An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Philadelphia, Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: Explained In Philadelphia, Pennsylvania, when a trust is established for the benefit of a beneficiary, there may arise circumstances where the beneficiary wishes to transfer or assign their interest in the trust to another party. This action is known as an Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Understanding this legal process is crucial for those involved in trusts, whether as beneficiaries or assignees. A trust is a legal entity created to hold and manage assets on behalf of beneficiaries. In Pennsylvania, trusts are governed by the Pennsylvania Uniform Trust Act (PUT). The purpose of an Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is to allow a beneficiary to pass their rights and interests in the trust to someone else, referred to as an assignee. When it comes to Philadelphia, Pennsylvania, the Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary may vary in its types, depending on the specific circumstances and needs of the parties involved. Some common types include: 1. General Assignment: This type of assignment allows the beneficiary to transfer their entire interest in the trust to the assignee, relinquishing all rights, benefits, and obligations associated with it. 2. Partial Assignment: In certain situations, a beneficiary may choose to assign only a portion of their interest in the trust to the assignee. This means that the beneficiary retains some rights and benefits from the trust while transferring others to the assignee. 3. Conditional Assignment: Here, the assignment is subject to certain conditions or restrictions defined by the beneficiary. For example, the beneficiary may specify that the assignment only takes effect after a certain event occurs or upon reaching a specific date. 4. Revocable Assignment: In this type of assignment, the beneficiary reserves the right to revoke or cancel the assignment at a later time, thereby reclaiming their interest in the trust. 5. Irrevocable Assignment: Unlike a revocable assignment, an irrevocable assignment cannot be revoked or withdrawn by the beneficiary once it is made. This type of assignment permanently transfers the beneficiary's interest in the trust. It is crucial to consult with a qualified attorney who specializes in trusts and estates to ensure that the Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is legally valid, meets the requirements of Pennsylvania law, and protects the interests of all parties involved. In conclusion, a Philadelphia, Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary allows a beneficiary to transfer or assign their rights and interests in a trust to an assignee. Specific types of assignments may include general, partial, conditional, revocable, or irrevocable assignments. Seeking legal expertise is essential to navigate this process effectively and ensure compliance with Pennsylvania trust laws.Philadelphia, Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: Explained In Philadelphia, Pennsylvania, when a trust is established for the benefit of a beneficiary, there may arise circumstances where the beneficiary wishes to transfer or assign their interest in the trust to another party. This action is known as an Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Understanding this legal process is crucial for those involved in trusts, whether as beneficiaries or assignees. A trust is a legal entity created to hold and manage assets on behalf of beneficiaries. In Pennsylvania, trusts are governed by the Pennsylvania Uniform Trust Act (PUT). The purpose of an Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is to allow a beneficiary to pass their rights and interests in the trust to someone else, referred to as an assignee. When it comes to Philadelphia, Pennsylvania, the Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary may vary in its types, depending on the specific circumstances and needs of the parties involved. Some common types include: 1. General Assignment: This type of assignment allows the beneficiary to transfer their entire interest in the trust to the assignee, relinquishing all rights, benefits, and obligations associated with it. 2. Partial Assignment: In certain situations, a beneficiary may choose to assign only a portion of their interest in the trust to the assignee. This means that the beneficiary retains some rights and benefits from the trust while transferring others to the assignee. 3. Conditional Assignment: Here, the assignment is subject to certain conditions or restrictions defined by the beneficiary. For example, the beneficiary may specify that the assignment only takes effect after a certain event occurs or upon reaching a specific date. 4. Revocable Assignment: In this type of assignment, the beneficiary reserves the right to revoke or cancel the assignment at a later time, thereby reclaiming their interest in the trust. 5. Irrevocable Assignment: Unlike a revocable assignment, an irrevocable assignment cannot be revoked or withdrawn by the beneficiary once it is made. This type of assignment permanently transfers the beneficiary's interest in the trust. It is crucial to consult with a qualified attorney who specializes in trusts and estates to ensure that the Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is legally valid, meets the requirements of Pennsylvania law, and protects the interests of all parties involved. In conclusion, a Philadelphia, Pennsylvania Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary allows a beneficiary to transfer or assign their rights and interests in a trust to an assignee. Specific types of assignments may include general, partial, conditional, revocable, or irrevocable assignments. Seeking legal expertise is essential to navigate this process effectively and ensure compliance with Pennsylvania trust laws.

