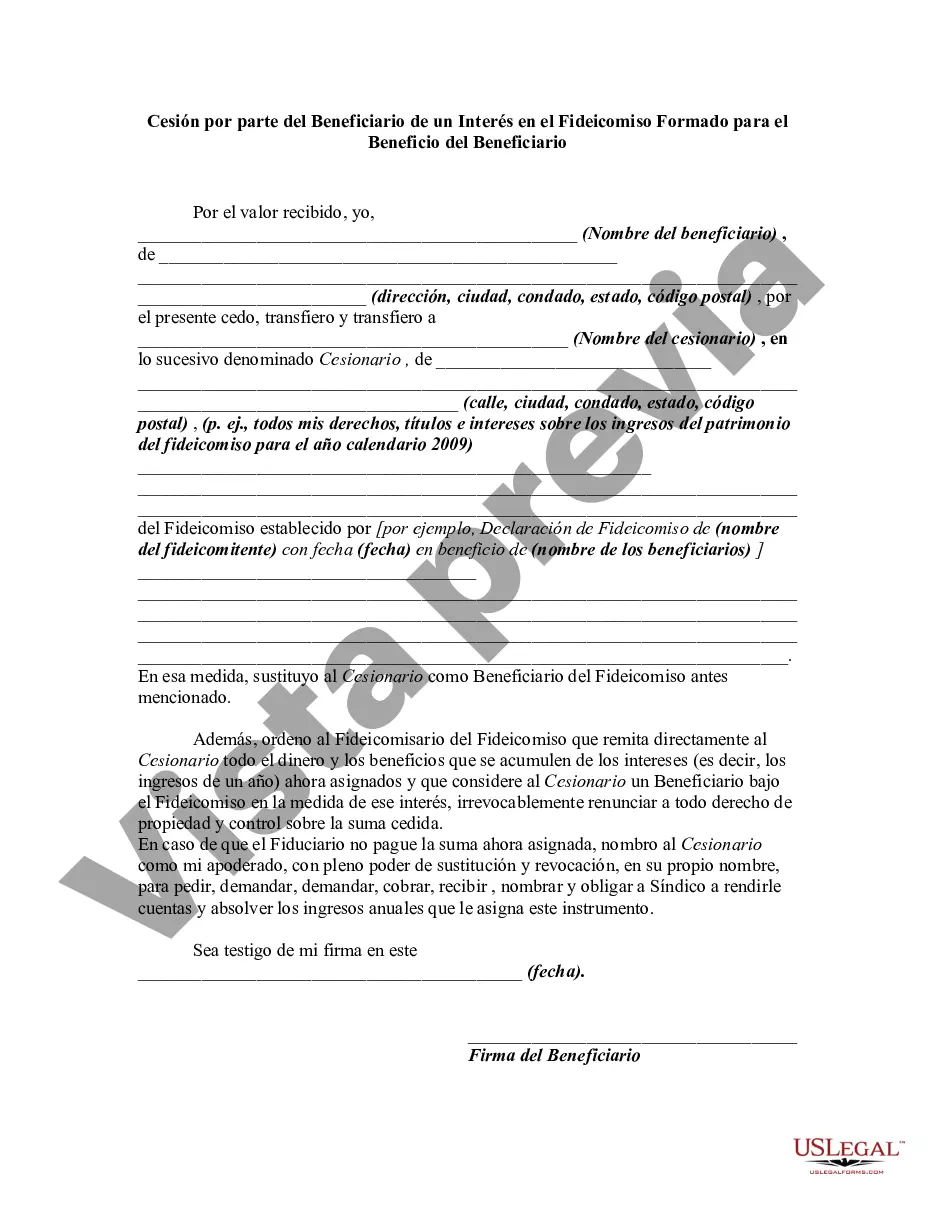

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Franklin Ohio Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a beneficiary of a trust to assign or transfer their interest in the trust to another party. This assignment can be done for various reasons, such as transferring ownership or as a part of estate planning. Keywords: Franklin Ohio, Assignment, Beneficiary, Interest, Trust, Benefit, Assignment by Beneficiary, Legal Document, Transfer, Ownership, Estate Planning. Types of Franklin Ohio Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: 1. Absolute Assignment: This type of assignment involves the complete transfer of the beneficiary's interest in the trust to another party, leaving them with no further claims or rights over the trust assets. 2. Partial Assignment: In this case, the beneficiary transfers a portion of their interest in the trust to another party, allowing them to benefit from a certain percentage or portion of the trust assets, income, or distributions. 3. Conditional Assignment: Here, the beneficiary assigns their interest in the trust under specific conditions or circumstances. For example, they may assign their interest only if they fulfill certain requirements or if certain events occur. 4. Revocable Assignment: This type of assignment allows the beneficiary to revoke or cancel the assignment in the future if they wish to retain their interest in the trust or transfer it to someone else. 5. Irrevocable Assignment: On the contrary, an irrevocable assignment means that once the beneficiary assigns their interest, it cannot be revoked or canceled at a later stage. The assignment becomes permanent, and the beneficiary no longer has control over the assigned interest. When preparing a Franklin Ohio Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is essential to consult with legal professionals who are well-versed in trust laws and regulations in Ohio. This ensures that the assignment is drafted accurately, adheres to the necessary legal requirements, and protects the interests of all parties involved.Franklin Ohio Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a beneficiary of a trust to assign or transfer their interest in the trust to another party. This assignment can be done for various reasons, such as transferring ownership or as a part of estate planning. Keywords: Franklin Ohio, Assignment, Beneficiary, Interest, Trust, Benefit, Assignment by Beneficiary, Legal Document, Transfer, Ownership, Estate Planning. Types of Franklin Ohio Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: 1. Absolute Assignment: This type of assignment involves the complete transfer of the beneficiary's interest in the trust to another party, leaving them with no further claims or rights over the trust assets. 2. Partial Assignment: In this case, the beneficiary transfers a portion of their interest in the trust to another party, allowing them to benefit from a certain percentage or portion of the trust assets, income, or distributions. 3. Conditional Assignment: Here, the beneficiary assigns their interest in the trust under specific conditions or circumstances. For example, they may assign their interest only if they fulfill certain requirements or if certain events occur. 4. Revocable Assignment: This type of assignment allows the beneficiary to revoke or cancel the assignment in the future if they wish to retain their interest in the trust or transfer it to someone else. 5. Irrevocable Assignment: On the contrary, an irrevocable assignment means that once the beneficiary assigns their interest, it cannot be revoked or canceled at a later stage. The assignment becomes permanent, and the beneficiary no longer has control over the assigned interest. When preparing a Franklin Ohio Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is essential to consult with legal professionals who are well-versed in trust laws and regulations in Ohio. This ensures that the assignment is drafted accurately, adheres to the necessary legal requirements, and protects the interests of all parties involved.

