensation methods to rectify the situation. Compensation could range from refunds, discounts on future purchases, or vouchers redeemable for products or services. Overall, Houston Texas Settlement Offer Letters from a Business Regarding a Disputed Account aim to provide solutions to conflicts, maintain customer satisfaction, and foster positive customer-business relationships. Each letter type is tailored to address specific circumstances and concerns, promoting a fair and reasonable dispute resolution process.A Houston Texas Settlement Offer Letter from a Business Regarding a Disputed Account is a formal communication sent by a business entity based in Houston, Texas, to address a dispute or disagreement regarding an account with a customer. This letter typically outlines the proposed settlement terms to resolve the issue and reach a mutually agreeable resolution. By using appropriate keywords, here is a detailed description of the different types of Houston Texas Settlement Offer Letters from a Business Regarding a Disputed Account: 1. Houston Texas Settlement Offer Letter — Standard Dispute Resolution: This type of letter is sent when a business wishes to resolve a dispute with a customer regarding an account smoothly and efficiently. It may detail the specific issue, provide an explanation, and propose a settlement offer based on the business's policy and the customer's circumstances. The settlement offer could include options like a partial payment, a revised payment plan, or potential discounts to fully resolve the disputed account. 2. Houston Texas Settlement Offer Letter — Forgiveness of Outstanding Debt: This particular letter is used when a business wants to extend generosity to its customers by forgiving a part or all of the outstanding debt. It acknowledges the disputed account, expresses the business's willingness to resolve the matter out of goodwill, and proposes a settlement offer that involves forgiving a certain portion of the debt or waiving late fees. The letter aims to rebuild trust and maintain customer loyalty. 3. Houston Texas Settlement Offer Letter — Implementing Revised Terms: When a customer disputes an account due to dissatisfaction with the initial terms, a business may opt to modify the terms to resolve the issue. This letter would address the concerns raised by the customer, propose revised terms, and offer an updated settlement agreement that aligns with both the customer's requirements and the business's policies. The revised terms could include adjustments to payment amounts, interest rates, or extended payment periods. 4. Houston Texas Settlement Offer Letter — Compensation for Errors or Unfair Practices: If a customer disputes an account due to errors, unfair practices, or undue charges, a business may issue this type of letter to address those concerns and offer compensation as a settlement. The letter would acknowledge the mistake or unfair treatment, express apologies, and propose a compensation amount or alternative compensation methods to rectify the situation. Compensation could range from refunds, discounts on future purchases, or vouchers redeemable for products or services. Overall, Houston Texas Settlement Offer Letters from a Business Regarding a Disputed Account aim to provide solutions to conflicts, maintain customer satisfaction, and foster positive customer-business relationships. Each letter type is tailored to address specific circumstances and concerns, promoting a fair and reasonable dispute resolution process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.