An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

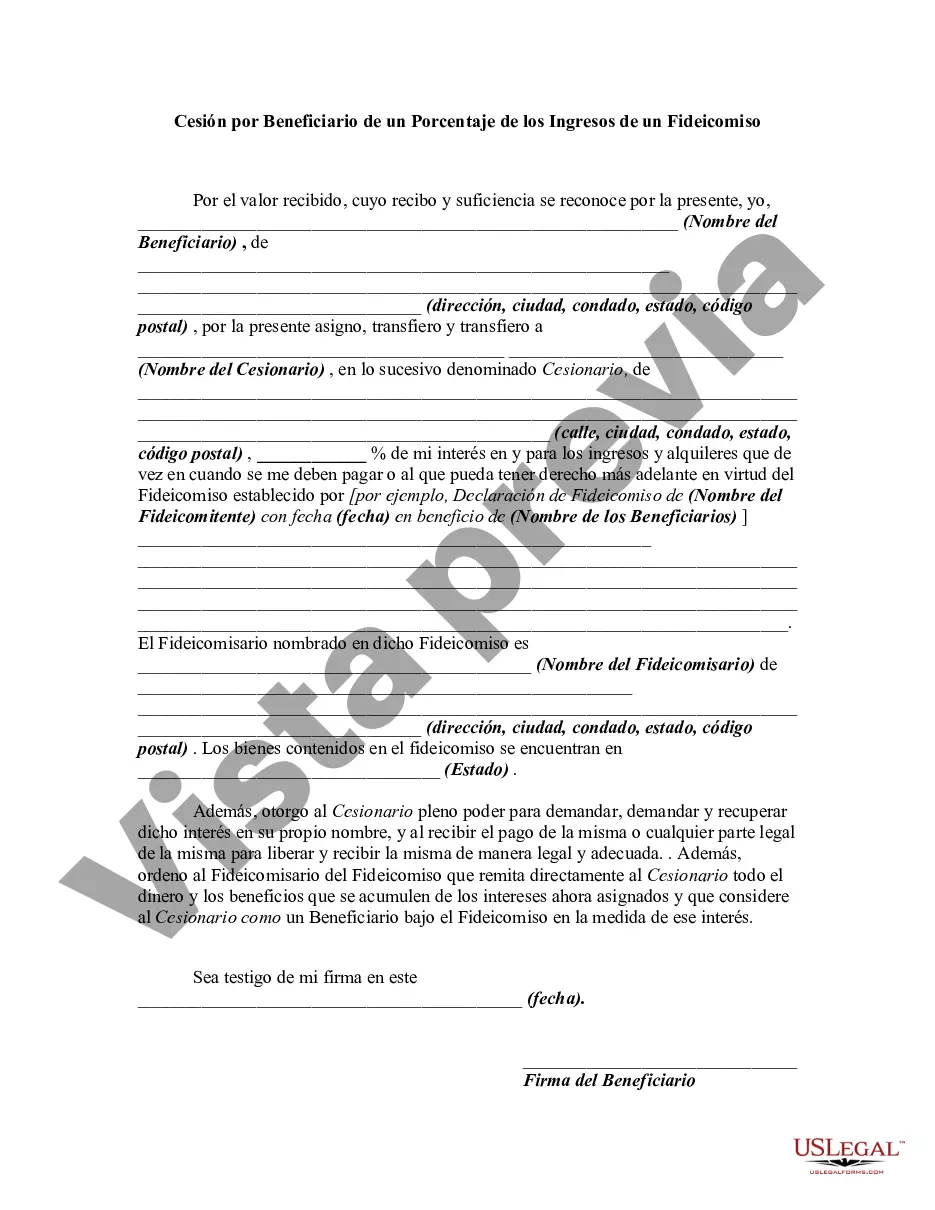

Mecklenburg North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust In Mecklenburg County, North Carolina, there is a unique legal mechanism called "Assignment by Beneficiary of a Percentage of the Income of a Trust." This arrangement refers to the ability of a beneficiary of a trust to assign a portion of their income entitlement to another person or entity. Let's delve deeper into this assignment process and explore any potential types or variations of this practice. The Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal provision that allows an individual legally entitled to receive income from a trust to transfer a specific percentage of that income to another party. It enables beneficiaries to share or delegate their income stream, fostering potential financial flexibility or opportunities for collaborative wealth management. One type of assignment that falls under this arrangement is a partial income assignment. In this situation, a beneficiary designates a specific percentage or fraction of their total income from the trust to be assigned to someone else, be it a family member, friend, or a charitable organization. By doing so, the beneficiary is distributing a portion of their entitlement, promoting philanthropy or ensuring the financial security of loved ones. Another type of assignment could be a recurring income assignment, where a beneficiary consistently allocates a fixed percentage of their income from the trust to another party. This recurring arrangement could be established for various purposes, such as supporting ongoing charitable endeavors or structuring family wealth distribution strategies. Furthermore, a temporary income assignment can be made by a beneficiary for a predetermined period, during which the assigned percentage of income is redirected to another recipient. This temporary assignment could be employed for specific purposes like financing a family member's education, contributing to a collaborative business venture, or addressing short-term financial needs or emergencies. It is essential to understand that Mecklenburg North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust is subject to legal regulations. Beneficiaries should consult with knowledgeable estate planning attorneys and carefully review the terms of their trust before proceeding with any form of income assignment. Compliance with relevant laws and ensuring the trust's integrity is crucial to avoid any potential legal complications or disputes. In summary, Mecklenburg North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries the flexibility to assign a portion of their income entitlement to another party. This practice can take various forms, such as partial income assignments, recurring income assignments, and temporary income assignments. However, it is crucial to approach these assignments with legal guidance to ensure compliance and protect the integrity of the