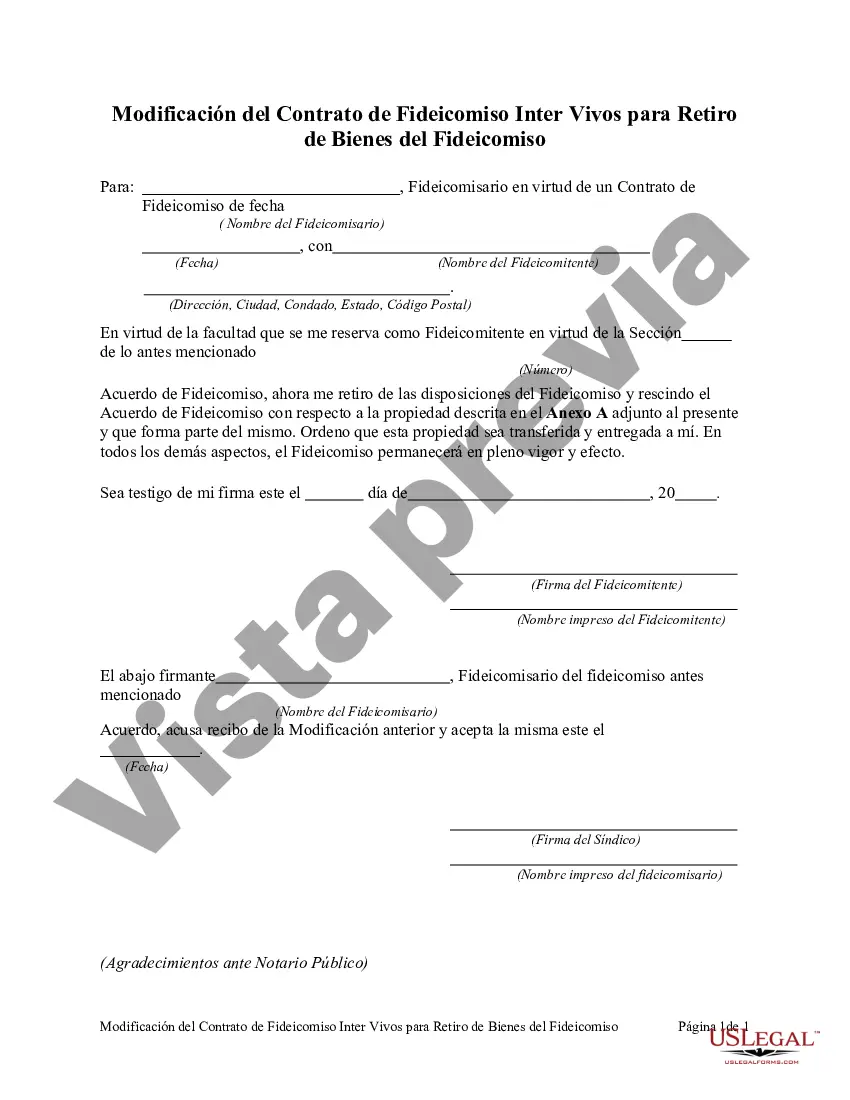

The Maricopa Arizona Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is an important legal document that allows individuals in Maricopa, Arizona, to make changes or modifications to their existing trust agreements, specifically for the purpose of withdrawing property from the trust. This amendment is often necessary when the trust or (the person who created the trust) wishes to remove certain assets from the trust, either to sell, transfer, or change the ownership of the property. By executing this amendment, the trust or can ensure that their intentions regarding the trust assets are accurately reflected and legally recognized. There are different types of Maricopa Arizona Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, each designed to address specific circumstances or property types. Some notable variations include: 1. Real Estate Withdrawal: This type of amendment is used when the trust or wishes to remove real estate properties, such as residential or commercial properties, from the trust. 2. Financial Asset Withdrawal: This amendment is suitable for individuals who want to withdraw financial assets like stocks, bonds, certificates of deposit, or other investment instruments from the trust. 3. Personal Property Withdrawal: When the trust or wants to remove personal property such as vehicles, jewelry, artwork, or any tangible assets from the trust, this amendment is employed. 4. Business Interest Withdrawal: If the trust includes ownership interests in a business or company, such as shares or partnership stakes, this specific amendment addresses the withdrawal of those assets. When drafting the Maricopa Arizona Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, it is important to consult with a qualified estate planning attorney who can provide guidance and ensure compliance with state laws and regulations. This amendment should clearly outline the assets being withdrawn, relevant details such as descriptions and values, and any necessary legal formalities to complete the property's removal from the trust. By utilizing this amendment, individuals in Maricopa, Arizona, can effectively modify their irrevocable or revocable trust agreements to accommodate their changing financial or personal circumstances, ensuring their estate planning goals are met accurately and legally.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Modificación del Contrato de Fideicomiso Inter Vivos para Retiro de Bienes del Fideicomiso - Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Maricopa Arizona Modificación Del Contrato De Fideicomiso Inter Vivos Para Retiro De Bienes Del Fideicomiso?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Maricopa Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Maricopa Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!