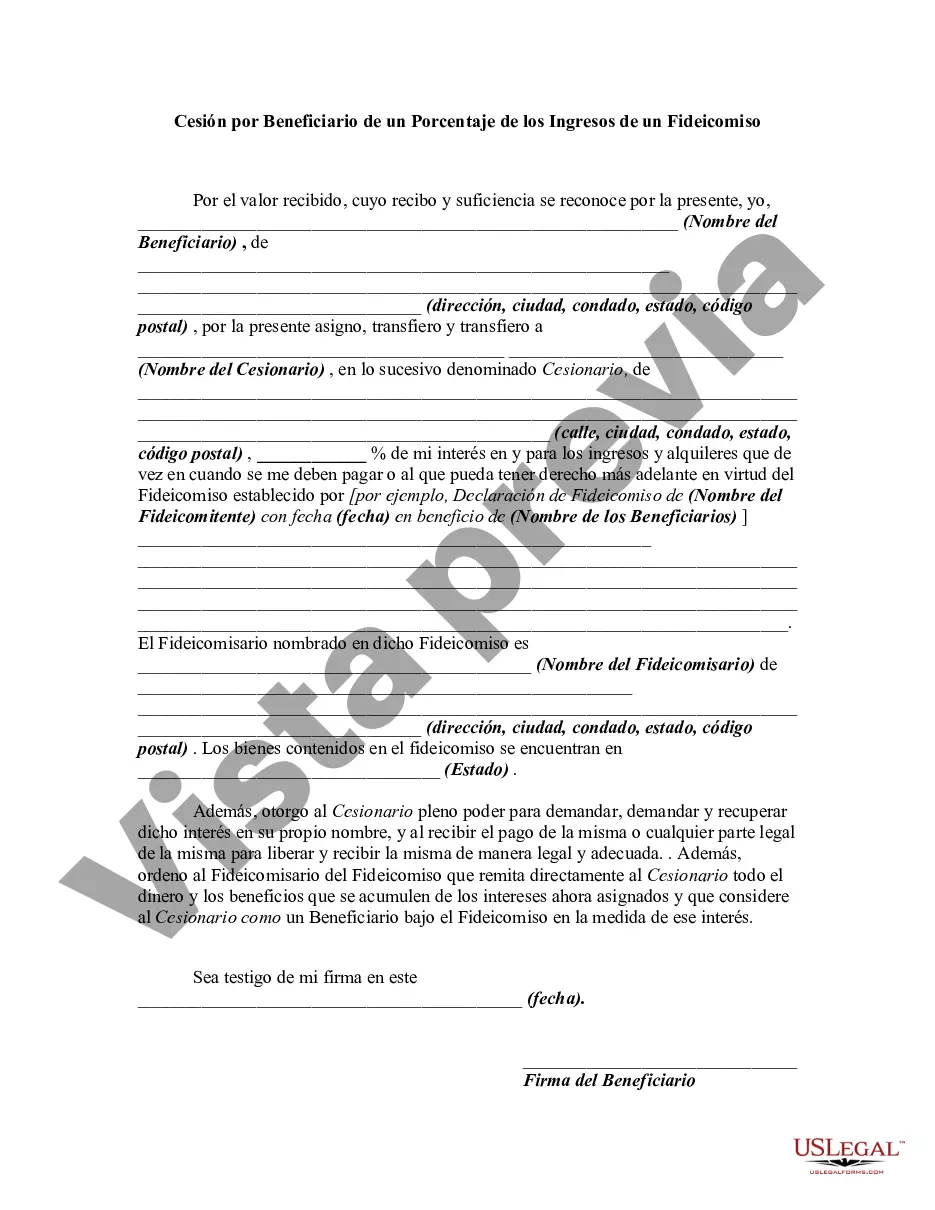

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

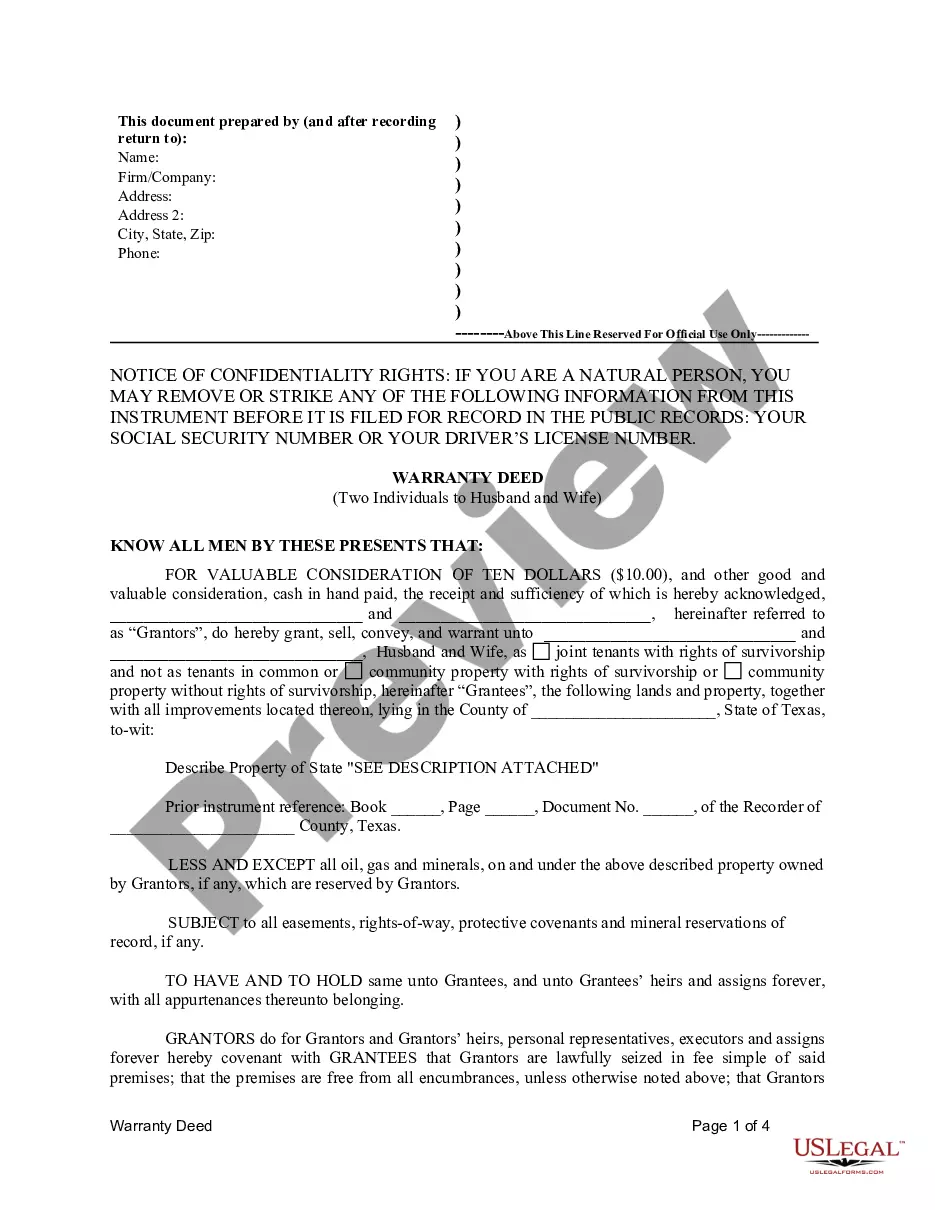

Collin Texas Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a specific legal document that allows beneficiaries of a trust to assign or transfer a portion of their trust income to another party in Collin County, Texas. This arrangement can be advantageous for beneficiaries who wish to share their income or fulfill specific financial obligations. One type of Collin Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is the "Partial Assignment." In this case, a beneficiary can assign a specific percentage or portion of their trust income to another individual, entity, or organization. This arrangement is useful when beneficiaries want to allocate a portion of their income to cover expenses, support family members, pay off debts, or donate to charities. Another type is the "Revocable Assignment." With a revocable assignment, beneficiaries have the option to modify or revoke the assigned percentage of income at any point during the trust's existence. This flexibility is beneficial for individuals who may encounter changing financial circumstances or wish to re-distribute their income differently. Additionally, there is the "Irrevocable Assignment," which grants beneficiaries the ability to permanently assign a percentage of their trust income to another party. Once the assignment is made, it cannot be altered or revoked, ensuring a consistent flow of income to the assigned entity. The Collin Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is a crucial tool that provides beneficiaries with flexibility in managing their trust income. By assigning a portion of their income through different types of assignments, beneficiaries can meet their financial goals, support others, and make a positive impact in their community. It is important to consult with a legal professional to fully understand the implications and requirements of these assignments, ensuring