An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust: A Comprehensive Overview Introduction: In Wake, North Carolina, Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a legal arrangement where a beneficiary of a trust assigns a portion of the trust's income to another individual or entity. This assignment can be beneficial for various reasons, such as estate planning, tax considerations, or charitable giving. This article aims to provide a detailed description of this assignment, its advantages, potential types, and its legal aspects. 1. Understanding Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust: This section will delve into the core concept of this assignment, explaining its purpose and what it entails for both the assignor (beneficiary) and assignee. It will outline the process of assigning a portion of the trust's income to another party and emphasize the voluntary nature of such assignments. 2. Advantages of Assigning a Percentage of the Income: Highlighting the potential benefits of this assignment, this section will discuss the key advantages that motivate beneficiaries to opt for such arrangements. It will include aspects like tax planning strategies, asset protection, flexibility in income distribution, and the ability to support charitable causes. 3. Types of Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust: Here, we explore possible variations in this assignment, providing an overview of different types that beneficiaries can consider. Examples may include standard assignments, diversionary assignments, assignments with income restrictions, and conditional assignments based on specific circumstances. 4. Tax Considerations and Compliance: Elaborating on the tax-related implications of assigning a percentage of trust income, this section will outline the potential tax benefits and discuss relevant compliance requirements imposed by law. It will stress the importance of seeking professional advice from tax experts to ensure compliance with Wake, North Carolina regulations. 5. Legal Aspects and Formalities: To avoid any misunderstandings or disputes, this section will highlight the importance of involving legal professionals in drafting and executing the assignment document. It will emphasize the necessity of complying with Wake, North Carolina trust law and detailing the rights and obligations of both parties involved. Conclusion: Concluding the article, the summary will reiterate the significance of the Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust as an effective estate planning tool. It will encourage readers to seek professional advice to determine whether this assignment aligns with their specific financial goals and ensure compliance with applicable laws. Keywords: Wake, North Carolina, Assignment by Beneficiary, Percentage of the Income, Trust, Estate Planning, Tax Considerations, Tax Benefits, Types, Diversionary Assignment, Income Restrictions, Legal Aspects, Compliance, Charitable Giving.Title: Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust: A Comprehensive Overview Introduction: In Wake, North Carolina, Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a legal arrangement where a beneficiary of a trust assigns a portion of the trust's income to another individual or entity. This assignment can be beneficial for various reasons, such as estate planning, tax considerations, or charitable giving. This article aims to provide a detailed description of this assignment, its advantages, potential types, and its legal aspects. 1. Understanding Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust: This section will delve into the core concept of this assignment, explaining its purpose and what it entails for both the assignor (beneficiary) and assignee. It will outline the process of assigning a portion of the trust's income to another party and emphasize the voluntary nature of such assignments. 2. Advantages of Assigning a Percentage of the Income: Highlighting the potential benefits of this assignment, this section will discuss the key advantages that motivate beneficiaries to opt for such arrangements. It will include aspects like tax planning strategies, asset protection, flexibility in income distribution, and the ability to support charitable causes. 3. Types of Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust: Here, we explore possible variations in this assignment, providing an overview of different types that beneficiaries can consider. Examples may include standard assignments, diversionary assignments, assignments with income restrictions, and conditional assignments based on specific circumstances. 4. Tax Considerations and Compliance: Elaborating on the tax-related implications of assigning a percentage of trust income, this section will outline the potential tax benefits and discuss relevant compliance requirements imposed by law. It will stress the importance of seeking professional advice from tax experts to ensure compliance with Wake, North Carolina regulations. 5. Legal Aspects and Formalities: To avoid any misunderstandings or disputes, this section will highlight the importance of involving legal professionals in drafting and executing the assignment document. It will emphasize the necessity of complying with Wake, North Carolina trust law and detailing the rights and obligations of both parties involved. Conclusion: Concluding the article, the summary will reiterate the significance of the Wake, North Carolina Assignment by Beneficiary of a Percentage of the Income of a Trust as an effective estate planning tool. It will encourage readers to seek professional advice to determine whether this assignment aligns with their specific financial goals and ensure compliance with applicable laws. Keywords: Wake, North Carolina, Assignment by Beneficiary, Percentage of the Income, Trust, Estate Planning, Tax Considerations, Tax Benefits, Types, Diversionary Assignment, Income Restrictions, Legal Aspects, Compliance, Charitable Giving.

