Title: King Washington Sample Letter for Employer's Verification on Loan Application Introduction: When applying for a loan, potential borrowers often need to provide various documents to provide evidence of their financial stability and employment status. One crucial document is the employer's verification letter, which serves as confirmation of an individual's employment details. This article will delve into the importance of a King Washington Sample Letter for Employer's Verification on Loan Application, highlighting its significance and benefits in different loan scenarios. 1. Key Elements of a King Washington Sample Letter for Employer's Verification on Loan Application: — Company Information: The letter should begin with the company's name, address, and contact details. Mention the official letterhead if applicable. — Employee Details: Include the borrower's full name, designation, and employment start date, highlighting their continuous employment. — Employment Status: Clearly state whether the employee is currently employed, including their employment type (full-time, part-time, or contractual). — Earnings Information: Specify the employee's gross monthly or annual income, emphasizing stability and consistency. — Job Stability: Highlight the duration of employment, indicating if it is a permanent position or a specified contract with a defined end date. — Supplementary Information: If relevant, include details regarding benefits, allowances, bonuses, or any outstanding loans or liabilities that could impact the borrower's financial stability. 2. Benefits of Using the King Washington Sample Letter for Employer's Verification: — Professional Format: The King Washington sample letter features a well-structured format, lending credibility to the information being provided. — Compliance with Lending Requirements: Banks and financial institutions often have specific formats and requirements for employment verification letters. Utilizing the King Washington sample ensures compliance and saves time in customizing the letter. — Streamlined Loan Processing: By using a standardized and professional letter, borrowers can expedite loan processing, resulting in faster access to funds. — Enhances Applicant's Credibility: An employer's verification letter can strengthen an applicant's credibility as it verifies their employment details, showcasing stable income and job security. — Reduces Risk of Fraud: Lenders utilize employer verification letters as a security measure against fraudulent loan applications, ensuring that the applicant is genuinely affiliated with the mentioned company. Types of King Washington Sample Letter for Employer's Verification on Loan Application: 1. Standard Employment Verification Letter: Applicable to individuals with regular, full-time employment seeking loans from traditional financial institutions. 2. Contractual Employment Verification Letter: Designed for applicants employed on a contractual basis and requiring a loan to fulfill their financial needs. 3. Part-Time Employment Verification Letter: Tailored for those employed part-time who wish to secure loans based on their income during restricted working hours. 4. Self-Employment Verification Letter: Suited for self-employed individuals who require a loan based on their business's stability and personal income. Conclusion: Obtaining a King Washington Sample Letter for Employer's Verification on Loan Application is crucial when seeking financial support. This carefully crafted letter, tailored to various types of employment, highlights an applicant's credibility, job stability, and financial standing. By using an appropriate verification letter, borrowers can enhance their chances of loan approval and expedite the loan application process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Carta de muestra para la verificación del empleador en la solicitud de préstamo - Sample Letter for Employer's Verification on Loan Application