compliance with Texas state laws and regulations.Collin Texas Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a specific legal document that allows beneficiaries of a trust to assign or transfer a portion of their trust income to another party in Collin County, Texas. This arrangement can be advantageous for beneficiaries who wish to share their income or fulfill specific financial obligations. One type of Collin Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is the "Partial Assignment." In this case, a beneficiary can assign a specific percentage or portion of their trust income to another individual, entity, or organization. This arrangement is useful when beneficiaries want to allocate a portion of their income to cover expenses, support family members, pay off debts, or donate to charities. Another type is the "Revocable Assignment." With a revocable assignment, beneficiaries have the option to modify or revoke the assigned percentage of income at any point during the trust's existence. This flexibility is beneficial for individuals who may encounter changing financial circumstances or wish to re-distribute their income differently. Additionally, there is the "Irrevocable Assignment," which grants beneficiaries the ability to permanently assign a percentage of their trust income to another party. Once the assignment is made, it cannot be altered or revoked, ensuring a consistent flow of income to the assigned entity. The Collin Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is a crucial tool that provides beneficiaries with flexibility in managing their trust income. By assigning a portion of their income through different types of assignments, beneficiaries can meet their financial goals, support others, and make a positive impact in their community. It is important to consult with a legal professional to fully understand the implications and requirements of these assignments, ensuring compliance with Texas state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.