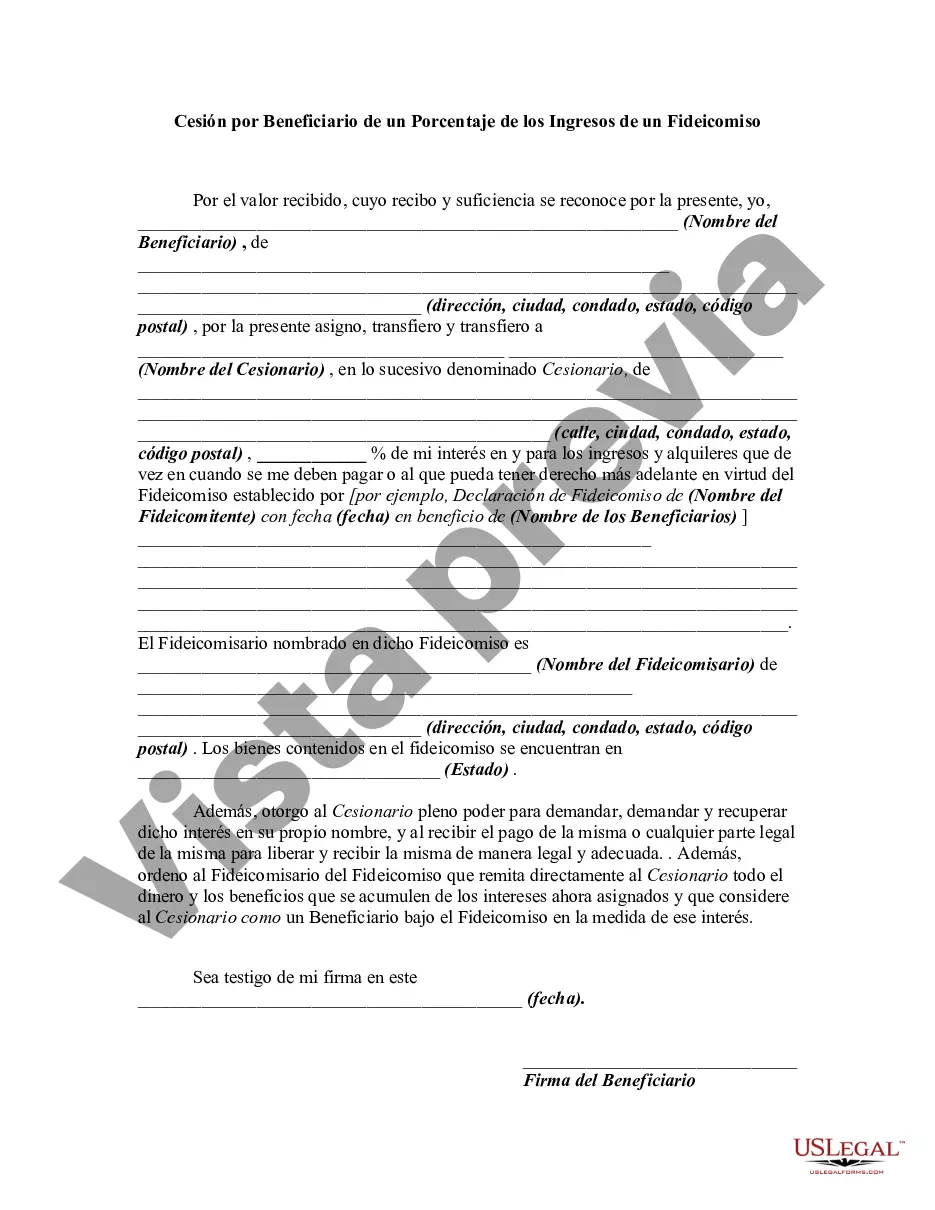

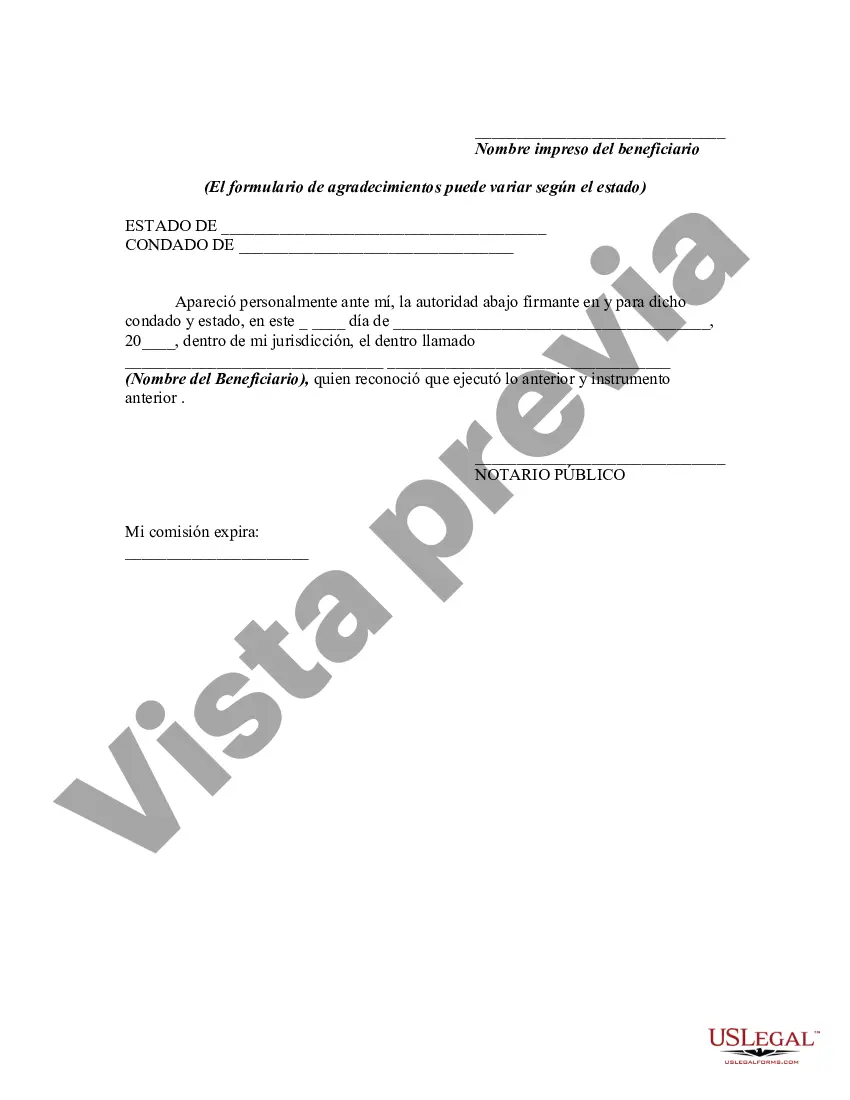

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston, Texas, known as the fourth-largest city in the United States, is a bustling metropolis located in the southeastern part of the state. Renowned for its diverse culture, thriving economy, and vibrant arts scene, Houston offers a plethora of opportunities for residents and visitors alike. When it comes to Houston Texas Assignment by Beneficiary of a Percentage of the Income of a Trust, there are different types available. One common type is an assignment of a percentage interest in the income of a trust to a beneficiary. This arrangement allows the beneficiary to receive a portion of the trust's income generated annually. The percentage assigned to the beneficiary can vary depending on the terms of the trust and the agreement between the trustee and the beneficiary. Houston, being a hub for many financial and legal institutions, provides a conducive environment for trust operations. This enables beneficiaries to leverage the city's expertise and resources to ensure their assigned percentages of trust income are managed efficiently and in accordance with their goals and objectives. Furthermore, Houston offers a wide range of investment opportunities, enhancing the potential income generated by the trust. The city boasts a vibrant real estate market, thriving energy sector, and a strong presence in industries such as healthcare, aerospace, and technology. These sectors provide ample opportunities for beneficiaries to diversify their trust assets and maximize their income potential, based on the assigned trust percentage. In addition, Houston features a robust legal framework and a skilled pool of professionals well-versed in trust administration and management. Beneficiaries can tap into the expertise of Houston-based attorneys, financial advisors, and accountants who specialize in trust matters. These professionals can offer guidance on taxation, investment strategies, and asset protection, ensuring that beneficiaries make informed decisions regarding their assigned trust income. Furthermore, Houston offers a high quality of life, making it an attractive location for beneficiaries who may choose to reside in the city. With its affordable housing options, excellent education systems, world-class healthcare facilities, and diverse recreational opportunities, Houston provides a conducive environment for beneficiaries to enjoy their assigned percentage of trust income while enjoying a fulfilling lifestyle. In summary, Houston, Texas, presents various opportunities for beneficiaries of Houston Texas Assignment by Beneficiary of a Percentage of the Income of a Trust. With its thriving economy, diverse investment prospects, skilled professionals, and favorable legal environment, the city offers an ideal backdrop for managing