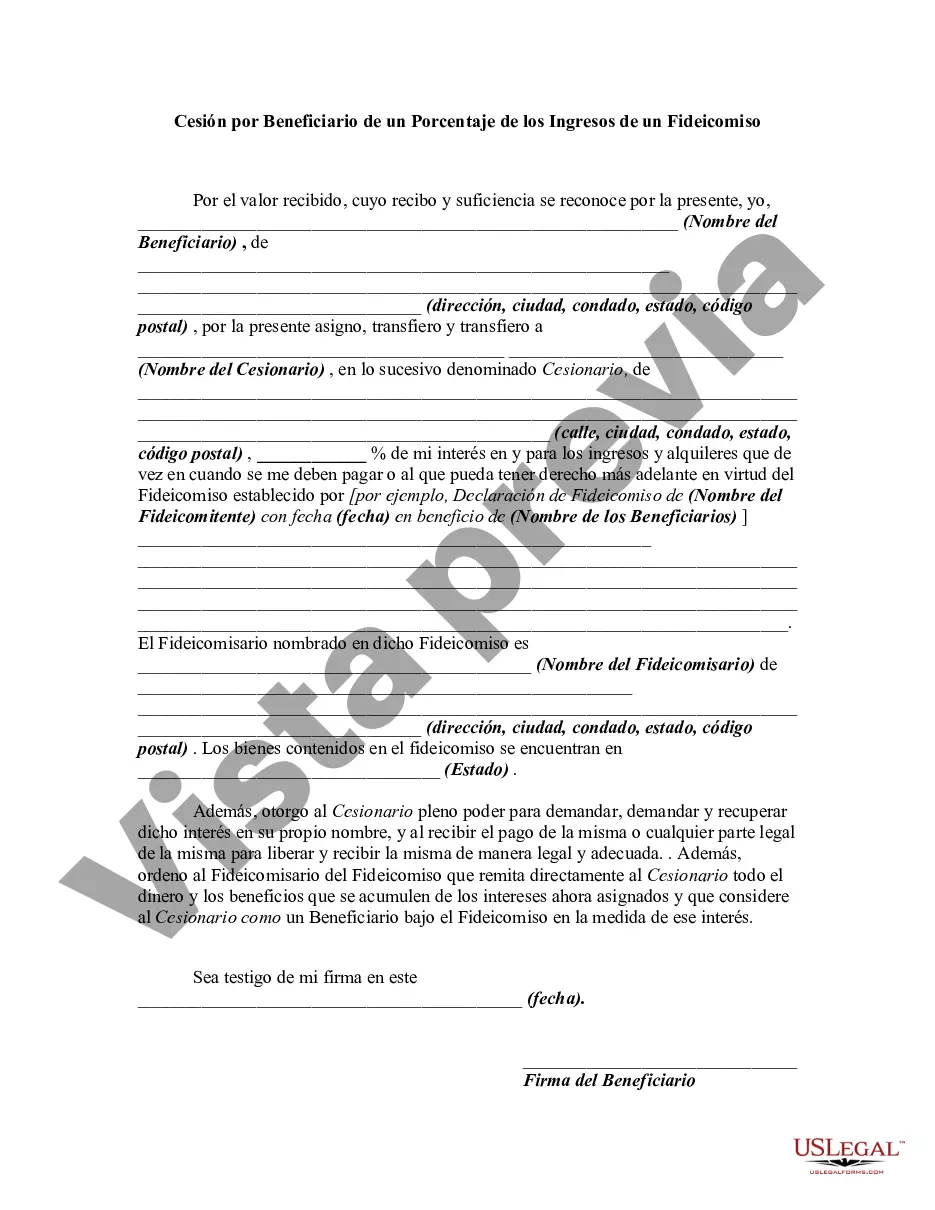

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust is a unique legal and financial concept that allows beneficiaries of a trust located in Chicago, Illinois to assign a specific percentage of the trust's income to themselves. This assignment grants beneficiaries the ability to receive a portion of the trust's income directly, providing them with financial support and flexibility. One type of Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust is known as a discretionary assignment. In this arrangement, beneficiaries have the discretion to assign a percentage of the trust's income to themselves based on their financial needs and circumstances. This type of assignment offers beneficiaries the flexibility to manage their income and adapt it to their changing circumstances. Another type of Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust is called a fixed assignment. Under a fixed assignment, beneficiaries assign a specific, predetermined percentage of the trust's income to themselves. This type of assignment provides beneficiaries with a fixed and predictable income stream, which can be beneficial for financial planning purposes. The Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust offers numerous benefits for beneficiaries. Firstly, it allows beneficiaries to have more control over their finances by directly accessing a portion of the trust's income. This can be particularly advantageous in cases where beneficiaries may need immediate financial support or have specific financial goals to achieve. Furthermore, this assignment enables beneficiaries to leverage the income generated by the trust to meet their personal expenses, invest in opportunities, or enhance their quality of life. It provides a source of steady income that can be utilized in various ways to support the beneficiary's financial well-being. In order to execute a Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries must work closely with their trustee and legal professionals familiar with trust law in the state of Illinois. This ensures that all legal requirements are met and that the assignment aligns with the terms and intentions of the trust. In conclusion, Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust offers beneficiaries the opportunity to assign a specific percentage of a trust's income to themselves. This arrangement provides beneficiaries with greater financial flexibility, control, and support. Whether through discretionary or fixed assignments, beneficiaries can leverage their trust's income to achieve their financial goals and improve their overall financial well-being.Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust is a unique legal and financial concept that allows beneficiaries of a trust located in Chicago, Illinois to assign a specific percentage of the trust's income to themselves. This assignment grants beneficiaries the ability to receive a portion of the trust's income directly, providing them with financial support and flexibility. One type of Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust is known as a discretionary assignment. In this arrangement, beneficiaries have the discretion to assign a percentage of the trust's income to themselves based on their financial needs and circumstances. This type of assignment offers beneficiaries the flexibility to manage their income and adapt it to their changing circumstances. Another type of Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust is called a fixed assignment. Under a fixed assignment, beneficiaries assign a specific, predetermined percentage of the trust's income to themselves. This type of assignment provides beneficiaries with a fixed and predictable income stream, which can be beneficial for financial planning purposes. The Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust offers numerous benefits for beneficiaries. Firstly, it allows beneficiaries to have more control over their finances by directly accessing a portion of the trust's income. This can be particularly advantageous in cases where beneficiaries may need immediate financial support or have specific financial goals to achieve. Furthermore, this assignment enables beneficiaries to leverage the income generated by the trust to meet their personal expenses, invest in opportunities, or enhance their quality of life. It provides a source of steady income that can be utilized in various ways to support the beneficiary's financial well-being. In order to execute a Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries must work closely with their trustee and legal professionals familiar with trust law in the state of Illinois. This ensures that all legal requirements are met and that the assignment aligns with the terms and intentions of the trust. In conclusion, Chicago, Illinois Assignment by Beneficiary of a Percentage of the Income of a Trust offers beneficiaries the opportunity to assign a specific percentage of a trust's income to themselves. This arrangement provides beneficiaries with greater financial flexibility, control, and support. Whether through discretionary or fixed assignments, beneficiaries can leverage their trust's income to achieve their financial goals and improve their overall financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.