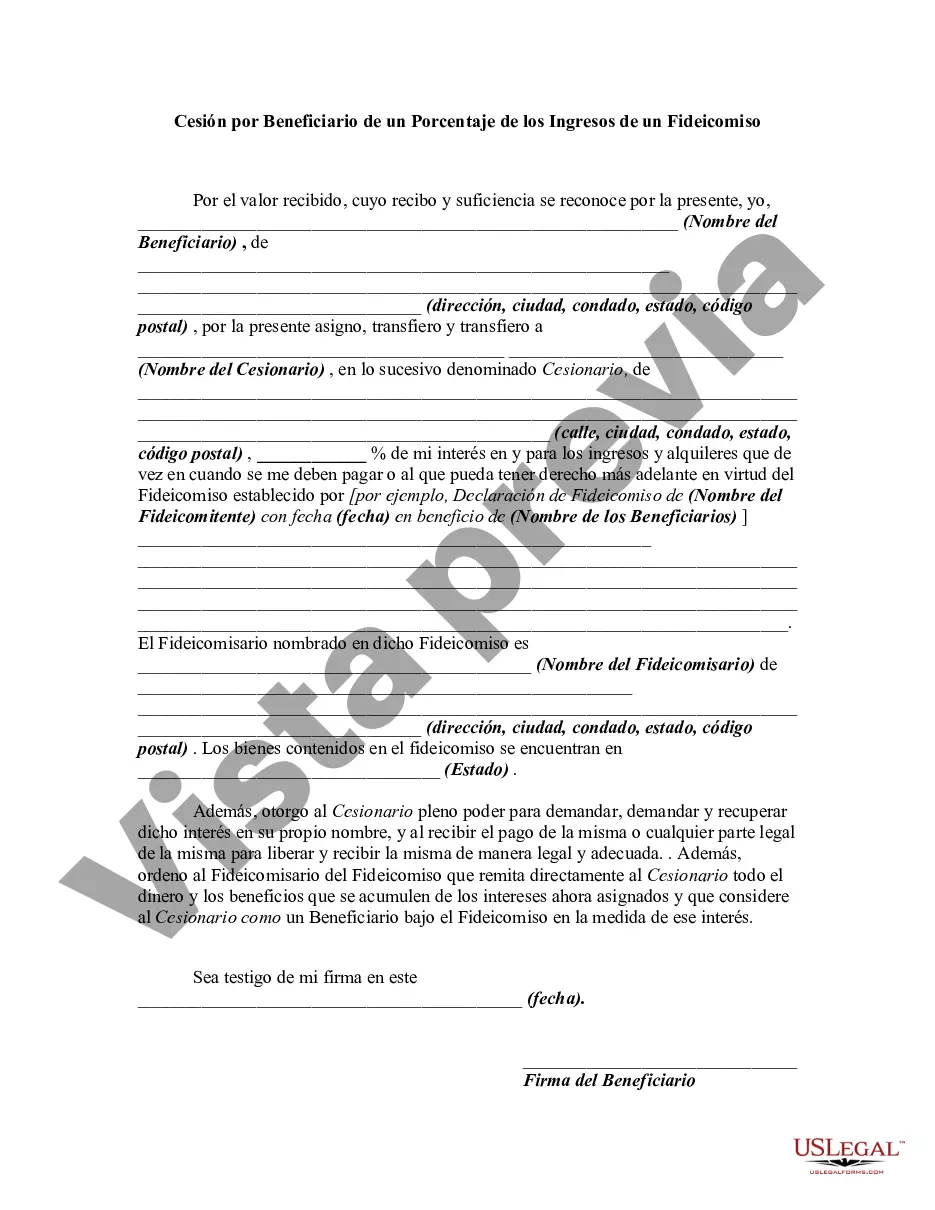

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal agreement that allows a beneficiary of a trust located in Harris County, Texas to assign a certain percentage of the trust's income to another party. This arrangement can be beneficial for various reasons, including financial planning, tax optimization, or simply to provide financial support to another individual or organization. The assignment itself refers to the act of transferring a portion of the trust's income to a designated assignee. This can be executed through a formal written agreement that outlines the terms and conditions agreed upon by both parties involved. It is crucial to consult with a legal professional to draft this document accurately, ensuring it complies with all relevant laws and regulations. In Harris County, Texas, there may be different types of Harris Texas Assignment by Beneficiary of a Percentage of the Income of a Trust, depending on the specific goals and requirements of the parties involved. These may include: 1. Fixed Percentage Assignment: This type of assignment allocates a specific fixed percentage of the trust's income to the assignee on a regular basis. For example, a beneficiary may assign 30% of the trust's income to a charitable organization every year. 2. Variable Percentage Assignment: In this scenario, the assignee's percentage of the trust's income fluctuates based on specific conditions or factors predetermined in the assignment agreement. This type of arrangement allows for flexibility and adjustments according to the beneficiary's changing needs. 3. Temporary Assignment: A temporary assignment involves assigning a percentage of the trust's income to an assignee for a specific period, after which the assignment reverts to the original beneficiary. This can be useful for short-term financial assistance or support during certain life circumstances. 4. Revocable Assignment: With a revocable assignment, the beneficiary retains the ability to revoke or modify the assignment at any time. This provides the beneficiary with flexibility and control over the income distribution. 5. Irrevocable Assignment: In contrast to a revocable assignment, an irrevocable assignment cannot be altered or revoked once executed. This type of assignment is binding, and the assignee has a legal right to the designated percentage of the trust's income. It is important to note that the specifics of a Harris Texas Assignment by Beneficiary of a Percentage of the Income of a Trust can vary depending on the trust's terms, the parties involved, and the governing authorities in Harris County, Texas. Seeking legal advice or consulting with an experienced estate planning attorney is recommended to ensure compliance with all applicable laws and to protect the interests of