This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Los Angeles, California, commonly referred to as LA, is a vibrant city located on the west coast of the United States. It is renowned for its glamorous entertainment industry, diverse culture, iconic landmarks, and beautiful sunny weather. With a population of nearly 4 million people, Los Angeles is the largest city in California and the second-largest city in the United States. When it comes to legal matters in Los Angeles, one important document that often comes into play is the "Notice to Trustee of Assignment by Beneficiary of Interest in Trust." This notice is used to inform the trustee of a trust that a beneficiary has assigned their interest in the trust to another individual or entity. The assignment of interest can include the right to receive distributions, income, or any other benefits associated with the trust. In Los Angeles, specifically, there may be various types of "Notice to Trustee of Assignment by Beneficiary of Interest in Trust" documents, depending on the specific details and requirements of each trust. Some common variations of this notice may include: 1. Notice to Trustee of Assignment of Beneficial Interest: This notice is used when a beneficiary assigns their beneficial interest in the trust to another party. It outlines the details of the assignment, including the assignee's name, contact information, and the effective date of the assignment. 2. Notice to Trustee of Assignment of Income Interest: In cases where a trust generates income, this notice is utilized when a beneficiary assigns their right to receive income from the trust to someone else. It provides essential information about the assignee and the income interest being transferred. 3. Notice to Trustee of Assignment of Distributions: If a trust regularly distributes assets to its beneficiaries, this notice is employed when a beneficiary assigns their right to receive such distributions to a third party. It specifies the assignee's details and the distribution rights being transferred. It is crucial to carefully draft and deliver a "Notice to Trustee of Assignment by Beneficiary of Interest in Trust" in compliance with the applicable laws, regulations, and provisions of the trust agreement. Working with a qualified attorney experienced in trust matters is advisable to ensure accuracy, legality, and smooth execution of such notices in Los Angeles, California.Los Angeles, California, commonly referred to as LA, is a vibrant city located on the west coast of the United States. It is renowned for its glamorous entertainment industry, diverse culture, iconic landmarks, and beautiful sunny weather. With a population of nearly 4 million people, Los Angeles is the largest city in California and the second-largest city in the United States. When it comes to legal matters in Los Angeles, one important document that often comes into play is the "Notice to Trustee of Assignment by Beneficiary of Interest in Trust." This notice is used to inform the trustee of a trust that a beneficiary has assigned their interest in the trust to another individual or entity. The assignment of interest can include the right to receive distributions, income, or any other benefits associated with the trust. In Los Angeles, specifically, there may be various types of "Notice to Trustee of Assignment by Beneficiary of Interest in Trust" documents, depending on the specific details and requirements of each trust. Some common variations of this notice may include: 1. Notice to Trustee of Assignment of Beneficial Interest: This notice is used when a beneficiary assigns their beneficial interest in the trust to another party. It outlines the details of the assignment, including the assignee's name, contact information, and the effective date of the assignment. 2. Notice to Trustee of Assignment of Income Interest: In cases where a trust generates income, this notice is utilized when a beneficiary assigns their right to receive income from the trust to someone else. It provides essential information about the assignee and the income interest being transferred. 3. Notice to Trustee of Assignment of Distributions: If a trust regularly distributes assets to its beneficiaries, this notice is employed when a beneficiary assigns their right to receive such distributions to a third party. It specifies the assignee's details and the distribution rights being transferred. It is crucial to carefully draft and deliver a "Notice to Trustee of Assignment by Beneficiary of Interest in Trust" in compliance with the applicable laws, regulations, and provisions of the trust agreement. Working with a qualified attorney experienced in trust matters is advisable to ensure accuracy, legality, and smooth execution of such notices in Los Angeles, California.

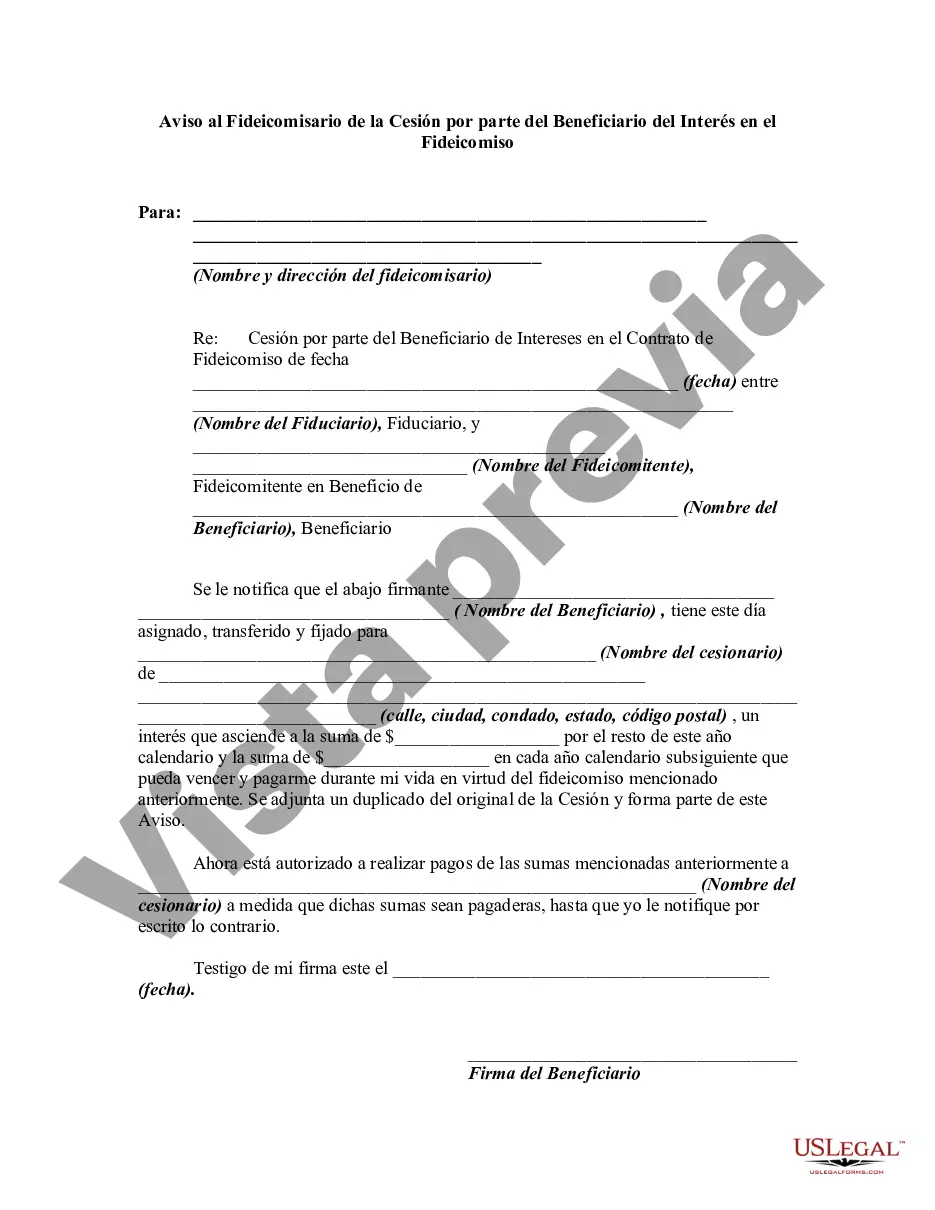

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.