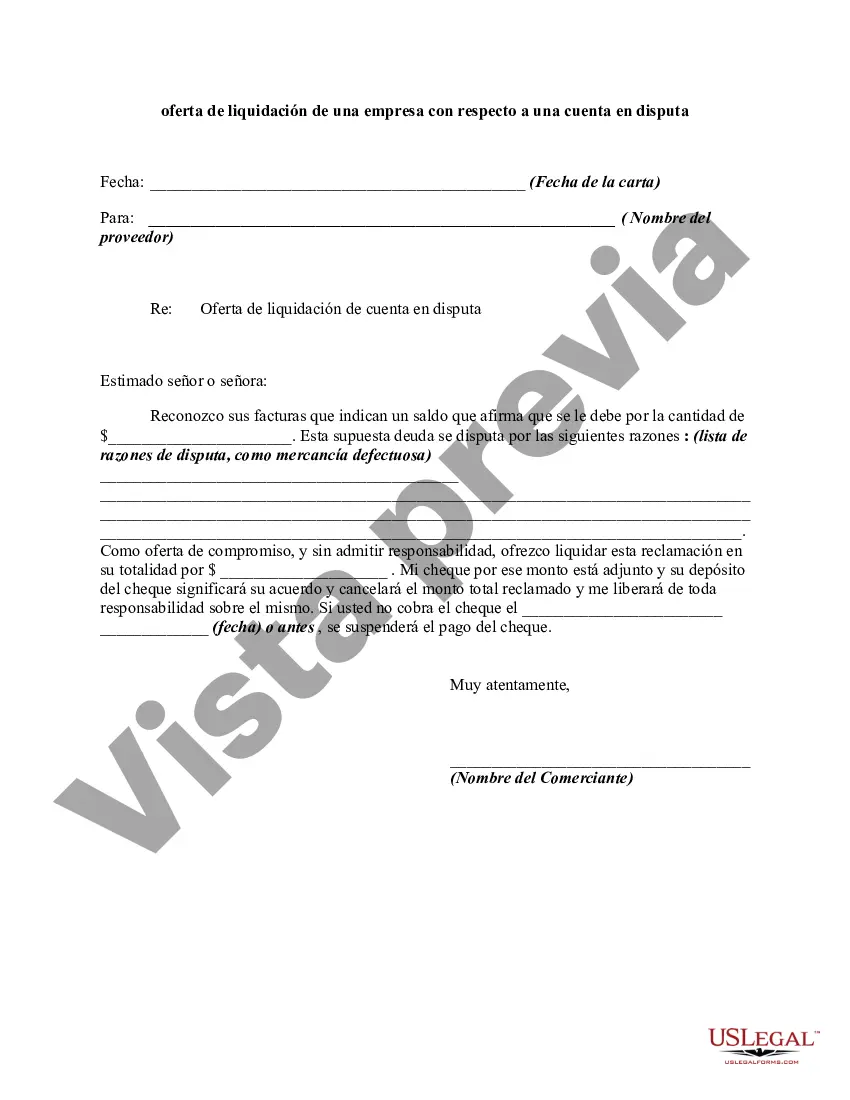

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

A Mecklenburg North Carolina Settlement Offer Letter from a Business Regarding a Disputed Account is a formal written document sent by a business to a consumer residing in Mecklenburg County, North Carolina, in order to propose a resolution to a disputed account or outstanding debt. This letter aims to provide clarity, propose settlement terms, and convey the business's willingness to resolve the matter amicably. Different types of Settlement Offer Letters may exist depending on the specific circumstances of the disputed account. Some possible categories or variations may include: 1. Debt Collection Settlement Offer Letter: This type of letter is typically sent by a debt collection agency on behalf of a creditor or business seeking to recover outstanding funds. It outlines a reduced settlement amount or alternative repayment terms in order to resolve the dispute. 2. Credit Card Settlement Offer Letter: These letters are frequently sent by credit card companies or banks to consumers regarding disputed credit card accounts. They may propose a lowered payment amount or extended repayment period to reach a mutually beneficial settlement. 3. Personal Loan Settlement Offer Letter: In cases where an individual has taken out a personal loan, this type of settlement offer letter may be sent by the lender. It presents negotiated settlement terms to resolve a disputed account, taking into consideration the debtor’s financial circumstances. 4. Medical Bill Settlement Offer Letter: Medical service providers or hospitals often send these letters to patients with disputed medical bills. This letter proposes either a reduced settlement amount or a payment plan that accommodates the patient's financial capabilities. 5. Utility Bill Settlement Offer Letter: Utility companies, such as power or water providers, may send this type of letter to consumers with disputed accounts. The letter offers a resolution plan, including potential reduced payment options or schedule adjustments to address the dispute. Each Mecklenburg North Carolina Settlement Offer Letter from a Business Regarding a Disputed Account generally includes several essential elements. These may involve a clear statement of the disputed account, a summary of the disagreement, a proposed settlement offer, and terms and conditions surrounding the resolution. The settlement offer letter should also specify the deadline for responding or accepting the proposed settlement. In conclusion, a Mecklenburg North Carolina Settlement Offer Letter from a Business Regarding a Disputed Account is a formal communication sent by a business to a consumer residing in Mecklenburg County to resolve a disputed account or outstanding debt. Different types of such letters may exist, including debt collection settlement offers, credit card settlement offers, personal loan settlement offers, medical bill settlement offers, and utility bill settlement offers. These letters aim to propose a mutually agreeable resolution and establish clear