all parties involved.Harris Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal agreement that allows a beneficiary of a trust located in Harris County, Texas to assign a certain percentage of the trust's income to another party. This arrangement can be beneficial for various reasons, including financial planning, tax optimization, or simply to provide financial support to another individual or organization. The assignment itself refers to the act of transferring a portion of the trust's income to a designated assignee. This can be executed through a formal written agreement that outlines the terms and conditions agreed upon by both parties involved. It is crucial to consult with a legal professional to draft this document accurately, ensuring it complies with all relevant laws and regulations. In Harris County, Texas, there may be different types of Harris Texas Assignment by Beneficiary of a Percentage of the Income of a Trust, depending on the specific goals and requirements of the parties involved. These may include: 1. Fixed Percentage Assignment: This type of assignment allocates a specific fixed percentage of the trust's income to the assignee on a regular basis. For example, a beneficiary may assign 30% of the trust's income to a charitable organization every year. 2. Variable Percentage Assignment: In this scenario, the assignee's percentage of the trust's income fluctuates based on specific conditions or factors predetermined in the assignment agreement. This type of arrangement allows for flexibility and adjustments according to the beneficiary's changing needs. 3. Temporary Assignment: A temporary assignment involves assigning a percentage of the trust's income to an assignee for a specific period, after which the assignment reverts to the original beneficiary. This can be useful for short-term financial assistance or support during certain life circumstances. 4. Revocable Assignment: With a revocable assignment, the beneficiary retains the ability to revoke or modify the assignment at any time. This provides the beneficiary with flexibility and control over the income distribution. 5. Irrevocable Assignment: In contrast to a revocable assignment, an irrevocable assignment cannot be altered or revoked once executed. This type of assignment is binding, and the assignee has a legal right to the designated percentage of the trust's income. It is important to note that the specifics of a Harris Texas Assignment by Beneficiary of a Percentage of the Income of a Trust can vary depending on the trust's terms, the parties involved, and the governing authorities in Harris County, Texas. Seeking legal advice or consulting with an experienced estate planning attorney is recommended to ensure compliance with all applicable laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.