This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston Texas Notice to Trustee of Assignment by Beneficiary of Interest in Trust is a legal document that formalizes the assignment of a beneficiary's interest in a trust to another party. This assignment allows for the transfer of the beneficiary's rights, benefits, and obligations to the assignee, providing a legal framework for the transaction. In Houston, Texas, there are several types of Notice to Trustee of Assignment by Beneficiary of Interest in Trust documents, each serving a specific purpose. Some common variants include: 1. Houston Texas Testamentary Trust: This type of trust is established through a valid will and becomes effective upon the testator's death. A Notice to Trustee of Assignment by Beneficiary of Interest in Trust in this context would typically occur when a beneficiary wishes to assign their interest in a testamentary trust to another person or entity. 2. Houston Texas Living Trust: Unlike testamentary trusts, living trusts are created during the granter's lifetime and are revocable or irrevocable. When a beneficiary wishes to assign their interest in a living trust to another party, a Notice to Trustee of Assignment by Beneficiary of Interest in Trust would be used. 3. Houston Texas Special Needs Trust: Special needs trusts are designed to provide financial support for individuals with disabilities without jeopardizing their eligibility for government assistance programs. If a beneficiary of such a trust decides to assign their interest to another party, a Notice to Trustee of Assignment by Beneficiary of Interest in Trust specific to special needs trusts would be relevant. 4. Houston Texas Charitable Trust: Charitable trusts are established to benefit charitable organizations or purposes. Should a beneficiary of a charitable trust choose to assign their interest, a charitable trust-specific Notice to Trustee of Assignment by Beneficiary of Interest in Trust would be necessary. Regardless of the type of trust involved, a Notice to Trustee of Assignment by Beneficiary of Interest in Trust should contain pertinent information such as the names and addresses of the assignor (beneficiary), assignee, trustee(s), and the specific terms of the assignment. It should also outline any limitations or conditions applicable to the assignment. The document must be signed and notarized to ensure its legal validity. It is crucial to consult with a knowledgeable attorney specializing in estate planning and trusts to ensure compliance with Houston, Texas laws and to provide accurate guidance in drafting and executing the Houston Texas Notice to Trustee of Assignment by Beneficiary of Interest in Trust document.Houston Texas Notice to Trustee of Assignment by Beneficiary of Interest in Trust is a legal document that formalizes the assignment of a beneficiary's interest in a trust to another party. This assignment allows for the transfer of the beneficiary's rights, benefits, and obligations to the assignee, providing a legal framework for the transaction. In Houston, Texas, there are several types of Notice to Trustee of Assignment by Beneficiary of Interest in Trust documents, each serving a specific purpose. Some common variants include: 1. Houston Texas Testamentary Trust: This type of trust is established through a valid will and becomes effective upon the testator's death. A Notice to Trustee of Assignment by Beneficiary of Interest in Trust in this context would typically occur when a beneficiary wishes to assign their interest in a testamentary trust to another person or entity. 2. Houston Texas Living Trust: Unlike testamentary trusts, living trusts are created during the granter's lifetime and are revocable or irrevocable. When a beneficiary wishes to assign their interest in a living trust to another party, a Notice to Trustee of Assignment by Beneficiary of Interest in Trust would be used. 3. Houston Texas Special Needs Trust: Special needs trusts are designed to provide financial support for individuals with disabilities without jeopardizing their eligibility for government assistance programs. If a beneficiary of such a trust decides to assign their interest to another party, a Notice to Trustee of Assignment by Beneficiary of Interest in Trust specific to special needs trusts would be relevant. 4. Houston Texas Charitable Trust: Charitable trusts are established to benefit charitable organizations or purposes. Should a beneficiary of a charitable trust choose to assign their interest, a charitable trust-specific Notice to Trustee of Assignment by Beneficiary of Interest in Trust would be necessary. Regardless of the type of trust involved, a Notice to Trustee of Assignment by Beneficiary of Interest in Trust should contain pertinent information such as the names and addresses of the assignor (beneficiary), assignee, trustee(s), and the specific terms of the assignment. It should also outline any limitations or conditions applicable to the assignment. The document must be signed and notarized to ensure its legal validity. It is crucial to consult with a knowledgeable attorney specializing in estate planning and trusts to ensure compliance with Houston, Texas laws and to provide accurate guidance in drafting and executing the Houston Texas Notice to Trustee of Assignment by Beneficiary of Interest in Trust document.