trust.Mecklenburg North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust In Mecklenburg County, North Carolina, there is a unique legal mechanism called "Assignment by Beneficiary of a Percentage of the Income of a Trust." This arrangement refers to the ability of a beneficiary of a trust to assign a portion of their income entitlement to another person or entity. Let's delve deeper into this assignment process and explore any potential types or variations of this practice. The Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal provision that allows an individual legally entitled to receive income from a trust to transfer a specific percentage of that income to another party. It enables beneficiaries to share or delegate their income stream, fostering potential financial flexibility or opportunities for collaborative wealth management. One type of assignment that falls under this arrangement is a partial income assignment. In this situation, a beneficiary designates a specific percentage or fraction of their total income from the trust to be assigned to someone else, be it a family member, friend, or a charitable organization. By doing so, the beneficiary is distributing a portion of their entitlement, promoting philanthropy or ensuring the financial security of loved ones. Another type of assignment could be a recurring income assignment, where a beneficiary consistently allocates a fixed percentage of their income from the trust to another party. This recurring arrangement could be established for various purposes, such as supporting ongoing charitable endeavors or structuring family wealth distribution strategies. Furthermore, a temporary income assignment can be made by a beneficiary for a predetermined period, during which the assigned percentage of income is redirected to another recipient. This temporary assignment could be employed for specific purposes like financing a family member's education, contributing to a collaborative business venture, or addressing short-term financial needs or emergencies. It is essential to understand that Mecklenburg North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust is subject to legal regulations. Beneficiaries should consult with knowledgeable estate planning attorneys and carefully review the terms of their trust before proceeding with any form of income assignment. Compliance with relevant laws and ensuring the trust's integrity is crucial to avoid any potential legal complications or disputes. In summary, Mecklenburg North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries the flexibility to assign a portion of their income entitlement to another party. This practice can take various forms, such as partial income assignments, recurring income assignments, and temporary income assignments. However, it is crucial to approach these assignments with legal guidance to ensure compliance and protect the integrity of the trust.

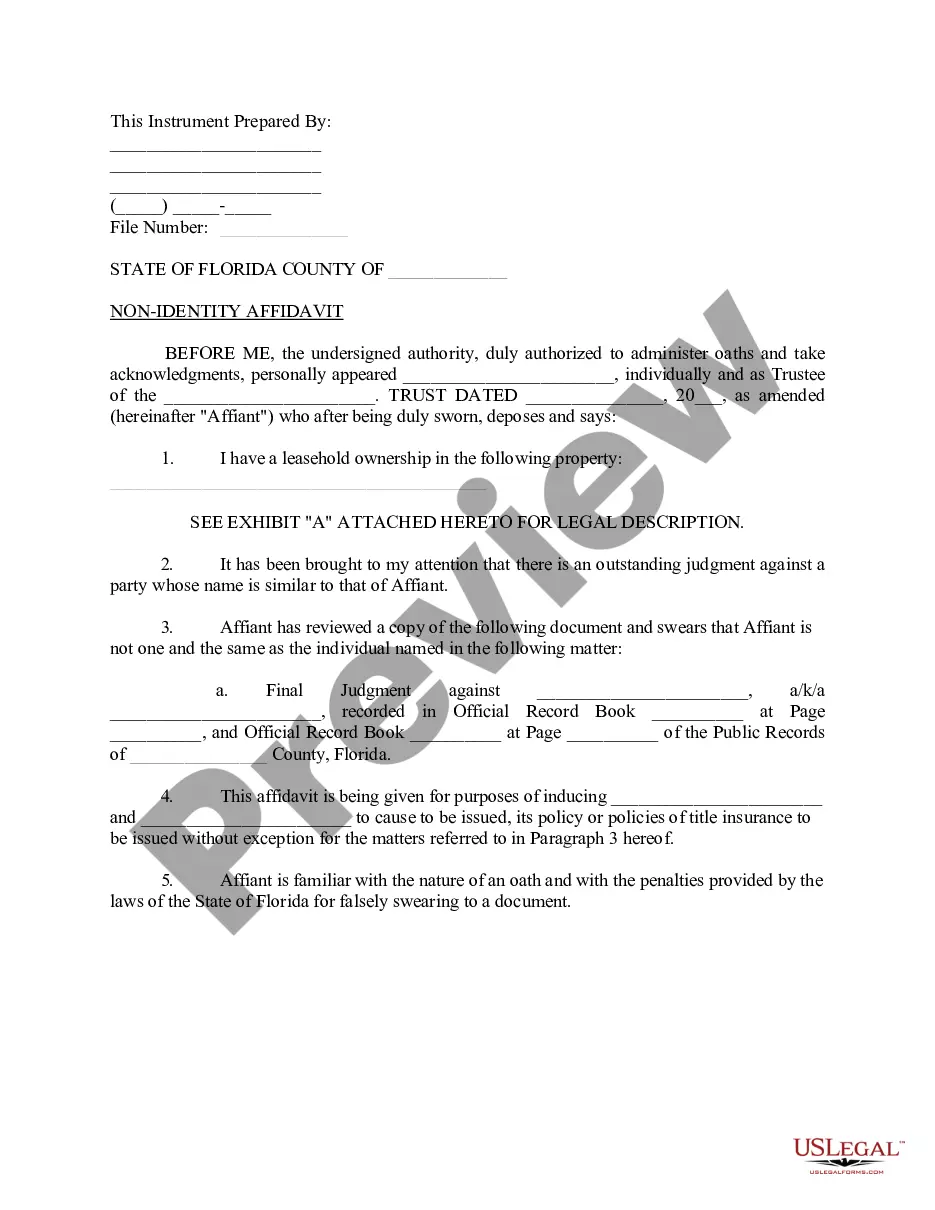

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.