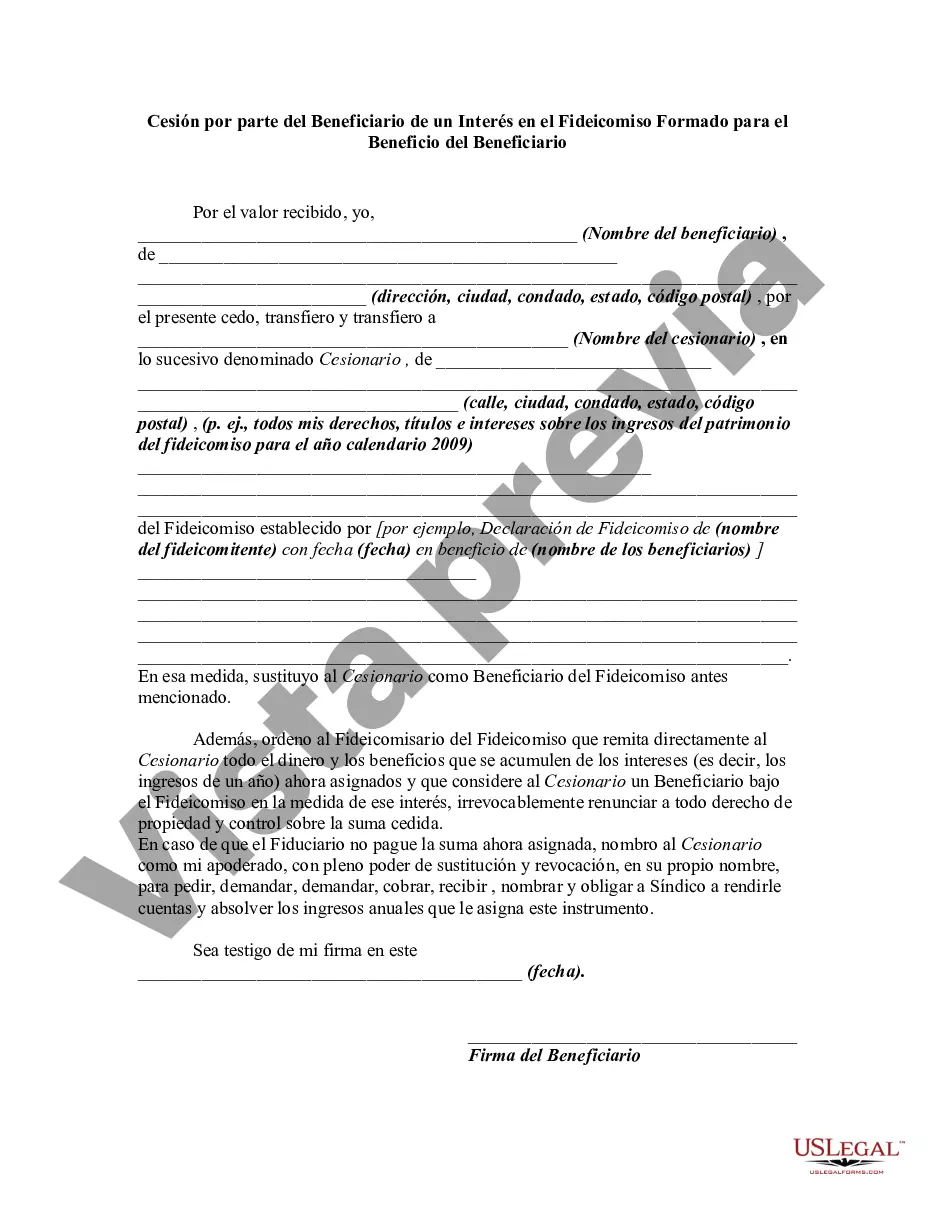

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a beneficiary to transfer or assign their interest in a trust to another party. This assignment can have specific types based on the nature and purpose of the trust. Some of these types include: 1. Assignment of a Revocable Trust: In this type of assignment, the beneficiary of a revocable trust can transfer their interests to another individual or entity. The revocable trust allows the trust or to make changes or revoke the trust during their lifetime. 2. Assignment of an Irrevocable Trust: An irrevocable trust assignment involves the transfer of a beneficiary's interest in an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be changed or revoked by the trust or once it has been established. 3. Assignment of a Living Trust: Living trusts, also known as inter vivos trusts, are created during the trust or's lifetime. The beneficiary assignment in this case involves the transfer of the beneficiary's interests in a living trust to another party. 4. Assignment of a Testamentary Trust: Testamentary trusts are created as per the instructions in the trust or's will. Assigning a beneficiary's interest in a testamentary trust refers to transferring their rights to another individual or entity according to the terms specified in the trust document. 5. Assignment of a Special Needs Trust: A special needs trust assignment occurs when a beneficiary intends to transfer their interest in a trust set up to provide for the needs of a person with disabilities. The assignment should consider the unique requirements and guidelines associated with special needs trusts. Collin Texas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a crucial legal instrument that enables beneficiaries to transfer their interests in different types of trusts. It is essential to consult an attorney familiar with Texas trust laws to ensure the assignment is executed correctly and complies with all legal requirements.Collin Texas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a beneficiary to transfer or assign their interest in a trust to another party. This assignment can have specific types based on the nature and purpose of the trust. Some of these types include: 1. Assignment of a Revocable Trust: In this type of assignment, the beneficiary of a revocable trust can transfer their interests to another individual or entity. The revocable trust allows the trust or to make changes or revoke the trust during their lifetime. 2. Assignment of an Irrevocable Trust: An irrevocable trust assignment involves the transfer of a beneficiary's interest in an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be changed or revoked by the trust or once it has been established. 3. Assignment of a Living Trust: Living trusts, also known as inter vivos trusts, are created during the trust or's lifetime. The beneficiary assignment in this case involves the transfer of the beneficiary's interests in a living trust to another party. 4. Assignment of a Testamentary Trust: Testamentary trusts are created as per the instructions in the trust or's will. Assigning a beneficiary's interest in a testamentary trust refers to transferring their rights to another individual or entity according to the terms specified in the trust document. 5. Assignment of a Special Needs Trust: A special needs trust assignment occurs when a beneficiary intends to transfer their interest in a trust set up to provide for the needs of a person with disabilities. The assignment should consider the unique requirements and guidelines associated with special needs trusts. Collin Texas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a crucial legal instrument that enables beneficiaries to transfer their interests in different types of trusts. It is essential to consult an attorney familiar with Texas trust laws to ensure the assignment is executed correctly and complies with all legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.