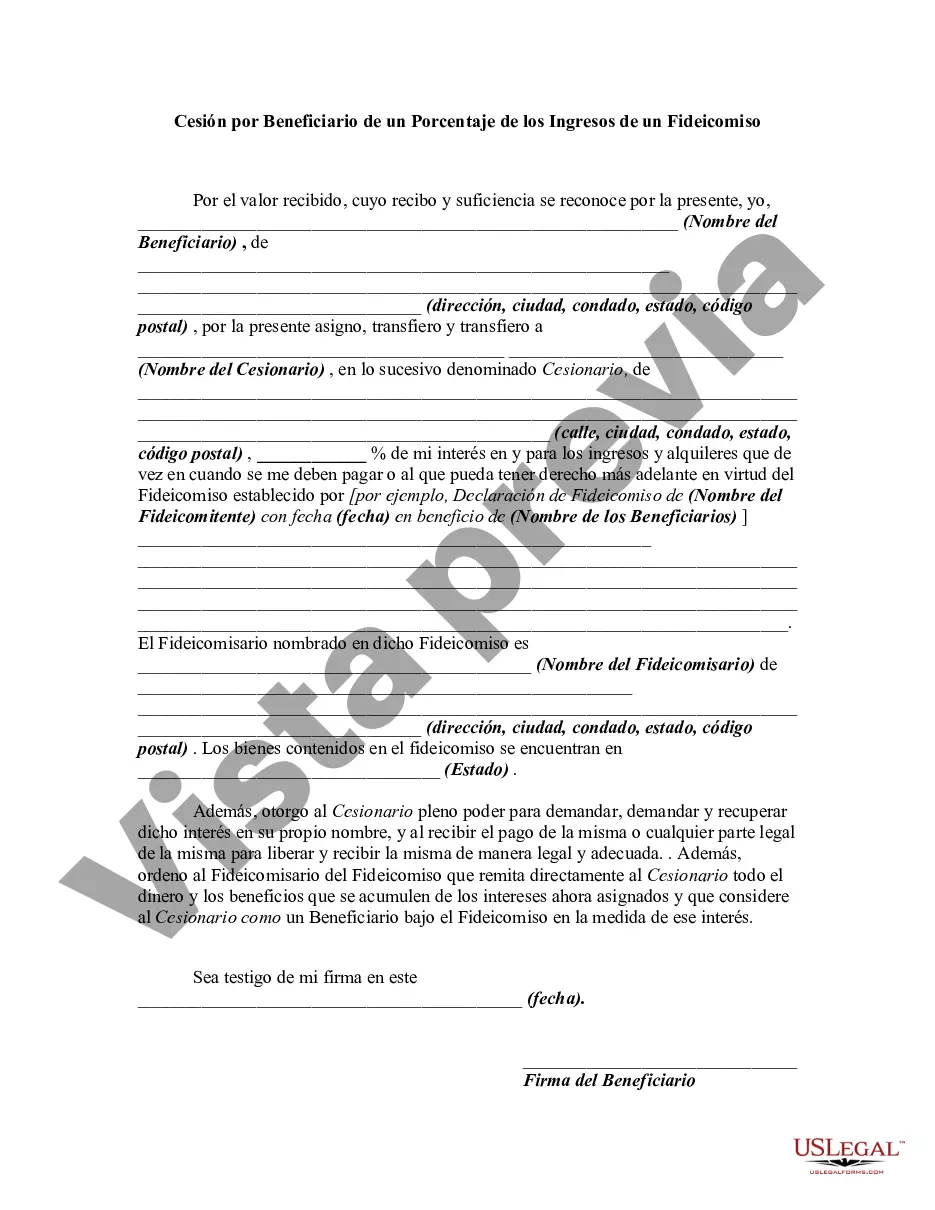

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Phoenix, Arizona Assignment by Beneficiary of a Percentage of the Income of a Trust: Explained In the realm of estate planning, Phoenix, Arizona offers a unique legal provision known as the Assignment by Beneficiary of a Percentage of the Income of a Trust. This arrangement allows beneficiaries to receive a portion of the income generated by a trust, providing them with a steady stream of financial support. Let's delve into the specifics of this assignment and explore its various types and implications. An Assignment by Beneficiary of a Percentage of the Income of a Trust empowers beneficiaries to claim a designated percentage of the trust's generated income. This is a highly flexible arrangement that grants beneficiaries the freedom to determine the percentage they wish to receive, tailoring the distribution to better meet their personal financial needs. This percentage can vary from a small fraction to a substantial share, as agreed upon by both the beneficiary and the trustee. Types of Phoenix, Arizona Assignment by Beneficiary of a Percentage of the Income of a Trust: 1. Fixed Percentage Assignment: In this type, beneficiaries receive a predetermined, fixed percentage of the trust's income. This arrangement provides a stable income that beneficiaries can rely on, regardless of any fluctuations in the trust's overall value or performance. This type is often preferred by beneficiaries seeking a dependable, regular income stream. 2. Variable Percentage Assignment: With this type, beneficiaries can choose to receive different percentages of the trust's income periodically. This flexibility allows beneficiaries to adjust their income according to their changing financial circumstances. For instance, during times of increased expenses, a beneficiary may opt for a larger percentage, while in times of financial stability, they may choose a smaller percentage. 3. Adjusted Percentage Assignment: This type of assignment allows beneficiaries to modify their percentage of income based on specific events or conditions. For example, if a beneficiary goes through a financial emergency or faces unforeseen financial obligations, they can request a temporary increase in their designated percentage for a pre-determined time. Once the circumstances stabilize, the percentage can revert to the original agreement. Benefits and Considerations: — Stable Income: The Assignment by Beneficiary of a Percentage of the Income of a Trust ensures a regular income for beneficiaries, providing financial security and stability. — Flexibility: Beneficiaries have the autonomy to determine their desired percentage, enabling them to adapt their income to match their immediate and long-term financial goals. — Impact on Living Standards: This arrangement can significantly improve a beneficiary's quality of life by providing a consistent income source to fulfill daily needs, cover medical expenses, or pursue personal aspirations. — Tax Implications: It is crucial for beneficiaries to consult with a financial advisor or tax professional to understand the tax implications of receiving trust income. The Assignment by Beneficiary of a Percentage of the Income of a Trust is an invaluable tool in estate planning, offering beneficiaries in Phoenix, Arizona the ability to grab hold of their financial future. By providing a steady income stream tailored to their preferences, this arrangement fosters financial security and