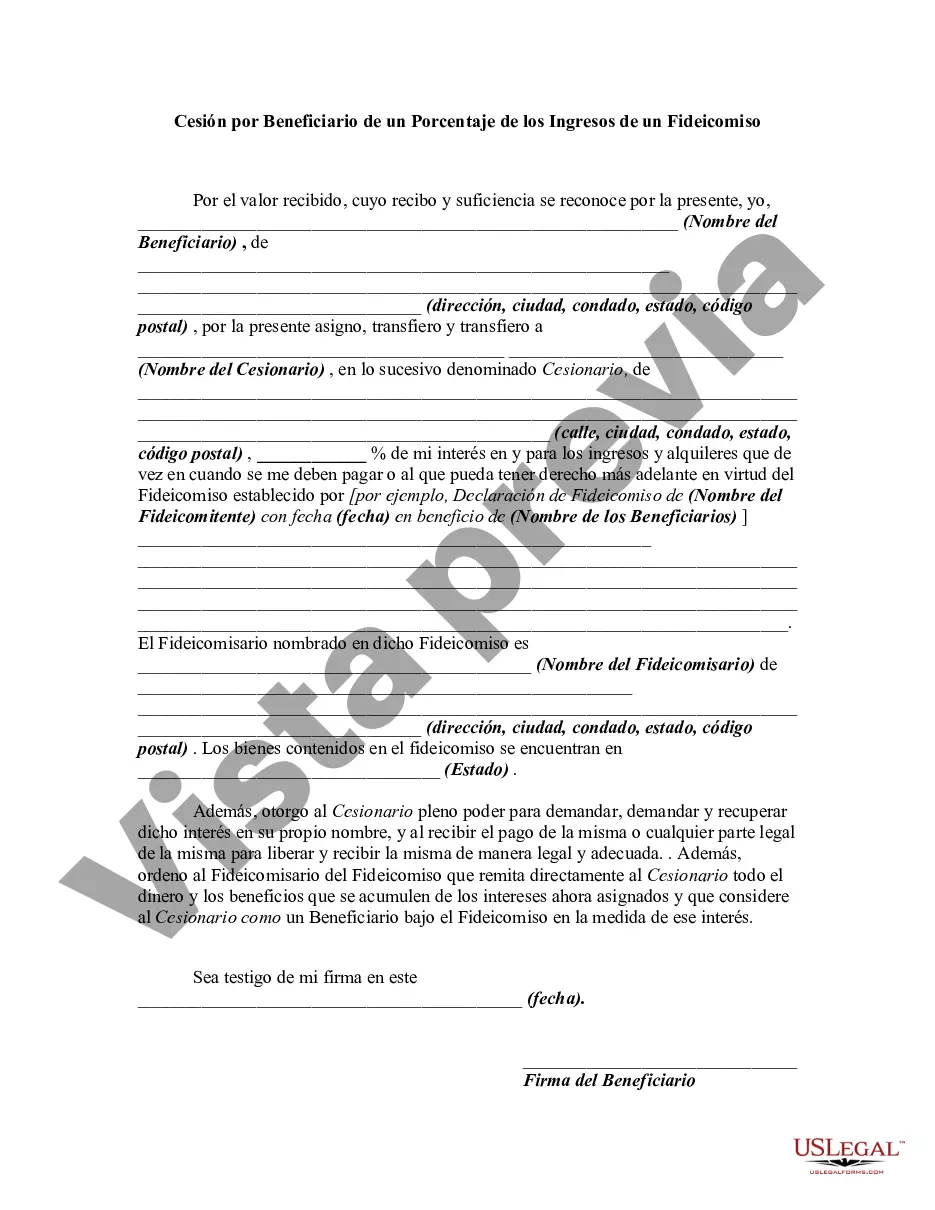

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montgomery, Maryland Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement where a beneficiary of a trust receives a designated portion of the trust's income. This type of assignment involves the transfer of a specific percentage of income from the trust to the beneficiary, subject to the terms and conditions set forth in the trust agreement. In Montgomery, Maryland, there are several types of assignments that a beneficiary can opt for, depending on their specific needs and goals. These may include: 1. Fixed Percentage Assignment: This type of assignment involves the beneficiary receiving a fixed percentage of the trust's income. For example, the beneficiary may be entitled to 20% of the trust's income each year. 2. Discretionary Percentage Assignment: Here, the beneficiary receives a percentage of the trust's income at the trustee's discretion. The trustee will evaluate various factors before determining the exact percentage to be assigned. This provides flexibility in adjusting the beneficiary's income share as required. 3. Revocable Percentage Assignment: In this case, the beneficiary has the ability to revoke or modify the assignment of the percentage of income they receive from the trust. This allows the beneficiary to adapt to any unforeseen changes in circumstances. 4. Irrevocable Percentage Assignment: Unlike the revocable assignment, the irrevocable assignment cannot be modified or revoked by the beneficiary once it is established. This arrangement ensures certainty and stability in the beneficiary's income stream. It is important to note that each assignment type may have different tax implications and legal obligations. Therefore, individuals considering a Montgomery, Maryland Assignment by Beneficiary of a Percentage of the Income of a Trust should consult with a qualified attorney or financial advisor knowledgeable in estate planning and trust law. Overall, Montgomery, Maryland Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries to receive a portion of the trust's income, providing financial support and potentially minimizing tax obligations.Montgomery, Maryland Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement where a beneficiary of a trust receives a designated portion of the trust's income. This type of assignment involves the transfer of a specific percentage of income from the trust to the beneficiary, subject to the terms and conditions set forth in the trust agreement. In Montgomery, Maryland, there are several types of assignments that a beneficiary can opt for, depending on their specific needs and goals. These may include: 1. Fixed Percentage Assignment: This type of assignment involves the beneficiary receiving a fixed percentage of the trust's income. For example, the beneficiary may be entitled to 20% of the trust's income each year. 2. Discretionary Percentage Assignment: Here, the beneficiary receives a percentage of the trust's income at the trustee's discretion. The trustee will evaluate various factors before determining the exact percentage to be assigned. This provides flexibility in adjusting the beneficiary's income share as required. 3. Revocable Percentage Assignment: In this case, the beneficiary has the ability to revoke or modify the assignment of the percentage of income they receive from the trust. This allows the beneficiary to adapt to any unforeseen changes in circumstances. 4. Irrevocable Percentage Assignment: Unlike the revocable assignment, the irrevocable assignment cannot be modified or revoked by the beneficiary once it is established. This arrangement ensures certainty and stability in the beneficiary's income stream. It is important to note that each assignment type may have different tax implications and legal obligations. Therefore, individuals considering a Montgomery, Maryland Assignment by Beneficiary of a Percentage of the Income of a Trust should consult with a qualified attorney or financial advisor knowledgeable in estate planning and trust law. Overall, Montgomery, Maryland Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries to receive a portion of the trust's income, providing financial support and potentially minimizing tax obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.