Title: Comprehensive Guide on Harris Texas Sample Letter for Employer's Verification on Loan Application Introduction: When applying for a loan, it is common for lenders to require verification from an applicant's employer to assess their financial stability and repayment capability. In Harris, Texas, there are various types of sample letters for employer's verification on loan applications, each serving a specific purpose. This guide aims to provide a detailed description of different types of Harris Texas sample letters for employer's verification on loan applications. 1. Harris Texas Sample Letter for Employment Verification: This letter confirms and verifies an individual's employment status, job title, duration of employment, income details, and any additional relevant information required by the lender. It includes the employer's contact details, the employee's name, and their consent for the employer to release the information. 2. Harris Texas Sample Letter for Income Verification: This letter serves to validate an individual's salary, wages, or other sources of income. It includes details such as the average monthly income, type of employment (full-time, part-time, contract, etc.), years of service, and any other significant income-related details necessary for the loan application. 3. Harris Texas Sample Letter for Self-Employment Verification: Applicable to individuals who are self-employed or own a business in Harris, Texas, this letter provides the necessary information about the business's nature, duration, profitability, and the applicant's position within the company. It may also include tax return information, business license details, and a statement about the consistency of income. 4. Harris Texas Sample Letter for Mortgage Verification: Specifically tailored for applicants seeking a mortgage loan, this letter verifies the financial stability of the applicant by providing details about the applicant's mortgage or rent payment history, any previous foreclosures or delinquencies, and other relevant mortgage-related information. This letter is typically requested by mortgage lenders when a previous loan has been paid off. 5. Harris Texas Sample Letter for Reference Verification: In some cases, lenders may request a reference verification letter to gain insights into an applicant's character, reliability, and integrity. This letter is usually obtained from a colleague or supervisor and includes details about the professional relationship, character assessment, and abilities of the applicant. Conclusion: When applying for a loan in Harris, Texas, securing a sample letter for employer's verification is essential to provide lenders with accurate, verifiable information. Whether for employment, income, self-employment, or mortgage-related purposes, these sample letters help lenders assess an applicant's eligibility and creditworthiness. By utilizing the appropriate type of letter, borrowers can enhance their chances of loan approval and obtain the financial assistance they need.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Carta de muestra para la verificación del empleador en la solicitud de préstamo - Sample Letter for Employer's Verification on Loan Application

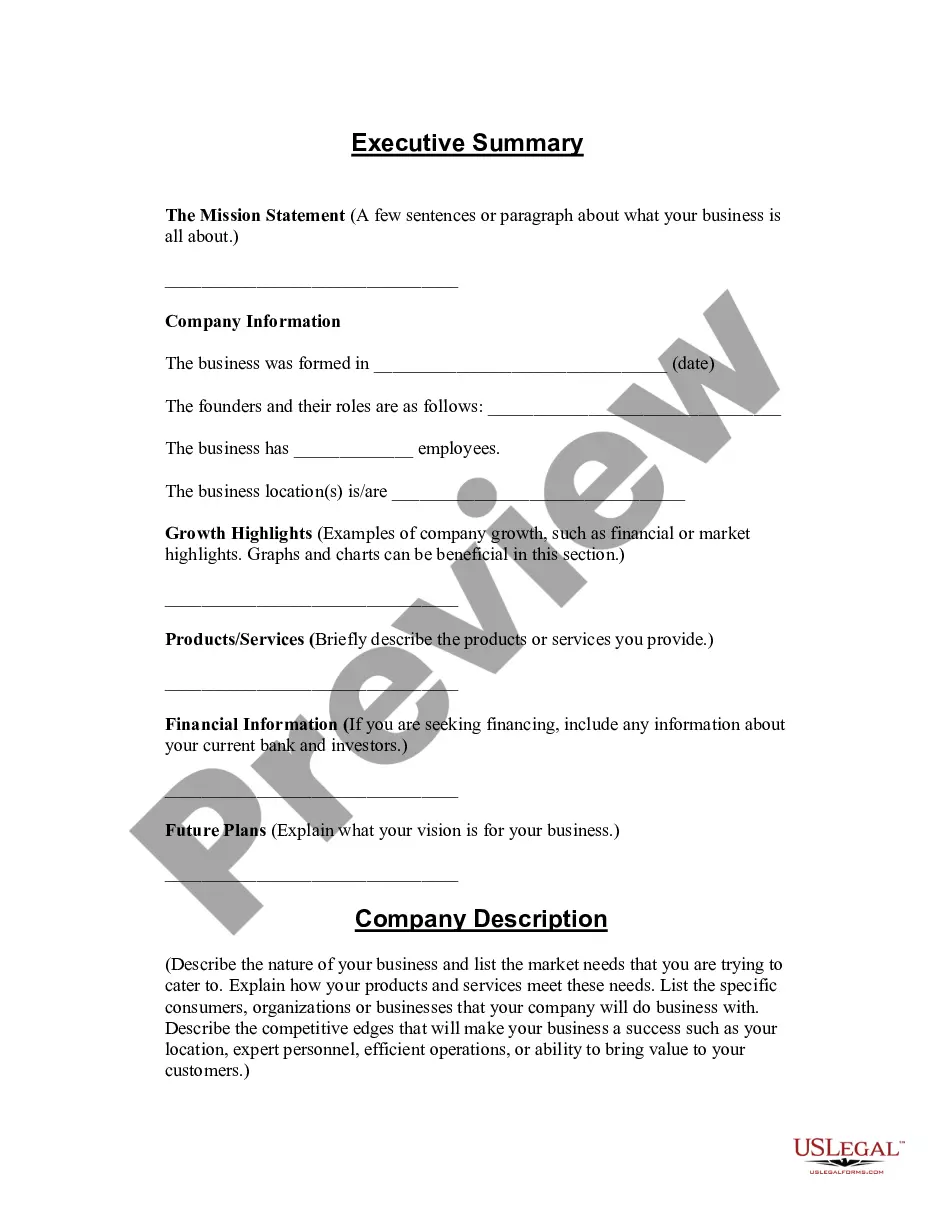

Description

How to fill out Harris Texas Carta De Muestra Para La Verificación Del Empleador En La Solicitud De Préstamo?

Creating documents, like Harris Sample Letter for Employer's Verification on Loan Application, to manage your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for a variety of scenarios and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Harris Sample Letter for Employer's Verification on Loan Application form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Harris Sample Letter for Employer's Verification on Loan Application:

- Make sure that your form is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Harris Sample Letter for Employer's Verification on Loan Application isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our website and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!