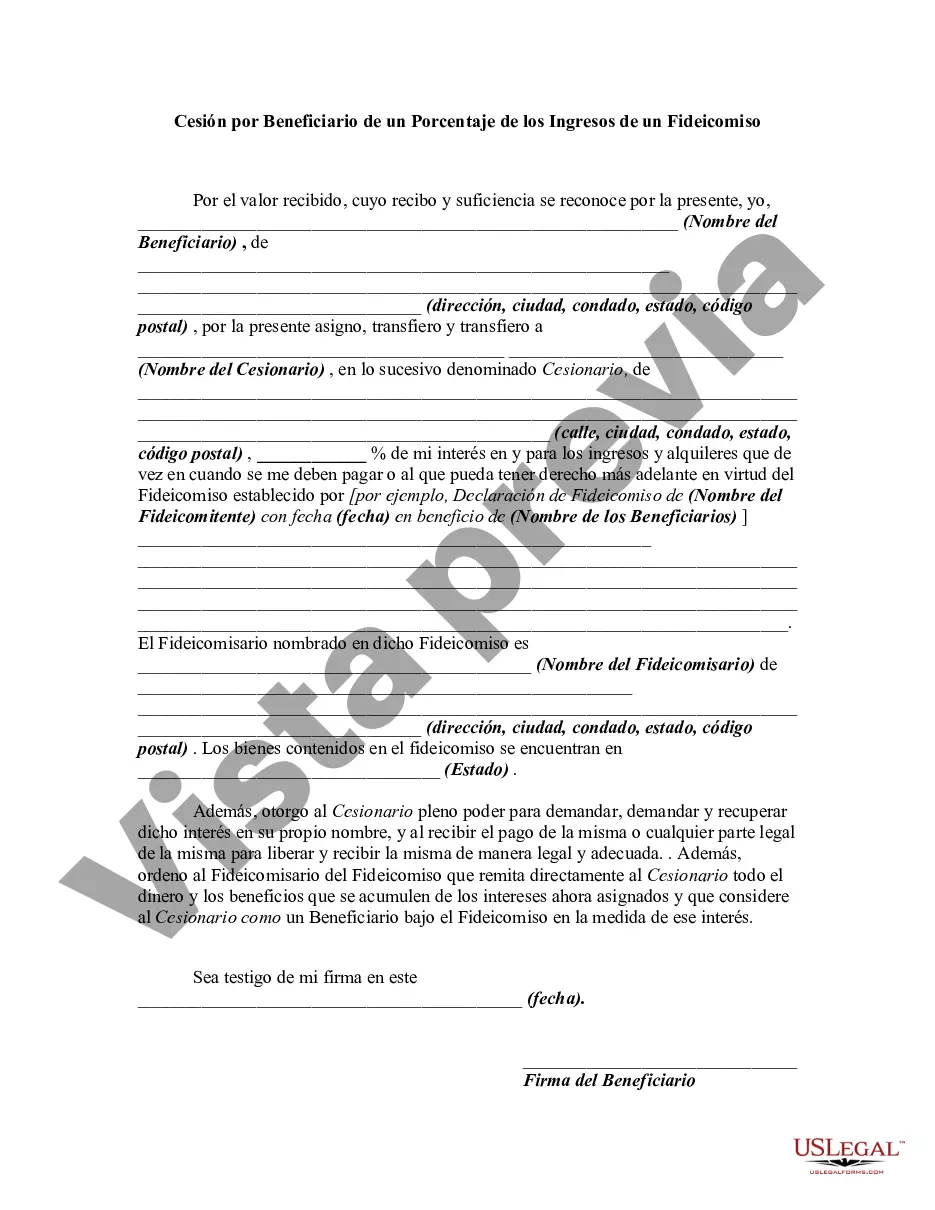

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cuyahoga County, Ohio is located in the northeastern part of the state and encompasses the city of Cleveland, as well as several suburbs and surrounding areas. As one of the most populous counties in Ohio, Cuyahoga County offers a diverse range of opportunities and attractions for residents and visitors alike. An Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement wherein a beneficiary of a trust receives a specific percentage of the trust's income. This assignment allows the beneficiary to receive a portion of the trust's earnings on a regular basis, providing them with a consistent stream of income. There are different types of assignments by beneficiaries of a percentage of the income of a trust that can be established based on the terms and provisions outlined in the trust documents. Some of these variations may include: 1. Fixed Percentage Assignment: In this type of assignment, the beneficiary is designated to receive a fixed percentage of the trust's income. For example, if the trust generates $10,000 in income, and the fixed percentage assigned to the beneficiary is 5%, the beneficiary would receive $500 from the trust's income. 2. Variable Percentage Assignment: With a variable percentage assignment, the beneficiary's share of the trust's income may fluctuate based on certain factors. These factors could include changes in the trust's earnings or a predetermined formula that adjusts the beneficiary's percentage over time. 3. Revocable Percentage Assignment: A revocable assignment allows the trustee to modify or revoke the beneficiary's percentage of the trust's income. This type of assignment provides flexibility for the trustee to make adjustments as necessary. 4. Irrevocable Percentage Assignment: In contrast to a revocable assignment, an irrevocable percentage assignment cannot be altered or revoked by the trustee. Once established, the beneficiary's percentage remains fixed and cannot be changed. 5. Temporary Percentage Assignment: This type of assignment may be created for a specific period or under certain circumstances. For instance, a beneficiary may only receive a percentage of the trust's income for a predetermined number of years or until they reach a certain age. It is important to consult with an experienced attorney or advisor specializing in trust law to ensure that the assignment by beneficiary of a percentage of the income of the trust is properly executed and aligned with the beneficiary's needs and goals. Legal professionals can guide individuals through the process of setting up such arrangements and provide necessary advice to ensure compliance with local