and benefiting from assigned trust income.Houston, Texas, known as the fourth-largest city in the United States, is a bustling metropolis located in the southeastern part of the state. Renowned for its diverse culture, thriving economy, and vibrant arts scene, Houston offers a plethora of opportunities for residents and visitors alike. When it comes to Houston Texas Assignment by Beneficiary of a Percentage of the Income of a Trust, there are different types available. One common type is an assignment of a percentage interest in the income of a trust to a beneficiary. This arrangement allows the beneficiary to receive a portion of the trust's income generated annually. The percentage assigned to the beneficiary can vary depending on the terms of the trust and the agreement between the trustee and the beneficiary. Houston, being a hub for many financial and legal institutions, provides a conducive environment for trust operations. This enables beneficiaries to leverage the city's expertise and resources to ensure their assigned percentages of trust income are managed efficiently and in accordance with their goals and objectives. Furthermore, Houston offers a wide range of investment opportunities, enhancing the potential income generated by the trust. The city boasts a vibrant real estate market, thriving energy sector, and a strong presence in industries such as healthcare, aerospace, and technology. These sectors provide ample opportunities for beneficiaries to diversify their trust assets and maximize their income potential, based on the assigned trust percentage. In addition, Houston features a robust legal framework and a skilled pool of professionals well-versed in trust administration and management. Beneficiaries can tap into the expertise of Houston-based attorneys, financial advisors, and accountants who specialize in trust matters. These professionals can offer guidance on taxation, investment strategies, and asset protection, ensuring that beneficiaries make informed decisions regarding their assigned trust income. Furthermore, Houston offers a high quality of life, making it an attractive location for beneficiaries who may choose to reside in the city. With its affordable housing options, excellent education systems, world-class healthcare facilities, and diverse recreational opportunities, Houston provides a conducive environment for beneficiaries to enjoy their assigned percentage of trust income while enjoying a fulfilling lifestyle. In summary, Houston, Texas, presents various opportunities for beneficiaries of Houston Texas Assignment by Beneficiary of a Percentage of the Income of a Trust. With its thriving economy, diverse investment prospects, skilled professionals, and favorable legal environment, the city offers an ideal backdrop for managing and benefiting from assigned trust income.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.