The Wayne Michigan Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is a legal document that allows individuals in Wayne, Michigan, to make changes to their existing inter vivos trust agreement to remove certain properties from the trust. This amendment is an essential tool for individuals looking to modify their trust arrangement and ensure it aligns with their current wishes and circumstances. Keywords: Wayne Michigan, Amendment of Inter Vivos Trust Agreement, Withdrawal of Property, Trust, legal document, properties, modify, trust arrangement, inter vivos trust. There are several types of Wayne Michigan Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, including: 1. Partial Property Withdrawal Amendment: This type of amendment allows the trust or to remove specific properties or assets from the trust while keeping the remaining assets intact. It provides flexibility in managing the trust and adjusting the property portfolio according to changing needs or preferences. 2. Complete Property Withdrawal Amendment: In some cases, the trust or may decide to withdraw all properties from the trust. This amendment allows for the dissolution of the trust by removing all assets held within it. It is crucial to consult an experienced attorney to ensure a smooth and lawful dissolution process. 3. Property Replacement Amendment: This type of amendment enables the trust or to withdraw a particular property from the existing trust and replace it with another asset or property. This can be beneficial when the trust or wishes to exchange a property with different financial or personal advantages. 4. Change of Beneficiary Amendment: In certain situations, the trust or may want to remove a specific beneficiary from the trust. This amendment allows for the withdrawal of beneficiary rights and interests, ensuring that the trust property is distributed according to the trust or's updated wishes. It is important to consult with a knowledgeable attorney specializing in trust law in Wayne, Michigan, to guide you through the process of creating or amending an inter vivos trust agreement. They can provide expert advice tailored to your specific circumstances, ensuring that all legal requirements are met and protecting your interests. Overall, the Wayne Michigan Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust empowers individuals to make necessary modifications to their trust arrangement, allowing them to adapt to changing circumstances, protect their assets, and ensure their estate planning aligns with their current wishes.

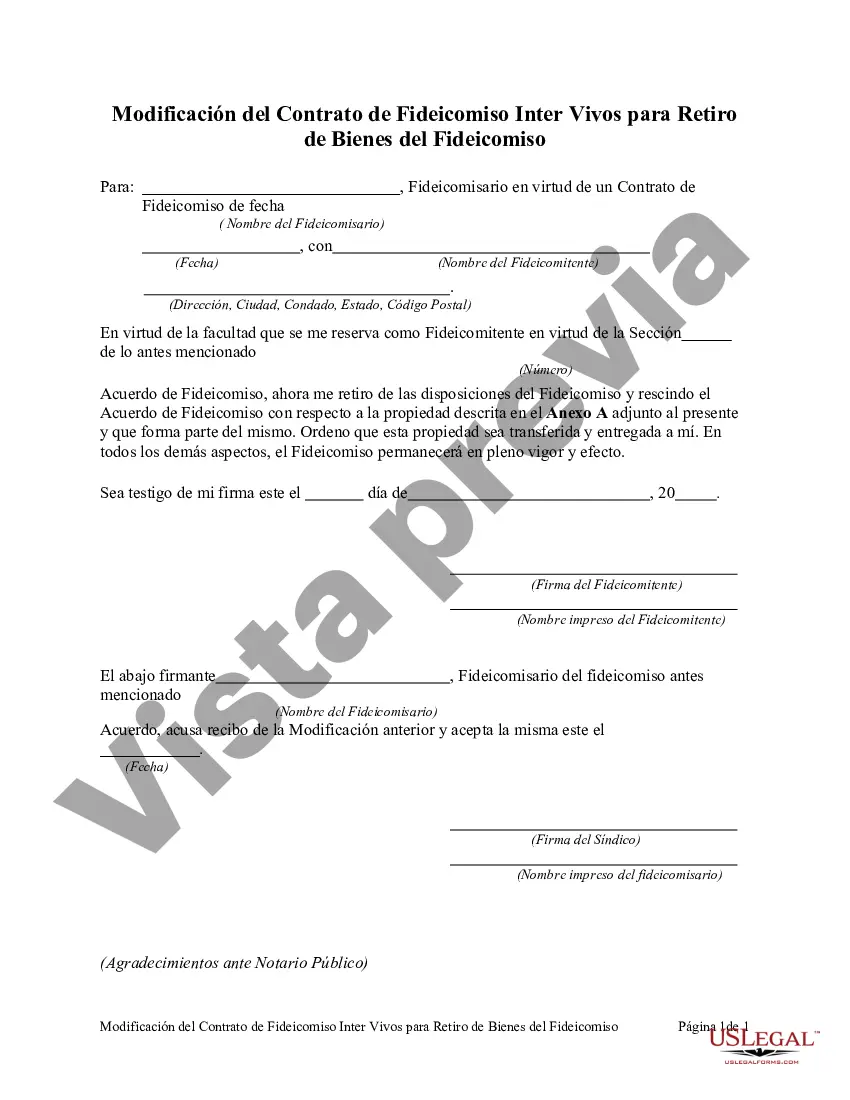

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Modificación del Contrato de Fideicomiso Inter Vivos para Retiro de Bienes del Fideicomiso - Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Wayne Michigan Modificación Del Contrato De Fideicomiso Inter Vivos Para Retiro De Bienes Del Fideicomiso?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Wayne Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Wayne Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Wayne Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Wayne Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

La IGJ inscribe todos los contratos de fideicomiso que satisfagan cualquiera de los extremos contemplados en el articulo 284 de la Resolucion General IGJ N° 7/2015, excluyendose los contratos de fideicomiso que se encuentren bajo el control de la CNV contemplados en los articulos 1690, 1691 y 1692 del Codigo Civil y

Un fideicomiso no es mas que una estructura legal a traves de la cual es posible designar la administracion de unos bienes a terceras personas, todo con la finalidad de obtener la mayor cantidad de beneficios (por ejemplo, proteger la privacidad de una persona que ya no desea que una propiedad este a su nombre).

La extincion del Fideicomiso, procede por las siguientes razones: 1. - Cumplimiento de los fines para los cuales fue constituido; 2. - Hacerse imposible su cumplimiento; 3. - Renuncia o muerte del Beneficiario sin tener sustituto; 4.

Tipos de fideicomiso segun su posibilidad de anulacion Revocables: El fideicomitente puede cambiarlo en cualquier momento de su vida. Irrevocable: No hay posibilidad de revertirlo una vez establecido el acuerdo, o a la muerte del fideicomitente.

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.

¿Que causas pueden provocar la remocion o cese del fiduciario? Remocion judicial por incumplimiento de las obligaciones asumidas. El juez puede proceder a instancias del fideicomitente o del beneficiario, con citacion al fideicomitente. Muerte o incapacidad declarada judicialmente si se trata de persona fisica.

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

Requisitos: Nombre y nacionalidad del fideicomitente. Nombre de la Institucion de credito (banco) que fungira como fiduciaria. Nombre y nacionalidad del fideicomisario y, si los hubiere, de los fideicomisarios en segundo lugar y de los fideicomisarios substitutos. Duracion del fideicomiso.

Cuando por sentencia se declare que existe un vicio en el contrato fiduciario, se da por declarada la nulidad del acto constitutivo, por tanto, se terminan los derechos y obligaciones contraidas por el fideicomitente, fiduciario y beneficiarios.

Para la documentacion a presentar debera tenerse en cuenta el tipo de fideicomiso que se trate: · Fideicomiso no financiero: Presenta fotocopia del contrato de fideicomiso y segun sea el fiduciario persona fisica o juridica, debera acompanarse tambien la documentacion que, para cada tipo de sujeto corresponda.