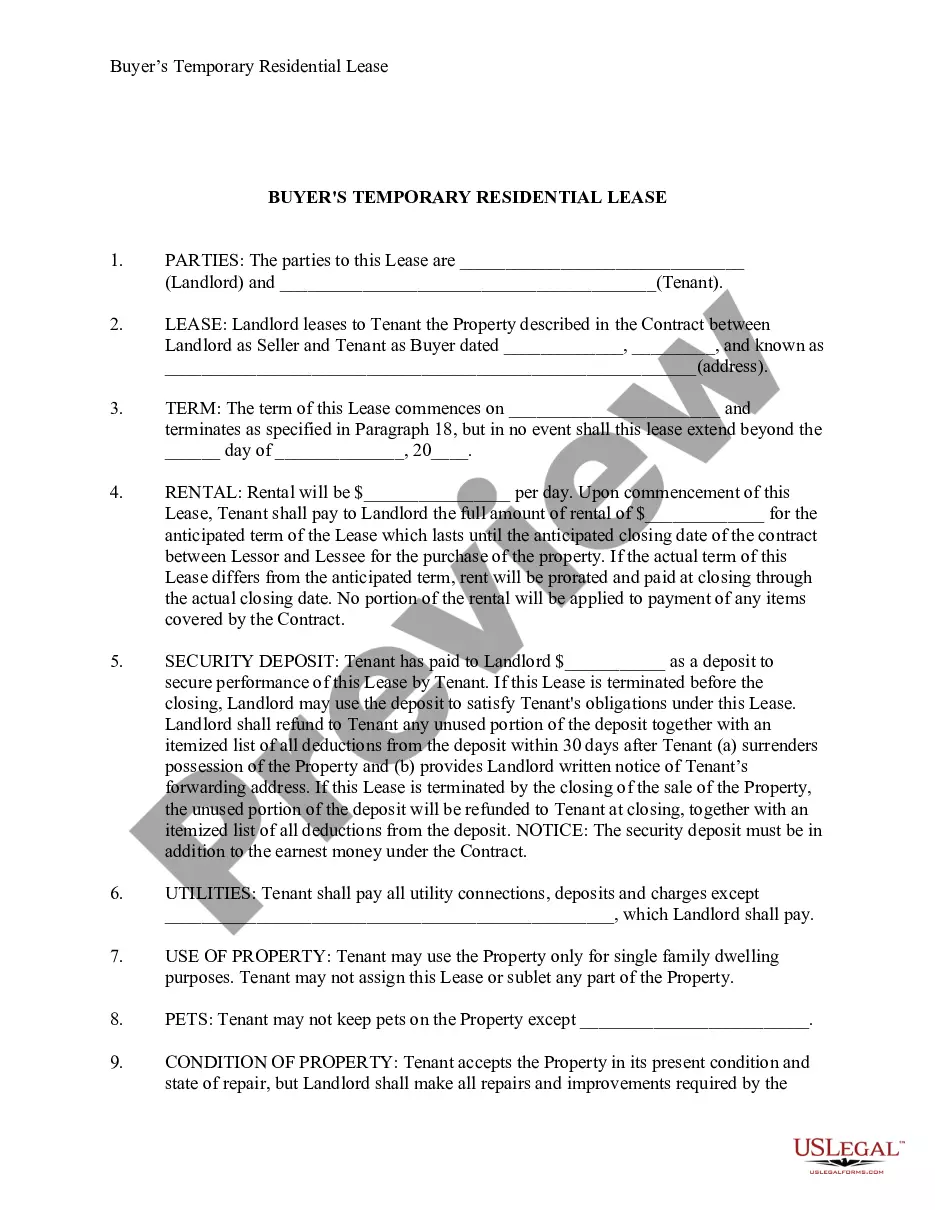

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.