Queens New York Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is a legal process that allows individuals in Queens, New York, to make changes to their inter vivos trust agreements in regard to the withdrawal of specific properties from the trust. This amendment is necessary when trust creators or beneficiaries wish to remove certain assets or properties from the trust, for various reasons such as financial planning, changes in personal circumstances, or estate planning. The Queens New York Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust ensures that the trust agreement is modified accordingly, reflecting the removal of the specified property. This amendment must be executed with the guidance of an experienced attorney to ensure compliance with New York State laws and to protect the interests of all involved parties. Different types of Queens New York Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust may include: 1. Partial Property Withdrawal Amendment: This type of amendment allows the trust creator or beneficiaries to withdraw specific properties or assets from the trust, while keeping other assets intact within the trust. 2. Full Property Withdrawal Amendment: In some cases, individuals may wish to withdraw all properties or assets from the trust. This type of amendment enables the complete removal of all assets from the trust, effectively terminating the trust agreement. 3. Replacement Property Amendment: When individuals wish to withdraw a property from the trust but want to replace it with another property of equal or greater value, a replacement property amendment is applicable. This type of amendment ensures the continuity of the trust's overall structure while accommodating changes in asset allocation. It's important to consult an attorney specializing in estate planning and trust laws in Queens, New York, to navigate the intricacies involved in the Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. A skilled attorney will provide the necessary guidance, review the trust documents, evaluate tax implications, and draft the precise amendment to ensure it aligns with the individual's specific objectives and complies with relevant legal requirements.

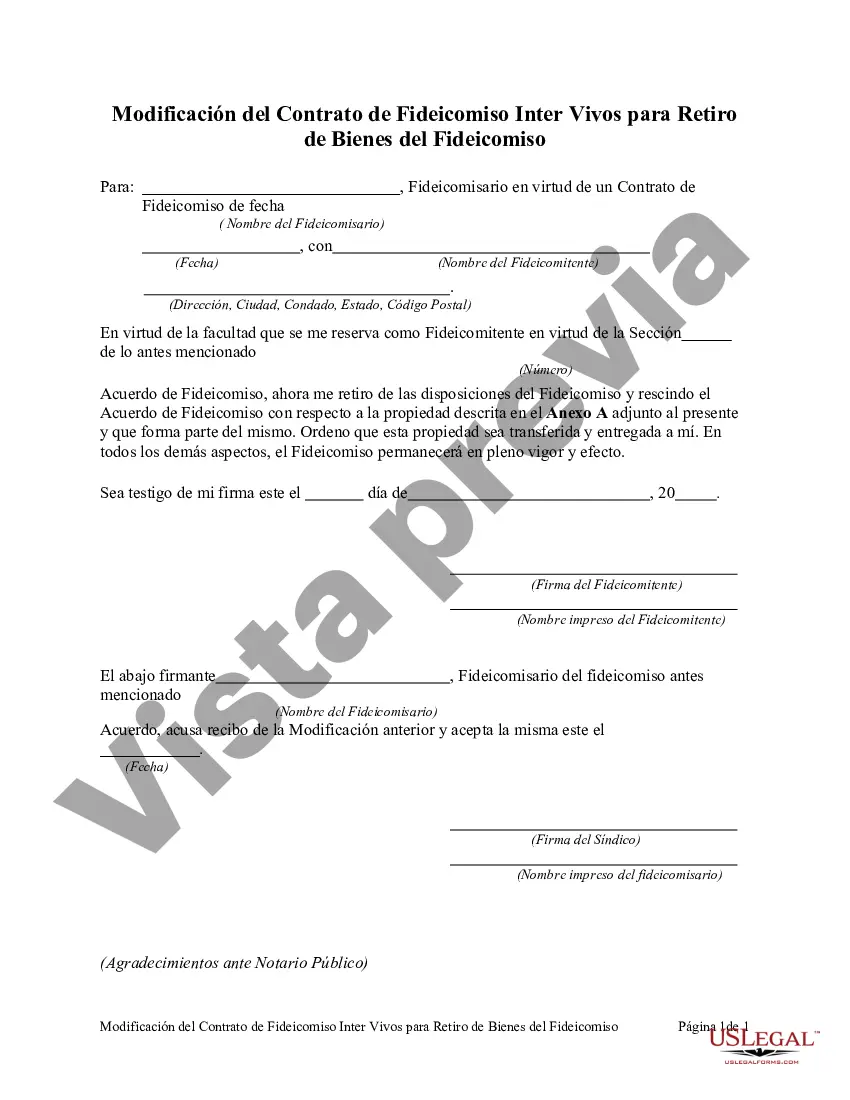

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Modificación del Contrato de Fideicomiso Inter Vivos para Retiro de Bienes del Fideicomiso - Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Queens New York Modificación Del Contrato De Fideicomiso Inter Vivos Para Retiro De Bienes Del Fideicomiso?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Queens Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to purchase and download Queens Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Queens Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Queens Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you have to deal with an exceptionally challenging situation, we advise getting an attorney to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!