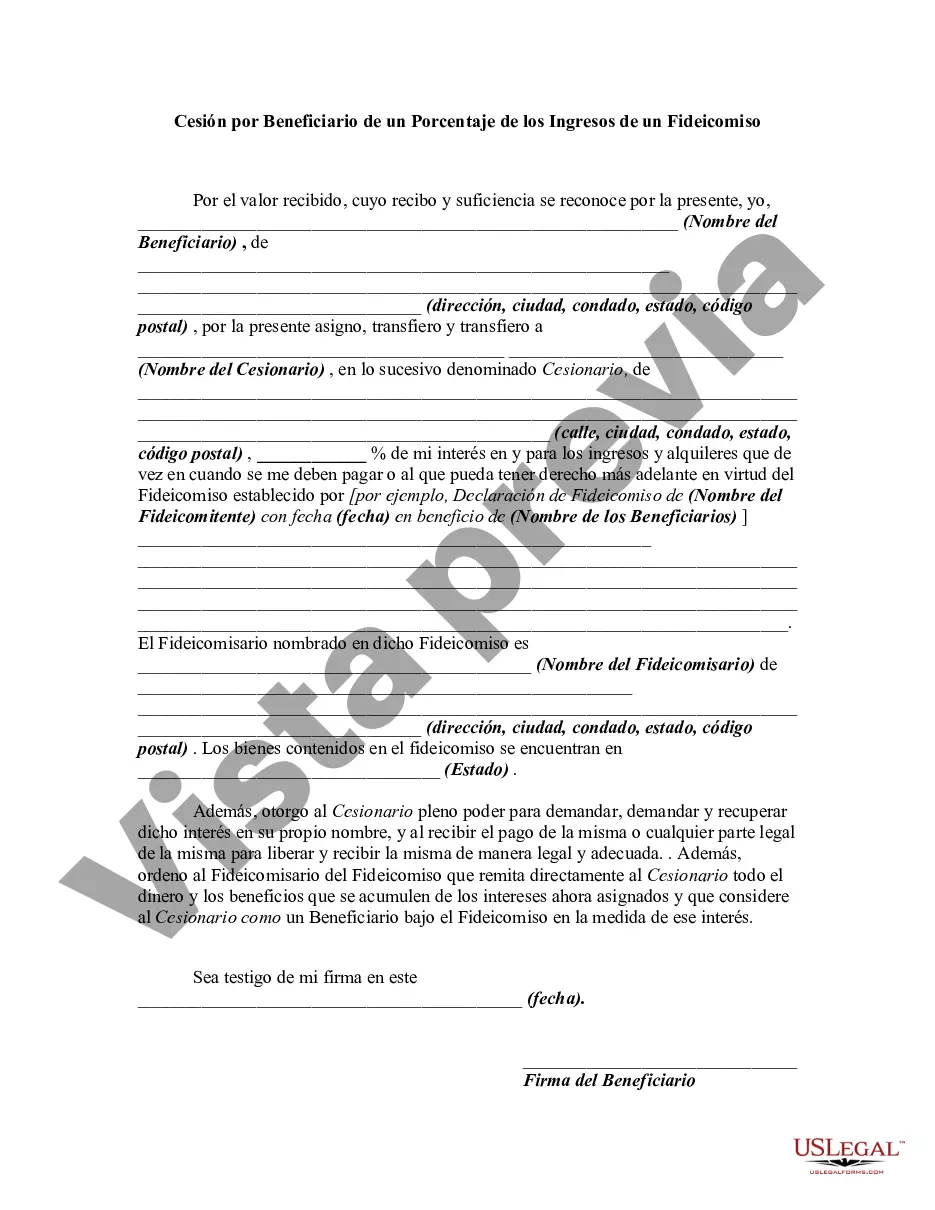

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement in which a beneficiary of a trust is assigned a specific percentage of the income generated by the trust. This type of assignment provides beneficiaries with a regular stream of income from the trust, while still preserving the principal for future distribution. The Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries to have a certain level of financial security and stability, as they receive a fixed portion of the income generated by the trust. This arrangement can be particularly beneficial for beneficiaries who rely on the trust for their living expenses or other financial needs. One of the key advantages of this assignment is that beneficiaries have the flexibility to receive a steady income stream without necessarily depleting the trust's assets. This is especially useful when the trust has a long-term purpose or when multiple beneficiaries are involved. The trust's principal remains intact, ensuring that future generations or other intended beneficiaries will also benefit from the trust's assets. Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust can vary in terms of the specific percentage awarded to beneficiaries. The assigned percentage often depends on factors such as the size of the trust, the financial needs of the beneficiaries, and the wishes of the trust's creator. Additionally, there are different variations of the Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust that can be tailored to meet specific requirements. These variations may include provisions for adjusting the assigned percentage in the event of changing circumstances or the introduction of new beneficiaries. In summary, the Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust provides beneficiaries with a reliable income stream while preserving the trust's principal for future distribution. This arrangement offers financial security and flexibility, ensuring that beneficiaries can enjoy a portion of the trust's income while also safeguarding the trust's assets.Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement in which a beneficiary of a trust is assigned a specific percentage of the income generated by the trust. This type of assignment provides beneficiaries with a regular stream of income from the trust, while still preserving the principal for future distribution. The Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries to have a certain level of financial security and stability, as they receive a fixed portion of the income generated by the trust. This arrangement can be particularly beneficial for beneficiaries who rely on the trust for their living expenses or other financial needs. One of the key advantages of this assignment is that beneficiaries have the flexibility to receive a steady income stream without necessarily depleting the trust's assets. This is especially useful when the trust has a long-term purpose or when multiple beneficiaries are involved. The trust's principal remains intact, ensuring that future generations or other intended beneficiaries will also benefit from the trust's assets. Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust can vary in terms of the specific percentage awarded to beneficiaries. The assigned percentage often depends on factors such as the size of the trust, the financial needs of the beneficiaries, and the wishes of the trust's creator. Additionally, there are different variations of the Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust that can be tailored to meet specific requirements. These variations may include provisions for adjusting the assigned percentage in the event of changing circumstances or the introduction of new beneficiaries. In summary, the Clark Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust provides beneficiaries with a reliable income stream while preserving the trust's principal for future distribution. This arrangement offers financial security and flexibility, ensuring that beneficiaries can enjoy a portion of the trust's income while also safeguarding the trust's assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.