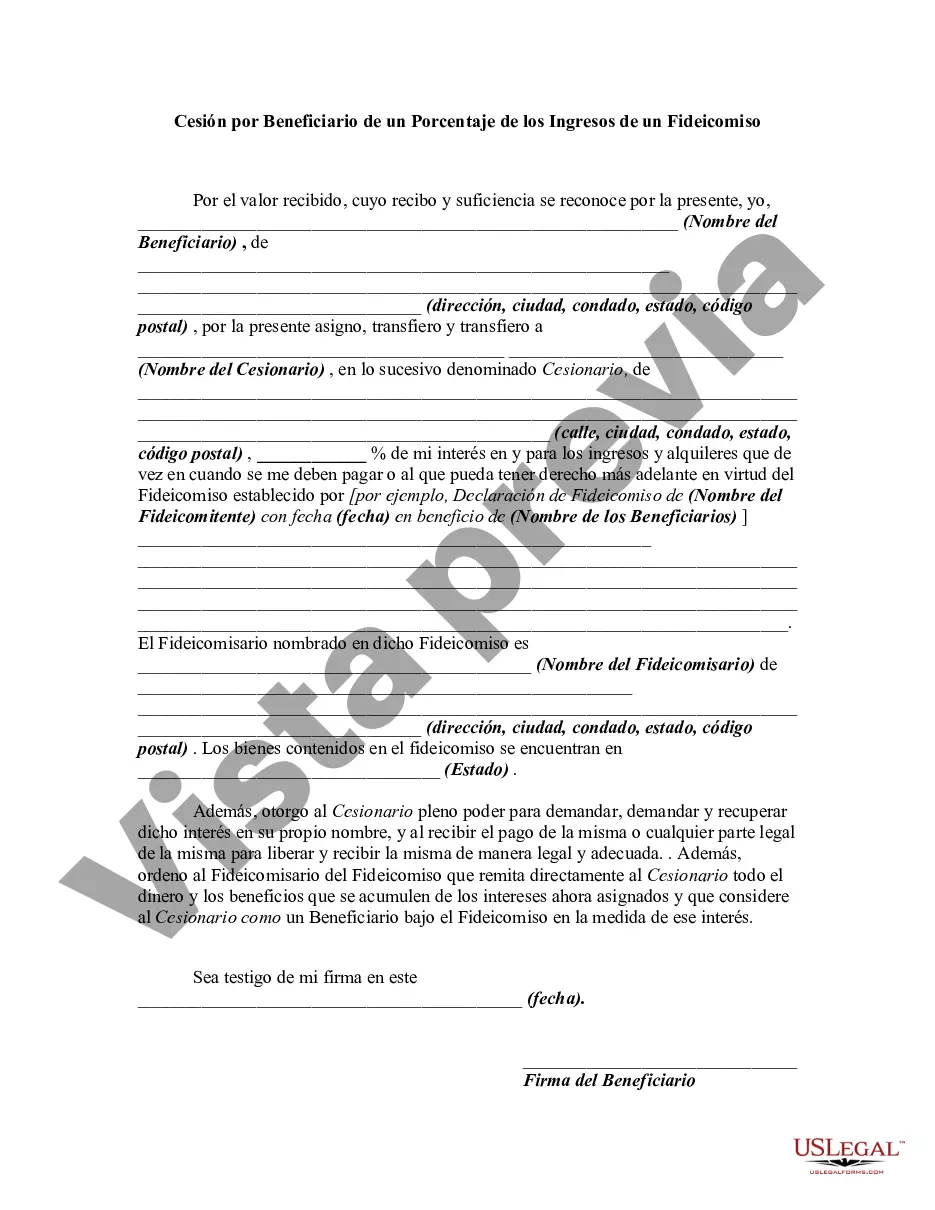

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement that allows a beneficiary of a trust to transfer a specific percentage of the trust's income to a designated individual or entity in Travis County, Texas. This assignment ensures that the beneficiary's chosen party receives a consistent stream of income from the trust assets. The primary purpose of a Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is to provide financial support or regular income to a designated recipient. This arrangement is often used for beneficiaries who want to share their trust income with another person or organization. It is a versatile tool that can be tailored to meet specific needs and objectives. There are various types of Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust, depending on the terms and conditions set by the trust or. These may include: 1. Fixed Percentage Assignment: In this type of assignment, the beneficiary designates a fixed percentage of the trust's income to be assigned to the designated recipient. The assigned percentage remains constant throughout the duration of the arrangement, ensuring a predictable income stream. 2. Variable Percentage Assignment: Unlike the fixed percentage assignment, this type allows the beneficiary to adjust the assigned percentage periodically. This flexibility enables the beneficiary to adapt to changing financial circumstances or the recipient's needs. 3. Revocable Assignment: This assignment type allows the beneficiary to modify or revoke the assignment at any time, providing them with the flexibility to make changes if circumstances or priorities change. 4. Irrevocable Assignment: In contrast to the revocable assignment, the irrevocable assignment cannot be modified or revoked once executed. This type of assignment provides a secure and permanent flow of income to the designated recipient. It is crucial to consult with a knowledgeable attorney to understand the implications and specific provisions of a Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust. The attorney can guide the beneficiary through the legal process, ensuring compliance with relevant laws and regulations while protecting the interests of all parties involved. Key phrases: Travis Texas Assignment by Beneficiary, Percentage of the Income, Trust, Trust Beneficiary, Trust Assignment, Trust Income, Travis County, Texas, Fixed Percentage Assignment, Variable Percentage Assignment, Revocable Assignment, Irrevocable Assignment, Trustee Roles, Trust or Obligations, Legal Arrangements.Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is a legal arrangement that allows a beneficiary of a trust to transfer a specific percentage of the trust's income to a designated individual or entity in Travis County, Texas. This assignment ensures that the beneficiary's chosen party receives a consistent stream of income from the trust assets. The primary purpose of a Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust is to provide financial support or regular income to a designated recipient. This arrangement is often used for beneficiaries who want to share their trust income with another person or organization. It is a versatile tool that can be tailored to meet specific needs and objectives. There are various types of Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust, depending on the terms and conditions set by the trust or. These may include: 1. Fixed Percentage Assignment: In this type of assignment, the beneficiary designates a fixed percentage of the trust's income to be assigned to the designated recipient. The assigned percentage remains constant throughout the duration of the arrangement, ensuring a predictable income stream. 2. Variable Percentage Assignment: Unlike the fixed percentage assignment, this type allows the beneficiary to adjust the assigned percentage periodically. This flexibility enables the beneficiary to adapt to changing financial circumstances or the recipient's needs. 3. Revocable Assignment: This assignment type allows the beneficiary to modify or revoke the assignment at any time, providing them with the flexibility to make changes if circumstances or priorities change. 4. Irrevocable Assignment: In contrast to the revocable assignment, the irrevocable assignment cannot be modified or revoked once executed. This type of assignment provides a secure and permanent flow of income to the designated recipient. It is crucial to consult with a knowledgeable attorney to understand the implications and specific provisions of a Travis Texas Assignment by Beneficiary of a Percentage of the Income of a Trust. The attorney can guide the beneficiary through the legal process, ensuring compliance with relevant laws and regulations while protecting the interests of all parties involved. Key phrases: Travis Texas Assignment by Beneficiary, Percentage of the Income, Trust, Trust Beneficiary, Trust Assignment, Trust Income, Travis County, Texas, Fixed Percentage Assignment, Variable Percentage Assignment, Revocable Assignment, Irrevocable Assignment, Trustee Roles, Trust or Obligations, Legal Arrangements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.