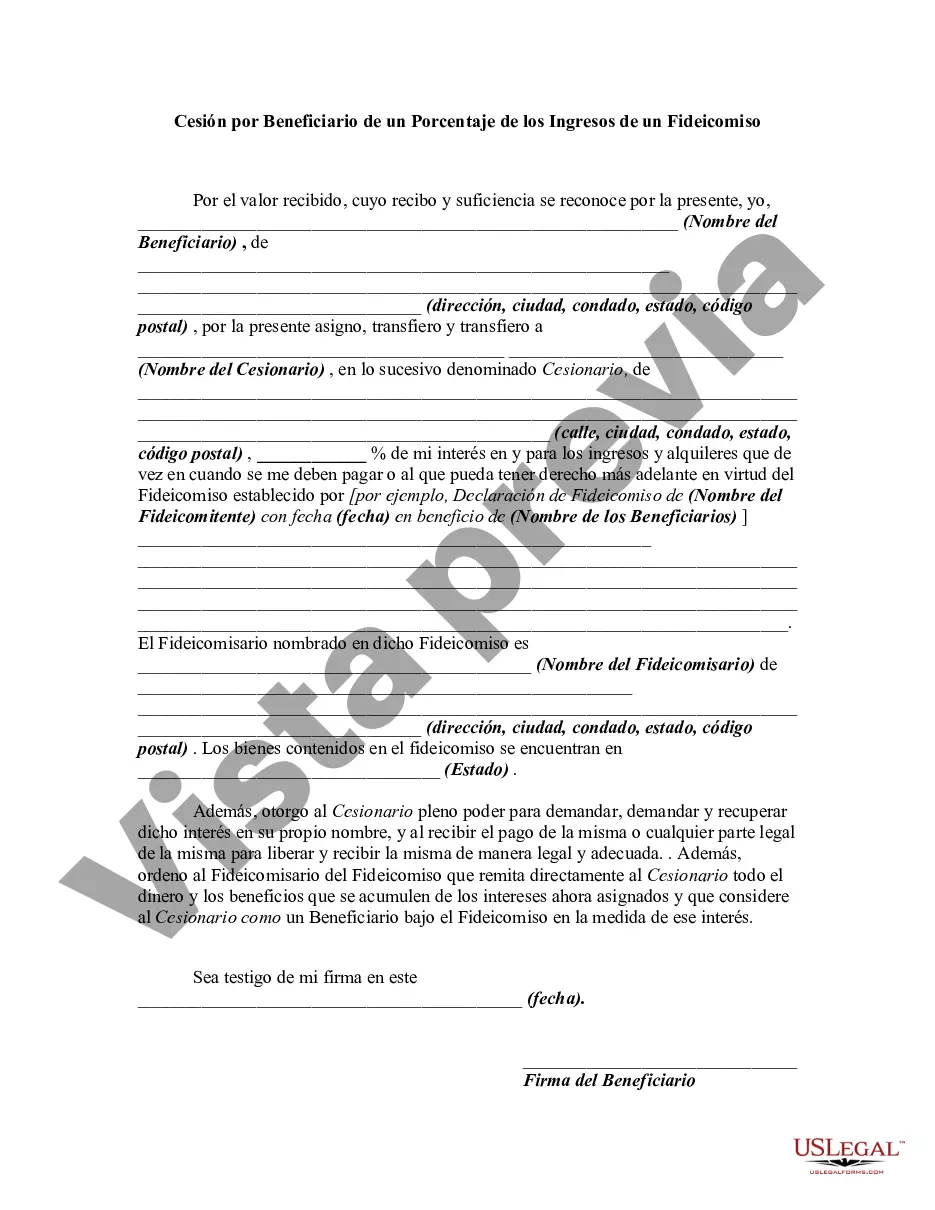

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.