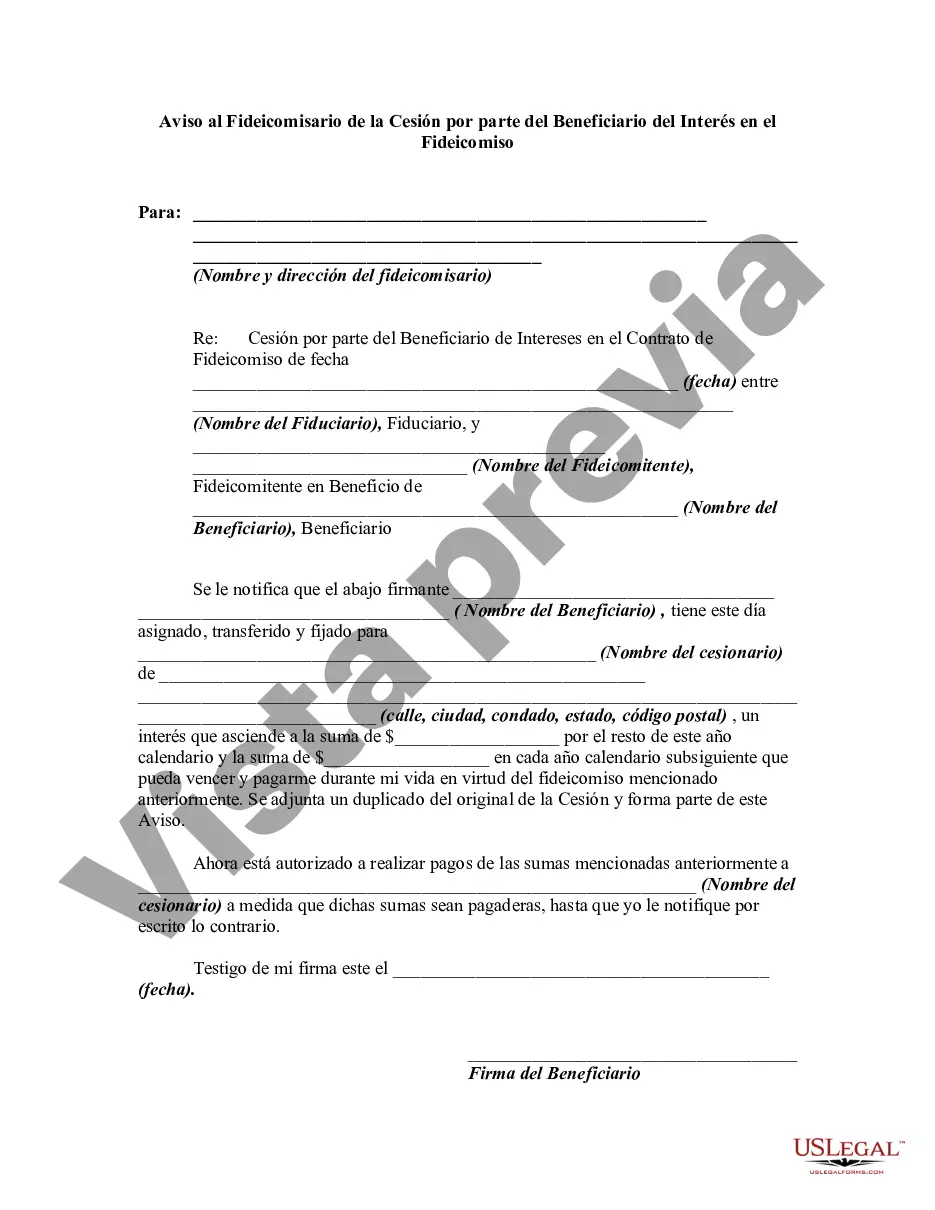

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.