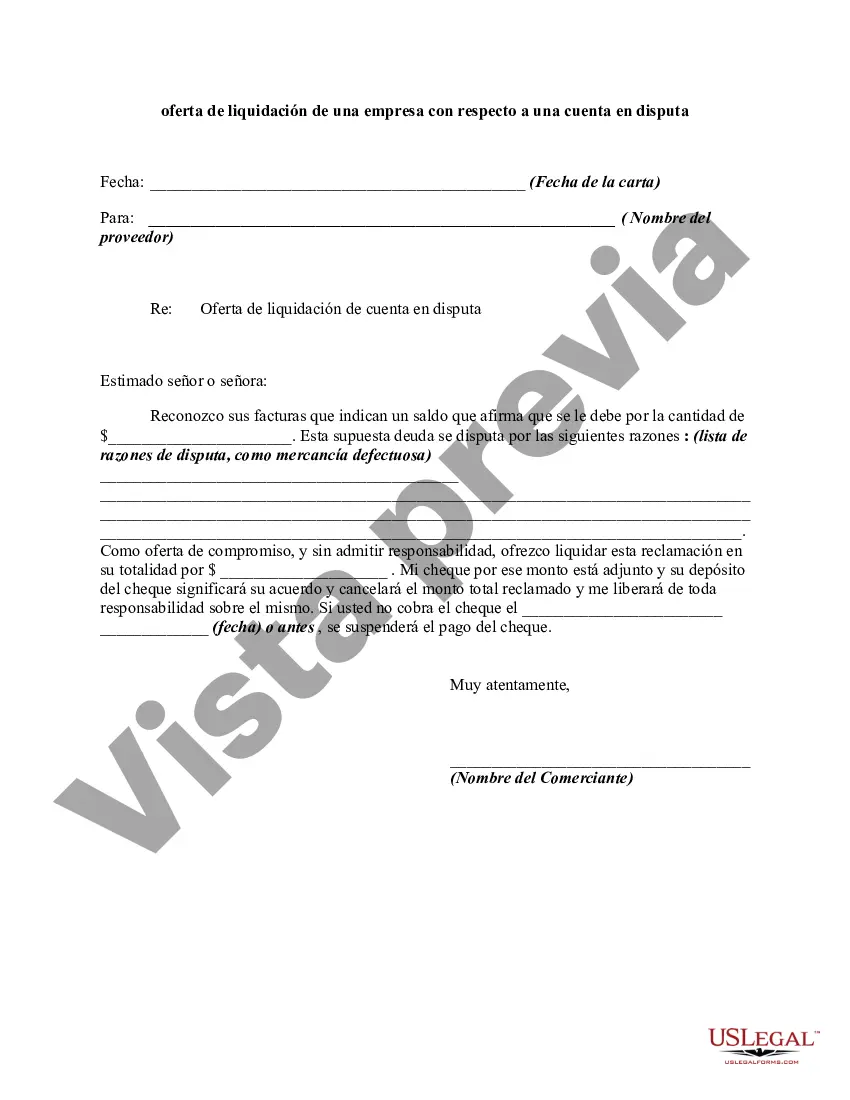

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

A Palm Beach Florida Settlement Offer Letter from a Business Regarding a Disputed Account is a formal communication sent by a company to a customer residing in Palm Beach, Florida, who has a disputed account with the business. This letter aims to propose a mutually agreeable resolution and settlement for the outstanding balance owed on the account. It is a legal document intended to protect the rights and interests of both parties involved. The content of a Palm Beach Florida Settlement Offer Letter may vary depending on the specific circumstances of the disputed account. However, some common elements and relevant keywords that could be included are: 1. Introduction: — Greeting: "Dear [Customer's Name]— - Identification: "Re: Account Dispute Settlement Offer" 2. Explanation of the Dispute: — Recap of the account history: "This letter is in reference to your account with [Company Name]..." — Description of the dispute: "We understand that there has been a disagreement regarding the charges/transactions made on the account..." — Mention of any previous communication: "We have reviewed the correspondence exchanged between us and taken your concerns into consideration..." 3. Settlement Proposal: — Offer details: "We propose a settlement amount of EX, which we believe to be fair and reasonable..." — Payment options and terms: "You may choose to settle this amount in a lump sum or through monthly installments..." — Deadline for accepting the offer: "To proceed with this settlement, we kindly request your written acceptance of this offer by [Date]..." 4. Release of Liability: — Clarification on the settlement's purpose: "By accepting this settlement, both parties agree to settle all claims and commence no further legal actions related to this dispute..." — Assurance of account resolution: "Upon receipt of the agreed-upon settlement amount, we will consider this account as fully settled and closed..." — Waiver signature: "Please sign and return a copy of this letter to indicate your acceptance and agreement to the terms..." 5. Contact Information: — Business name, address, and contact details: "Should you have any questions or require further clarification, please do not hesitate to contact our customer service department at [Phone Number] or [Email Address]..." Alternate Types of Palm Beach Florida Settlement Offer Letters from a Business Regarding a Disputed Account may include: 1. Palm Beach Florida Settlement Offer Letter — Partial Payment: If the company proposes a settlement that allows the customer to pay a reduced amount of the outstanding balance to resolve the dispute. 2. Palm Beach Florida Settlement Offer Letter — Debt Forgiveness: If the company is willing to forgive a certain portion of the disputed balance as a gesture of goodwill or to facilitate prompt resolution. 