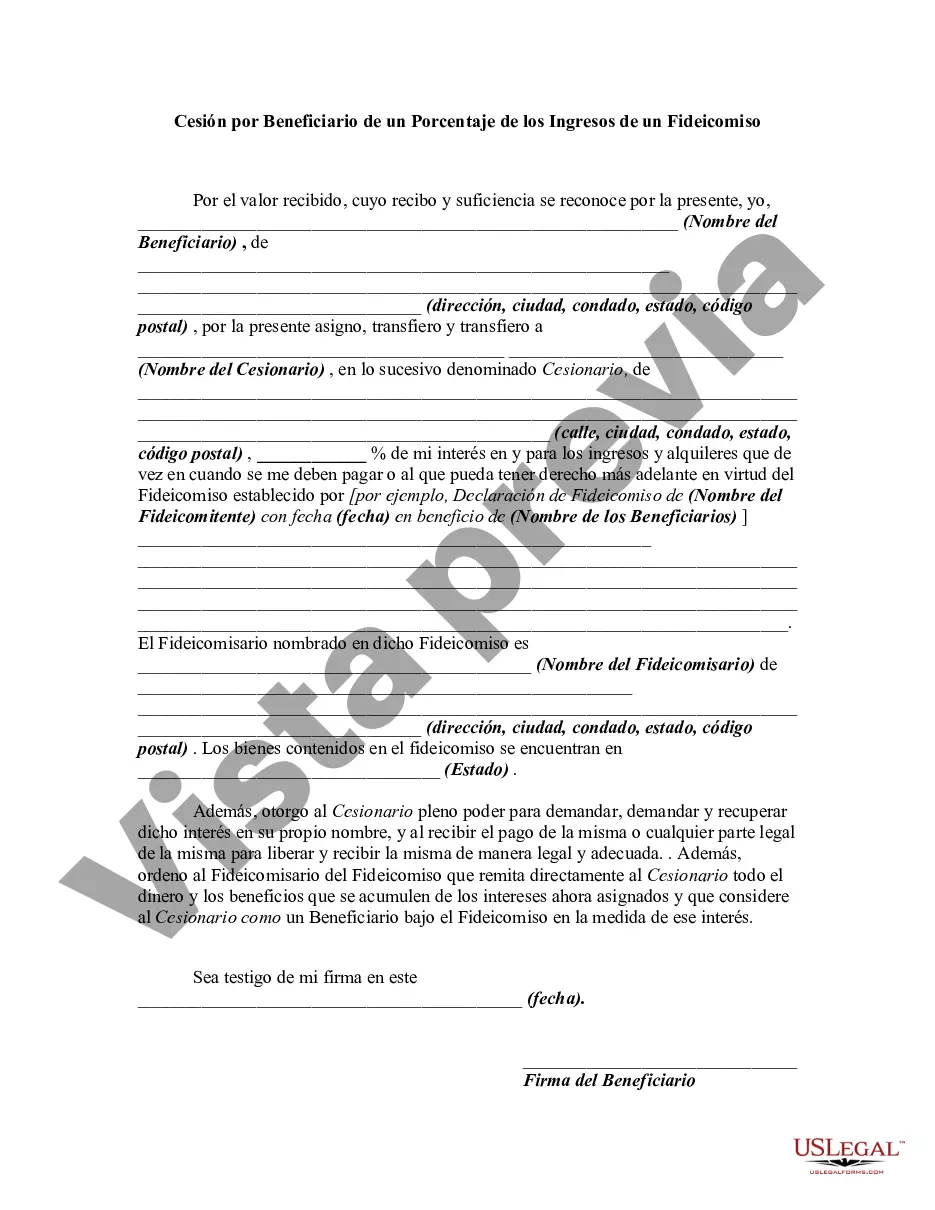

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Salt Lake City, Utah is the vibrant and bustling capital of the state of Utah, located in Salt Lake County. This thriving city is nestled within the stunning Wasatch Mountain Range, offering breathtaking natural beauty and a wide array of recreational opportunities. Salt Lake City is also known for its rich history, welcoming community, and diverse cultural scene, making it a popular destination for residents and tourists alike. When it comes to Salt Lake Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, there can be different types to consider. These assignments typically involve a beneficiary being entitled to a specific percentage of the income generated by a trust. Here are a few variations and aspects to be aware of: 1. Percentage Allocation: This type of assignment specifies a fixed percentage of the trust's income that will be allocated to the beneficiary. For example, a beneficiary may receive 20% of the generated income annually. 2. Term and Duration: The assignment can be structured for a specific term or duration. It may be set to last for a certain number of years or until a specific event occurs, such as the beneficiary reaching a certain age. 3. Revocable vs. Irrevocable Assignment: Depending on the trust's terms, the assignment may be revocable or irrevocable. A revocable assignment allows the granter or trustee to modify or terminate the assignment, while an irrevocable assignment cannot be changed once established. 4. Interests and Rights: The assignment may grant various rights and interests to the beneficiary. These can include the right to receive regular income distributions, participate in trust decisions, and potentially receive additional benefits tied to the trust's performance. 5. Tax Considerations: Salt Lake Utah Assignment by Beneficiary of a Percentage of the Income of a Trust may have tax implications for all parties involved. It is important to consult with a tax professional or legal advisor to understand the tax consequences and any potential tax planning opportunities. Whether you're a trust beneficiary or a trustee, Salt Lake City offers numerous resources and professionals well-versed in trust law to assist with navigating these assignments. From experienced estate planning attorneys to financial advisors specialized in trust management, these experts can help ensure a smooth process for both parties involved in a trust assignment. In conclusion, Salt Lake City, Utah provides a vibrant backdrop for various types of trust assignments, including Salt Lake Utah Assignment by Beneficiary of a Percentage of the Income of a Trust. Understanding the various aspects, types, and implications of these assignments is crucial for all parties involved to make informed decisions and secure the desired