An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oakland County, Michigan is a vibrant and populous county located in the southeastern part of the state. It is home to a diverse population and offers a range of attractions and amenities for residents and visitors alike. One interesting aspect of Oakland County pertains to the Assignment by Beneficiary of a Percentage of the Income of a Trust. An Oakland Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust refers to an arrangement wherein a beneficiary of a trust is allocated a specific percentage of the income generated by that trust. This type of assignment allows beneficiaries to receive a regular income stream based on the trust's earnings, ensuring financial stability and supplemental income. There are two primary types of Oakland Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust: discretionary and mandatory. 1. Discretionary Assignment: In a discretionary assignment, the trustee has the discretion to determine the percentage of income to distribute to the beneficiary. The trustee considers various factors such as the beneficiary's financial needs and circumstances, the current state of the trust's income, and any other relevant considerations before making a distribution decision. This type of assignment provides flexibility to the trustee and can be suitable for beneficiaries with uncertain income needs. 2. Mandatory Assignment: On the other hand, a mandatory assignment mandates a specific percentage of income to be distributed to the beneficiary. The trust document or an applicable law typically outlines this percentage, leaving little or no discretion for the trustee. This type of assignment provides a predictable income stream for the beneficiary and is often utilized when fixed financial support is crucial. Oakland County, Michigan, with its thriving community and strong economy, offers numerous opportunities for individuals to benefit from an Assignment by Beneficiary of a Percentage of the Income of a Trust. Whether it is to ensure financial stability during retirement, support ongoing education, or provide for the needs of a loved one, this arrangement can play a significant role in securing the financial future of beneficiaries.Oakland County, Michigan is a vibrant and populous county located in the southeastern part of the state. It is home to a diverse population and offers a range of attractions and amenities for residents and visitors alike. One interesting aspect of Oakland County pertains to the Assignment by Beneficiary of a Percentage of the Income of a Trust. An Oakland Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust refers to an arrangement wherein a beneficiary of a trust is allocated a specific percentage of the income generated by that trust. This type of assignment allows beneficiaries to receive a regular income stream based on the trust's earnings, ensuring financial stability and supplemental income. There are two primary types of Oakland Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust: discretionary and mandatory. 1. Discretionary Assignment: In a discretionary assignment, the trustee has the discretion to determine the percentage of income to distribute to the beneficiary. The trustee considers various factors such as the beneficiary's financial needs and circumstances, the current state of the trust's income, and any other relevant considerations before making a distribution decision. This type of assignment provides flexibility to the trustee and can be suitable for beneficiaries with uncertain income needs. 2. Mandatory Assignment: On the other hand, a mandatory assignment mandates a specific percentage of income to be distributed to the beneficiary. The trust document or an applicable law typically outlines this percentage, leaving little or no discretion for the trustee. This type of assignment provides a predictable income stream for the beneficiary and is often utilized when fixed financial support is crucial. Oakland County, Michigan, with its thriving community and strong economy, offers numerous opportunities for individuals to benefit from an Assignment by Beneficiary of a Percentage of the Income of a Trust. Whether it is to ensure financial stability during retirement, support ongoing education, or provide for the needs of a loved one, this arrangement can play a significant role in securing the financial future of beneficiaries.

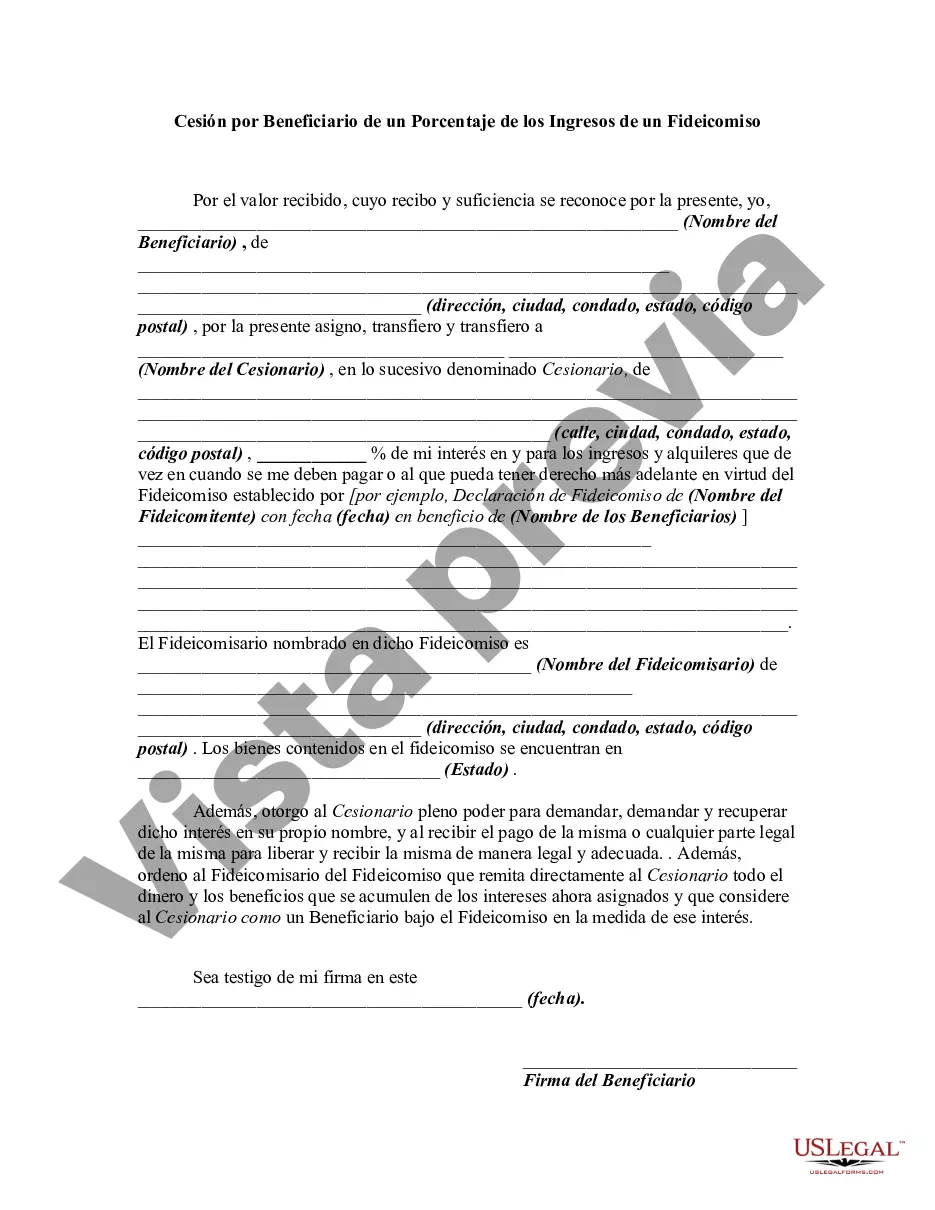

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.