3. Palm Beach Florida Settlement Offer Letter — Account Adjustment: If the company suggests adjusting the account balance by correcting any errors or inaccuracies that may have contributed to the dispute. Remember, it is crucial to consult with legal professionals or experts before sending any settlement offer letters to ensure compliance with applicable laws and regulations.A Palm Beach Florida Settlement Offer Letter from a Business Regarding a Disputed Account is a formal communication sent by a company to a customer residing in Palm Beach, Florida, who has a disputed account with the business. This letter aims to propose a mutually agreeable resolution and settlement for the outstanding balance owed on the account. It is a legal document intended to protect the rights and interests of both parties involved. The content of a Palm Beach Florida Settlement Offer Letter may vary depending on the specific circumstances of the disputed account. However, some common elements and relevant keywords that could be included are: 1. Introduction: — Greeting: "Dear [Customer's Name]— - Identification: "Re: Account Dispute Settlement Offer" 2. Explanation of the Dispute: — Recap of the account history: "This letter is in reference to your account with [Company Name]..." — Description of the dispute: "We understand that there has been a disagreement regarding the charges/transactions made on the account..." — Mention of any previous communication: "We have reviewed the correspondence exchanged between us and taken your concerns into consideration..." 3. Settlement Proposal: — Offer details: "We propose a settlement amount of EX, which we believe to be fair and reasonable..." — Payment options and terms: "You may choose to settle this amount in a lump sum or through monthly installments..." — Deadline for accepting the offer: "To proceed with this settlement, we kindly request your written acceptance of this offer by [Date]..." 4. Release of Liability: — Clarification on the settlement's purpose: "By accepting this settlement, both parties agree to settle all claims and commence no further legal actions related to this dispute..." — Assurance of account resolution: "Upon receipt of the agreed-upon settlement amount, we will consider this account as fully settled and closed..." — Waiver signature: "Please sign and return a copy of this letter to indicate your acceptance and agreement to the terms..." 5. Contact Information: — Business name, address, and contact details: "Should you have any questions or require further clarification, please do not hesitate to contact our customer service department at [Phone Number] or [Email Address]..." Alternate Types of Palm Beach Florida Settlement Offer Letters from a Business Regarding a Disputed Account may include: 1. Palm Beach Florida Settlement Offer Letter — Partial Payment: If the company proposes a settlement that allows the customer to pay a reduced amount of the outstanding balance to resolve the dispute. 2. Palm Beach Florida Settlement Offer Letter — Debt Forgiveness: If the company is willing to forgive a certain portion of the disputed balance as a gesture of goodwill or to facilitate prompt resolution. 3. Palm Beach Florida Settlement Offer Letter — Account Adjustment: If the company suggests adjusting the account balance by correcting any errors or inaccuracies that may have contributed to the dispute. Remember, it is crucial to consult with legal professionals or experts before sending any settlement offer letters to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.