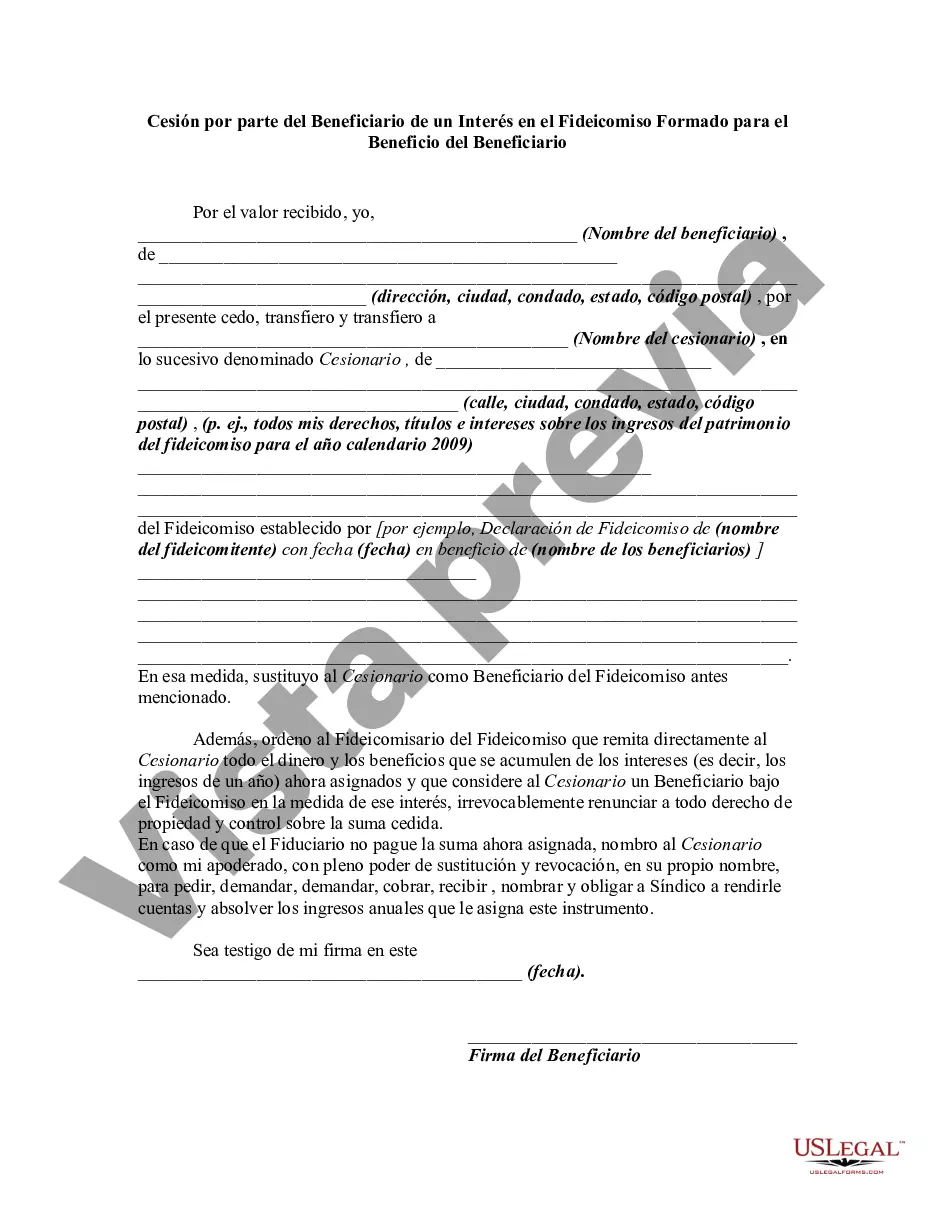

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.