benefits from the trust.Salt Lake City, Utah is the vibrant and bustling capital of the state of Utah, located in Salt Lake County. This thriving city is nestled within the stunning Wasatch Mountain Range, offering breathtaking natural beauty and a wide array of recreational opportunities. Salt Lake City is also known for its rich history, welcoming community, and diverse cultural scene, making it a popular destination for residents and tourists alike. When it comes to Salt Lake Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, there can be different types to consider. These assignments typically involve a beneficiary being entitled to a specific percentage of the income generated by a trust. Here are a few variations and aspects to be aware of: 1. Percentage Allocation: This type of assignment specifies a fixed percentage of the trust's income that will be allocated to the beneficiary. For example, a beneficiary may receive 20% of the generated income annually. 2. Term and Duration: The assignment can be structured for a specific term or duration. It may be set to last for a certain number of years or until a specific event occurs, such as the beneficiary reaching a certain age. 3. Revocable vs. Irrevocable Assignment: Depending on the trust's terms, the assignment may be revocable or irrevocable. A revocable assignment allows the granter or trustee to modify or terminate the assignment, while an irrevocable assignment cannot be changed once established. 4. Interests and Rights: The assignment may grant various rights and interests to the beneficiary. These can include the right to receive regular income distributions, participate in trust decisions, and potentially receive additional benefits tied to the trust's performance. 5. Tax Considerations: Salt Lake Utah Assignment by Beneficiary of a Percentage of the Income of a Trust may have tax implications for all parties involved. It is important to consult with a tax professional or legal advisor to understand the tax consequences and any potential tax planning opportunities. Whether you're a trust beneficiary or a trustee, Salt Lake City offers numerous resources and professionals well-versed in trust law to assist with navigating these assignments. From experienced estate planning attorneys to financial advisors specialized in trust management, these experts can help ensure a smooth process for both parties involved in a trust assignment. In conclusion, Salt Lake City, Utah provides a vibrant backdrop for various types of trust assignments, including Salt Lake Utah Assignment by Beneficiary of a Percentage of the Income of a Trust. Understanding the various aspects, types, and implications of these assignments is crucial for all parties involved to make informed decisions and secure the desired benefits from the trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.