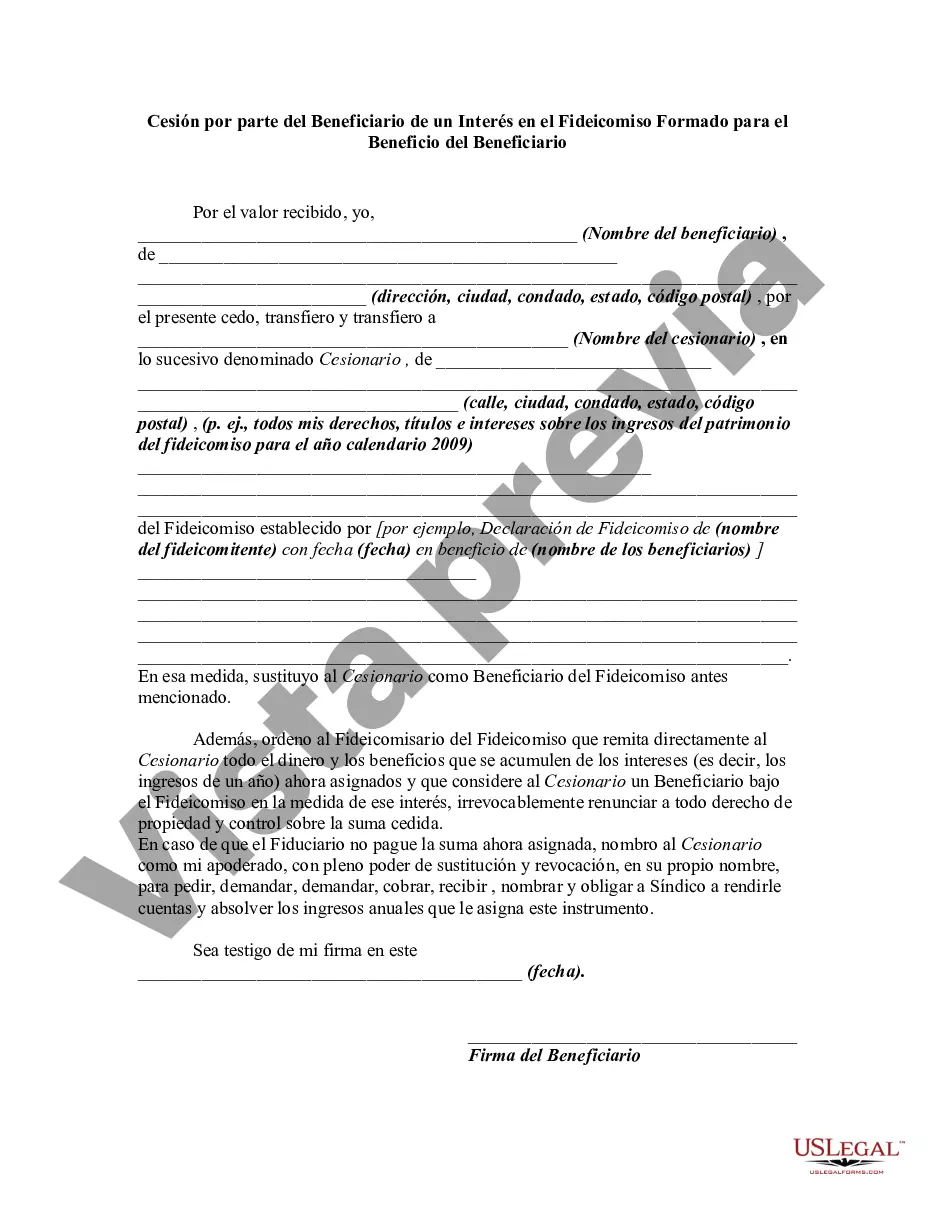

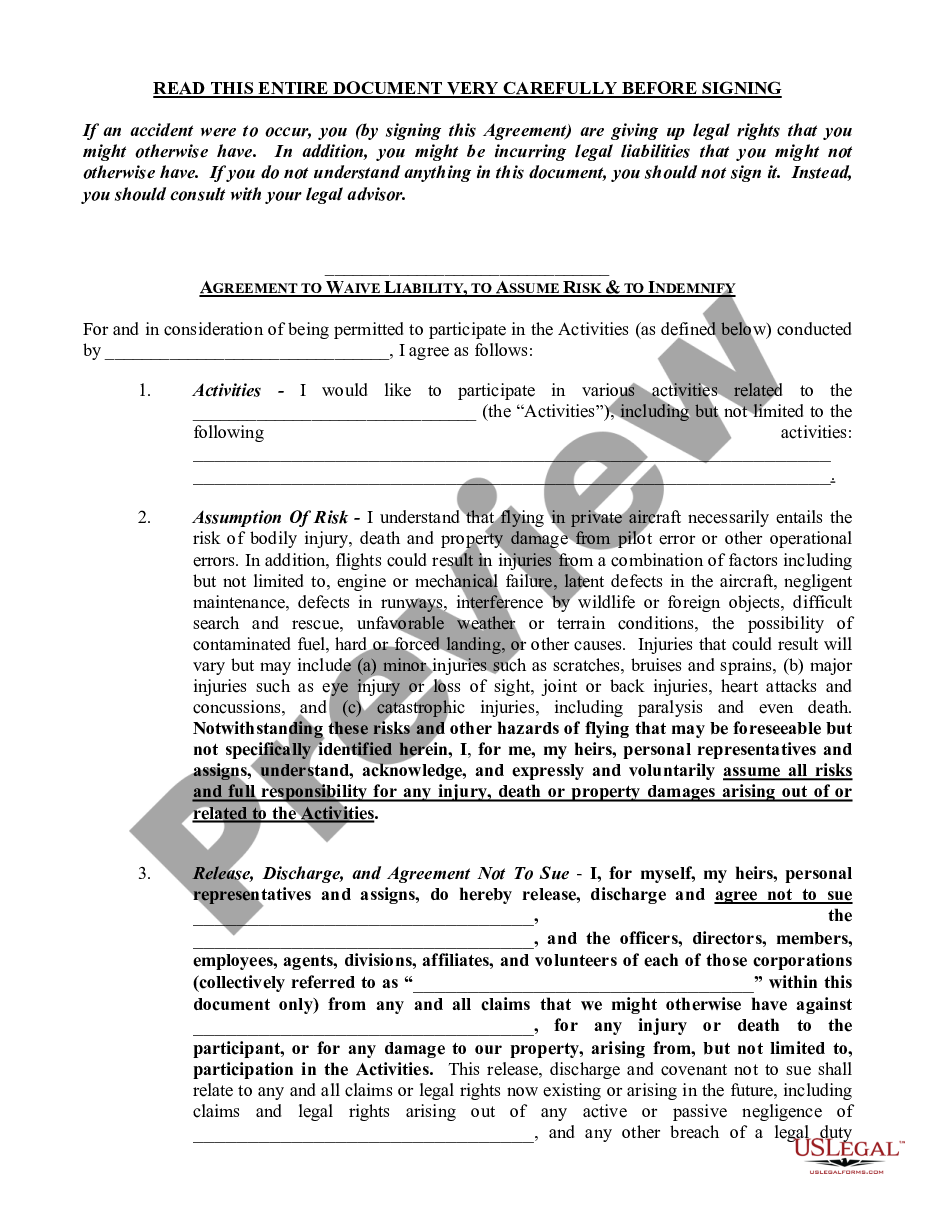

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montgomery, Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary refers to a legal process through which a beneficiary transfers or assigns their interest or rights in a trust to another individual or entity. This assignment allows the beneficiary to transfer their share of assets, income, or any other benefits derived from the trust to a third party, enabling them to access funds or ensure the financial security of a designated recipient. Montgomery, Maryland, being the location where the trust is formed, follows specific legal guidelines and procedures governing the assignment of interests in trusts. This jurisdiction ensures transparency, fairness, and compliance with trust laws to protect the interests of both beneficiaries and trust administrators. Different Types of Montgomery, Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: 1. Partial Assignment: In this form, a beneficiary assigns only a portion of their interest in the trust to another party. The assigned portion may consist of a specific percentage, amount, or designated assets within the trust. 2. Absolute Assignment: An absolute assignment involves the complete transfer of a beneficiary's interest in the trust to another entity or individual. This type of assignment relinquishes all rights and benefits associated with the trust, leaving the beneficiary with no further claim. 3. Income Assignment: This type of assignment focuses on transferring only the income generated by the trust to a designated party, while keeping the principal assets intact. It allows the beneficiary to secure a regular income stream for themselves or their chosen beneficiary. 4. Contingent Assignment: A contingent assignment refers to the transfer of a beneficiary’s interest in the trust under specific circumstances or predefined conditions. It provides a flexible arrangement that triggers the assignment based on certain events, such as the death or disability of the beneficiary. 5. Revocable Assignment: Unlike a permanent assignment, a revocable assignment allows the beneficiary to retract or modify the assignment of their interest in the trust at a later stage. This type of assignment offers flexibility and allows for changes to be made in light of evolving circumstances. In summary, Montgomery, Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary facilitates the legal transfer of trust benefits from one individual to another, ensuring the security and financial well-being of all parties involved. Understanding the types and intricacies of such assignments can help beneficiaries make informed decisions to meet their unique needs within