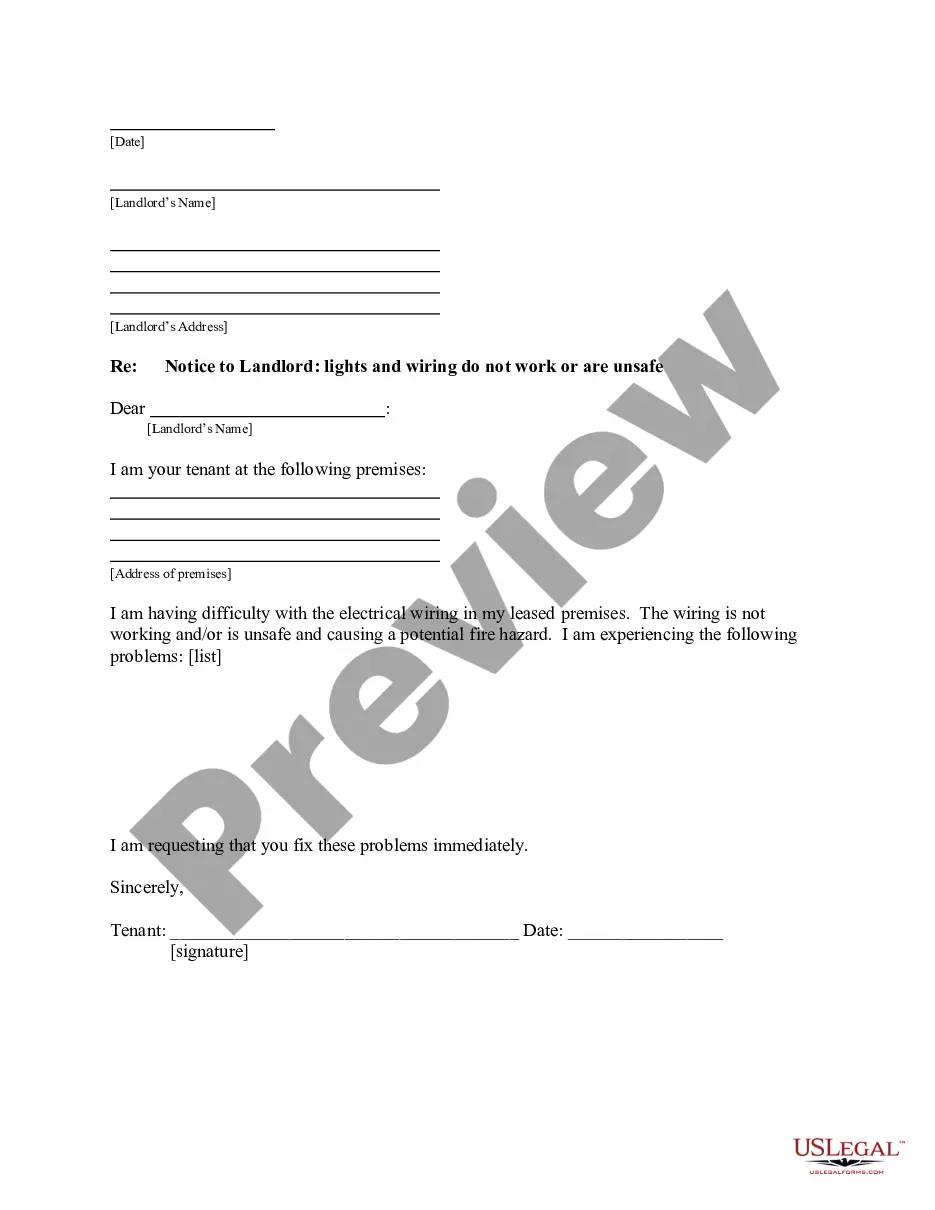

Description

How to fill out King Washington Carta De Muestra Para La Verificación Del Empleador En La Solicitud De Préstamo?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a King Sample Letter for Employer's Verification on Loan Application meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the King Sample Letter for Employer's Verification on Loan Application, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your King Sample Letter for Employer's Verification on Loan Application:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the King Sample Letter for Employer's Verification on Loan Application.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Una carta de verificacion de beneficios es un documento oficial que detalla tus beneficios del Seguro Social, de la Seguridad de Ingreso Suplementario o tu cobertura de Medicare. Se puede usar cuando necesites un comprobante de ingresos o de discapacidad.

La carta de verificacion de empleo es un documento proporcionado por el empleador que confirma la relacion laboral entre la empresa y el empleado. Ademas, la carta aporta la informacion de contacto, el periodo de contratacion y los cargos desempenados.

Los elementos de la carta de recomendacion laboral Encabezado.Recomendador.Recomendado.Duracion de la relacion laboral.Referencia a las actitudes del empleado.Referencia al puesto que desempenaba el trabajador.Formacion recibida en la empresa o planes de carrera.Desarrollo del empleado en la empresa.

Una carta de presentacion es un documento que se usa como portada del curriculum en el que el aplicante describe sus habilidades, experiencias y profundiza en el motivo de su eleccion de carrera o estudios, ademas de su interes en ocupar la vacante para la que esta aplicando y los motivos por los cuales seria la

Una carta de presentacion es un documento que se usa como portada del curriculum en el que el aplicante describe sus habilidades, experiencias y profundiza en el motivo de su eleccion de carrera o estudios, ademas de su interes en ocupar la vacante para la que esta aplicando y los motivos por los cuales seria la

Una carta de presentacion es un documento que se usa como portada del curriculum en el que el aplicante describe sus habilidades, experiencias y profundiza en el motivo de su eleccion de carrera o estudios, ademas de su interes en ocupar la vacante para la que esta aplicando y los motivos por los cuales seria la

Como solicitar una carta de verificacion de empleo Averigua quien envia las cartas de verificacion de empleo en la empresa. Sigue los procedimientos de la empresa. Especifica los detalles. Facilita la direccion del destinatario. Avisa al empleador con suficiente antelacion. Incluye tu informacion de contacto.

Como solicitar una carta de verificacion de empleo Averigua quien envia las cartas de verificacion de empleo en la empresa. Sigue los procedimientos de la empresa. Especifica los detalles. Facilita la direccion del destinatario. Avisa al empleador con suficiente antelacion. Incluye tu informacion de contacto.

El usuario debe apersonarse a la oficina de Recursos Humanos de su Institucion y solicitar la creacion de una Contrasena. Luego de realizado este procedimiento, el usuario podra generar su carta de trabajo en linea. Para orientacion y consultas sobre tramites puede llamar gratis al 311.

Una carta de verificacion de empleo suele incluir la direccion de su empleador, el nombre y la direccion de la organizacion que solicita el documento, su nombre, las fechas de su empleo, su cargo y su salario.