enhances overall well-being.Phoenix, Arizona Assignment by Beneficiary of a Percentage of the Income of a Trust: Explained In the realm of estate planning, Phoenix, Arizona offers a unique legal provision known as the Assignment by Beneficiary of a Percentage of the Income of a Trust. This arrangement allows beneficiaries to receive a portion of the income generated by a trust, providing them with a steady stream of financial support. Let's delve into the specifics of this assignment and explore its various types and implications. An Assignment by Beneficiary of a Percentage of the Income of a Trust empowers beneficiaries to claim a designated percentage of the trust's generated income. This is a highly flexible arrangement that grants beneficiaries the freedom to determine the percentage they wish to receive, tailoring the distribution to better meet their personal financial needs. This percentage can vary from a small fraction to a substantial share, as agreed upon by both the beneficiary and the trustee. Types of Phoenix, Arizona Assignment by Beneficiary of a Percentage of the Income of a Trust: 1. Fixed Percentage Assignment: In this type, beneficiaries receive a predetermined, fixed percentage of the trust's income. This arrangement provides a stable income that beneficiaries can rely on, regardless of any fluctuations in the trust's overall value or performance. This type is often preferred by beneficiaries seeking a dependable, regular income stream. 2. Variable Percentage Assignment: With this type, beneficiaries can choose to receive different percentages of the trust's income periodically. This flexibility allows beneficiaries to adjust their income according to their changing financial circumstances. For instance, during times of increased expenses, a beneficiary may opt for a larger percentage, while in times of financial stability, they may choose a smaller percentage. 3. Adjusted Percentage Assignment: This type of assignment allows beneficiaries to modify their percentage of income based on specific events or conditions. For example, if a beneficiary goes through a financial emergency or faces unforeseen financial obligations, they can request a temporary increase in their designated percentage for a pre-determined time. Once the circumstances stabilize, the percentage can revert to the original agreement. Benefits and Considerations: — Stable Income: The Assignment by Beneficiary of a Percentage of the Income of a Trust ensures a regular income for beneficiaries, providing financial security and stability. — Flexibility: Beneficiaries have the autonomy to determine their desired percentage, enabling them to adapt their income to match their immediate and long-term financial goals. — Impact on Living Standards: This arrangement can significantly improve a beneficiary's quality of life by providing a consistent income source to fulfill daily needs, cover medical expenses, or pursue personal aspirations. — Tax Implications: It is crucial for beneficiaries to consult with a financial advisor or tax professional to understand the tax implications of receiving trust income. The Assignment by Beneficiary of a Percentage of the Income of a Trust is an invaluable tool in estate planning, offering beneficiaries in Phoenix, Arizona the ability to grab hold of their financial future. By providing a steady income stream tailored to their preferences, this arrangement fosters financial security and enhances overall well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.