the framework of Maryland trust laws.Montgomery, Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary refers to a legal process through which a beneficiary transfers or assigns their interest or rights in a trust to another individual or entity. This assignment allows the beneficiary to transfer their share of assets, income, or any other benefits derived from the trust to a third party, enabling them to access funds or ensure the financial security of a designated recipient. Montgomery, Maryland, being the location where the trust is formed, follows specific legal guidelines and procedures governing the assignment of interests in trusts. This jurisdiction ensures transparency, fairness, and compliance with trust laws to protect the interests of both beneficiaries and trust administrators. Different Types of Montgomery, Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: 1. Partial Assignment: In this form, a beneficiary assigns only a portion of their interest in the trust to another party. The assigned portion may consist of a specific percentage, amount, or designated assets within the trust. 2. Absolute Assignment: An absolute assignment involves the complete transfer of a beneficiary's interest in the trust to another entity or individual. This type of assignment relinquishes all rights and benefits associated with the trust, leaving the beneficiary with no further claim. 3. Income Assignment: This type of assignment focuses on transferring only the income generated by the trust to a designated party, while keeping the principal assets intact. It allows the beneficiary to secure a regular income stream for themselves or their chosen beneficiary. 4. Contingent Assignment: A contingent assignment refers to the transfer of a beneficiary’s interest in the trust under specific circumstances or predefined conditions. It provides a flexible arrangement that triggers the assignment based on certain events, such as the death or disability of the beneficiary. 5. Revocable Assignment: Unlike a permanent assignment, a revocable assignment allows the beneficiary to retract or modify the assignment of their interest in the trust at a later stage. This type of assignment offers flexibility and allows for changes to be made in light of evolving circumstances. In summary, Montgomery, Maryland Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary facilitates the legal transfer of trust benefits from one individual to another, ensuring the security and financial well-being of all parties involved. Understanding the types and intricacies of such assignments can help beneficiaries make informed decisions to meet their unique needs within the framework of Maryland trust laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.