terms for settlement.A Mecklenburg North Carolina Settlement Offer Letter from a Business Regarding a Disputed Account is a formal written document sent by a business to a consumer residing in Mecklenburg County, North Carolina, in order to propose a resolution to a disputed account or outstanding debt. This letter aims to provide clarity, propose settlement terms, and convey the business's willingness to resolve the matter amicably. Different types of Settlement Offer Letters may exist depending on the specific circumstances of the disputed account. Some possible categories or variations may include: 1. Debt Collection Settlement Offer Letter: This type of letter is typically sent by a debt collection agency on behalf of a creditor or business seeking to recover outstanding funds. It outlines a reduced settlement amount or alternative repayment terms in order to resolve the dispute. 2. Credit Card Settlement Offer Letter: These letters are frequently sent by credit card companies or banks to consumers regarding disputed credit card accounts. They may propose a lowered payment amount or extended repayment period to reach a mutually beneficial settlement. 3. Personal Loan Settlement Offer Letter: In cases where an individual has taken out a personal loan, this type of settlement offer letter may be sent by the lender. It presents negotiated settlement terms to resolve a disputed account, taking into consideration the debtor’s financial circumstances. 4. Medical Bill Settlement Offer Letter: Medical service providers or hospitals often send these letters to patients with disputed medical bills. This letter proposes either a reduced settlement amount or a payment plan that accommodates the patient's financial capabilities. 5. Utility Bill Settlement Offer Letter: Utility companies, such as power or water providers, may send this type of letter to consumers with disputed accounts. The letter offers a resolution plan, including potential reduced payment options or schedule adjustments to address the dispute. Each Mecklenburg North Carolina Settlement Offer Letter from a Business Regarding a Disputed Account generally includes several essential elements. These may involve a clear statement of the disputed account, a summary of the disagreement, a proposed settlement offer, and terms and conditions surrounding the resolution. The settlement offer letter should also specify the deadline for responding or accepting the proposed settlement. In conclusion, a Mecklenburg North Carolina Settlement Offer Letter from a Business Regarding a Disputed Account is a formal communication sent by a business to a consumer residing in Mecklenburg County to resolve a disputed account or outstanding debt. Different types of such letters may exist, including debt collection settlement offers, credit card settlement offers, personal loan settlement offers, medical bill settlement offers, and utility bill settlement offers. These letters aim to propose a mutually agreeable resolution and establish clear terms for settlement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.