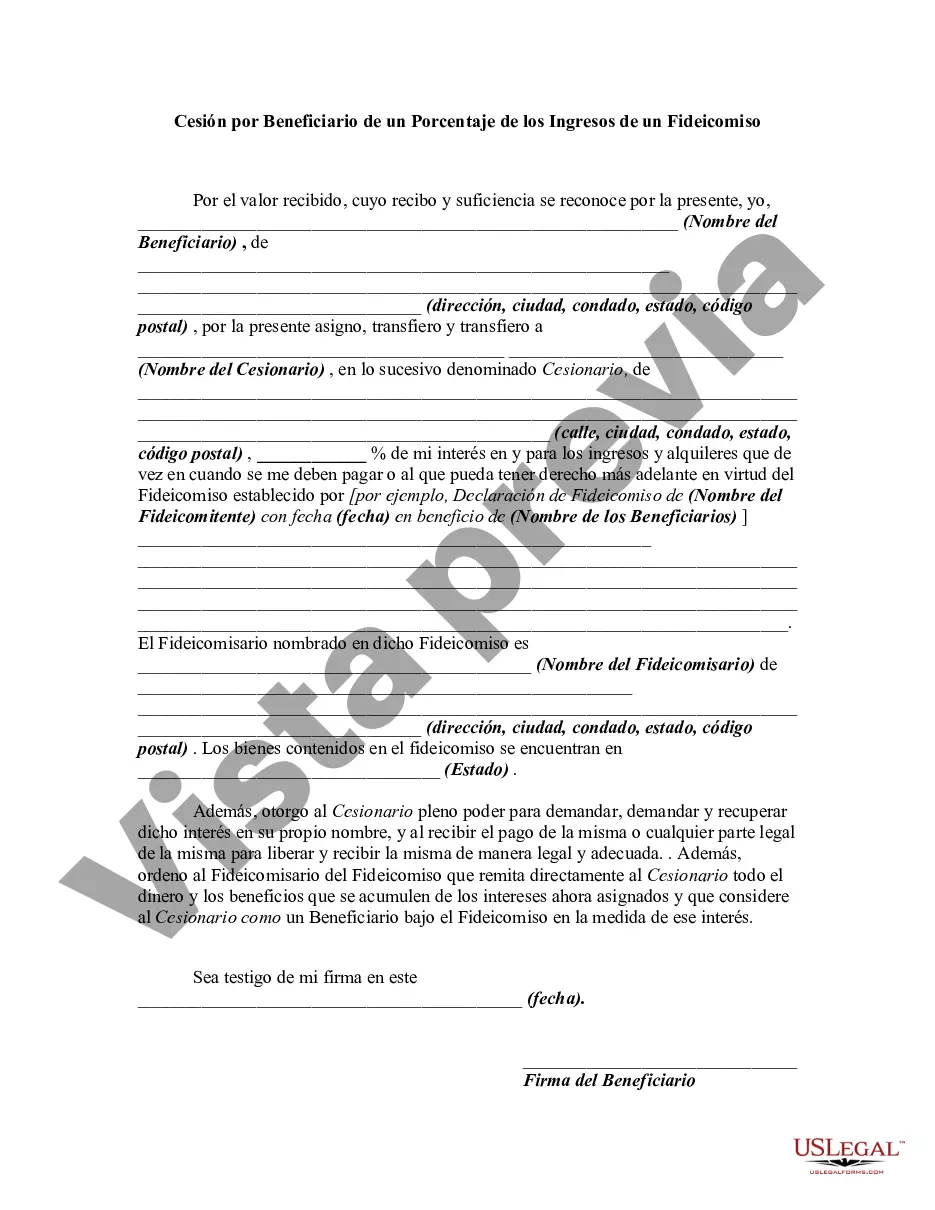

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Cesión por Beneficiario de un Porcentaje de los Ingresos de un Fideicomiso - Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Nassau New York Cesión Por Beneficiario De Un Porcentaje De Los Ingresos De Un Fideicomiso?

If you need to find a trustworthy legal form supplier to find the Nassau Assignment by Beneficiary of a Percentage of the Income of a Trust, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to get and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Nassau Assignment by Beneficiary of a Percentage of the Income of a Trust, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Nassau Assignment by Beneficiary of a Percentage of the Income of a Trust template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Nassau Assignment by Beneficiary of a Percentage of the Income of a Trust - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.

La muerte del fideicomitente no va a modificar el titulo juridico por el cual los fideicomisarios van a recibir el be- neficio. No fueron senalados herederos por causa de muerte. Son fideicomisarios por fideicomiso. No son herederos.

Articulo 821. Fallecimiento del fideicomisario. El fideicomisario que fallece antes de la restitucion, no trasmite por testamento o abintestato derecho alguno sobre fideicomiso, ni aun la simple expectativa que pasa ipso jure al sustituto o sustitutos designados por el constituyente, si los hubiere.

FIDUCIARIO: Es la persona encargada por el fideicomitente de realizar el fin del fideicomiso. El fiduciario se convierte en el titular del patrimonio constituido por los bienes o derechos destinados a la realizacion de tal finalidad.

Los fideicomisos son sujetos en el Impuesto a las Ganancias, segun lo dispuesto por el art. 73 inciso a), apartado 6 de la ley, debiendo tributar el impuesto a la tasa actual del 30%. Es decir que tienen el mismo tratamiento que los demas sujetos mencionados en el art. 73 (SA, SRL, etc.)

Dentro del ambito fiduciario podemos definir al beneficiario o fideicomisario como aquella persona natural o juridica designada en un contrato fiduciario cuya constitucion se hizo en su favor.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Un fideicomiso no es mas que una estructura legal a traves de la cual es posible designar la administracion de unos bienes a terceras personas, todo con la finalidad de obtener la mayor cantidad de beneficios (por ejemplo, proteger la privacidad de una persona que ya no desea que una propiedad este a su nombre).

Tal como se menciono, el fideicomiso no es una persona fisica ni moral, es asi que, quienes tienen que contribuir, mediante el pago de los impuestos correspondientes, son las personas fisicas y, en su caso, las morales y no el fideicomiso.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.