regulations and laws.Cuyahoga County, Ohio is located in the northeastern part of the state and encompasses the city of Cleveland, as well as several suburbs and surrounding areas. As one of the most populous counties in Ohio, Cuyahoga County offers a diverse range of opportunities and attractions for residents and visitors alike. An Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement wherein a beneficiary of a trust receives a specific percentage of the trust's income. This assignment allows the beneficiary to receive a portion of the trust's earnings on a regular basis, providing them with a consistent stream of income. There are different types of assignments by beneficiaries of a percentage of the income of a trust that can be established based on the terms and provisions outlined in the trust documents. Some of these variations may include: 1. Fixed Percentage Assignment: In this type of assignment, the beneficiary is designated to receive a fixed percentage of the trust's income. For example, if the trust generates $10,000 in income, and the fixed percentage assigned to the beneficiary is 5%, the beneficiary would receive $500 from the trust's income. 2. Variable Percentage Assignment: With a variable percentage assignment, the beneficiary's share of the trust's income may fluctuate based on certain factors. These factors could include changes in the trust's earnings or a predetermined formula that adjusts the beneficiary's percentage over time. 3. Revocable Percentage Assignment: A revocable assignment allows the trustee to modify or revoke the beneficiary's percentage of the trust's income. This type of assignment provides flexibility for the trustee to make adjustments as necessary. 4. Irrevocable Percentage Assignment: In contrast to a revocable assignment, an irrevocable percentage assignment cannot be altered or revoked by the trustee. Once established, the beneficiary's percentage remains fixed and cannot be changed. 5. Temporary Percentage Assignment: This type of assignment may be created for a specific period or under certain circumstances. For instance, a beneficiary may only receive a percentage of the trust's income for a predetermined number of years or until they reach a certain age. It is important to consult with an experienced attorney or advisor specializing in trust law to ensure that the assignment by beneficiary of a percentage of the income of the trust is properly executed and aligned with the beneficiary's needs and goals. Legal professionals can guide individuals through the process of setting up such arrangements and provide necessary advice to ensure compliance with local regulations and laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.