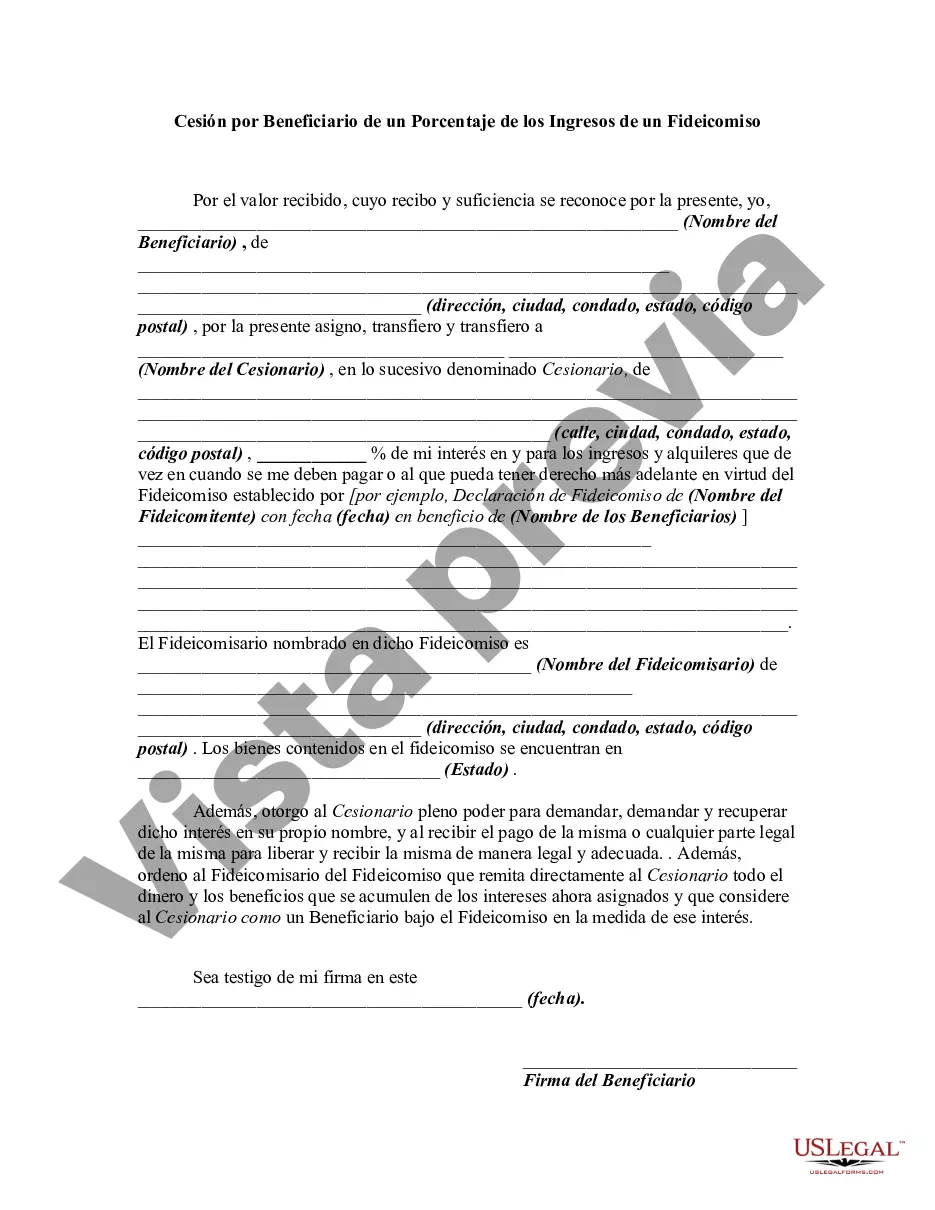

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California, also known as the "Capital of Silicon Valley," is a major city located in the heart of Santa Clara County. Renowned for its thriving tech industry and diverse cultural scene, this bustling city is an ideal destination for entrepreneurs, professionals, and artists alike. If you are the beneficiary of a trust and seeking to assign a percentage of its income, San Jose offers several options to consider. One type of San Jose, California Assignment by Beneficiary of a Percentage of the Income of a Trust is a charitable assignment. This involves allocating a portion of the trust's income to support charitable organizations or causes based in San Jose. By contributing to local nonprofits, you can make a positive impact on the community, addressing key issues such as education, healthcare, or environmental conservation. Another type of assignment worthy of consideration is an educational assignment. San Jose is home to numerous esteemed educational institutions, such as San Jose State University and Santa Clara University. By assigning a percentage of the trust's income to educational purposes, you can support scholarships, research programs, and facility enhancements, thus empowering individuals to pursue academic excellence in San Jose. Moreover, there are cultural assignments that aim to promote the arts and cultural heritage of San Jose. With its vibrant arts scene and diverse population, this city offers numerous opportunities to support local museums, theaters, and art galleries. By dedicating a percentage of the trust's income to cultural endeavors, you can contribute to the growth and preservation of San Jose's artistic community. Additionally, a sustainable assignment is an impactful choice for those concerned about environmental conservation. San Jose is committed to sustainability and reducing its carbon footprint, making it an ideal destination for eco-conscious trust beneficiaries. By assigning a percentage of the trust's income to initiatives such as renewable energy projects, conservation efforts, or sustainable development, you can contribute to San Jose's commitment to a greener future. In conclusion, San Jose, California, offers various avenues for beneficiaries of a trust to assign a percentage of its income. Whether you choose charitable assignments, educational assignments, cultural assignments, or sustainable assignments, this dynamic city provides an array of opportunities to make a positive and lasting impact. Consider these options and consult with legal professionals to determine the best approach for your specific situation.San Jose, California, also known as the "Capital of Silicon Valley," is a major city located in the heart of Santa Clara County. Renowned for its thriving tech industry and diverse cultural scene, this bustling city is an ideal destination for entrepreneurs, professionals, and artists alike. If you are the beneficiary of a trust and seeking to assign a percentage of its income, San Jose offers several options to consider. One type of San Jose, California Assignment by Beneficiary of a Percentage of the Income of a Trust is a charitable assignment. This involves allocating a portion of the trust's income to support charitable organizations or causes based in San Jose. By contributing to local nonprofits, you can make a positive impact on the community, addressing key issues such as education, healthcare, or environmental conservation. Another type of assignment worthy of consideration is an educational assignment. San Jose is home to numerous esteemed educational institutions, such as San Jose State University and Santa Clara University. By assigning a percentage of the trust's income to educational purposes, you can support scholarships, research programs, and facility enhancements, thus empowering individuals to pursue academic excellence in San Jose. Moreover, there are cultural assignments that aim to promote the arts and cultural heritage of San Jose. With its vibrant arts scene and diverse population, this city offers numerous opportunities to support local museums, theaters, and art galleries. By dedicating a percentage of the trust's income to cultural endeavors, you can contribute to the growth and preservation of San Jose's artistic community. Additionally, a sustainable assignment is an impactful choice for those concerned about environmental conservation. San Jose is committed to sustainability and reducing its carbon footprint, making it an ideal destination for eco-conscious trust beneficiaries. By assigning a percentage of the trust's income to initiatives such as renewable energy projects, conservation efforts, or sustainable development, you can contribute to San Jose's commitment to a greener future. In conclusion, San Jose, California, offers various avenues for beneficiaries of a trust to assign a percentage of its income. Whether you choose charitable assignments, educational assignments, cultural assignments, or sustainable assignments, this dynamic city provides an array of opportunities to make a positive and lasting impact. Consider these options and consult with legal professionals to determine the best approach for your specific situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.