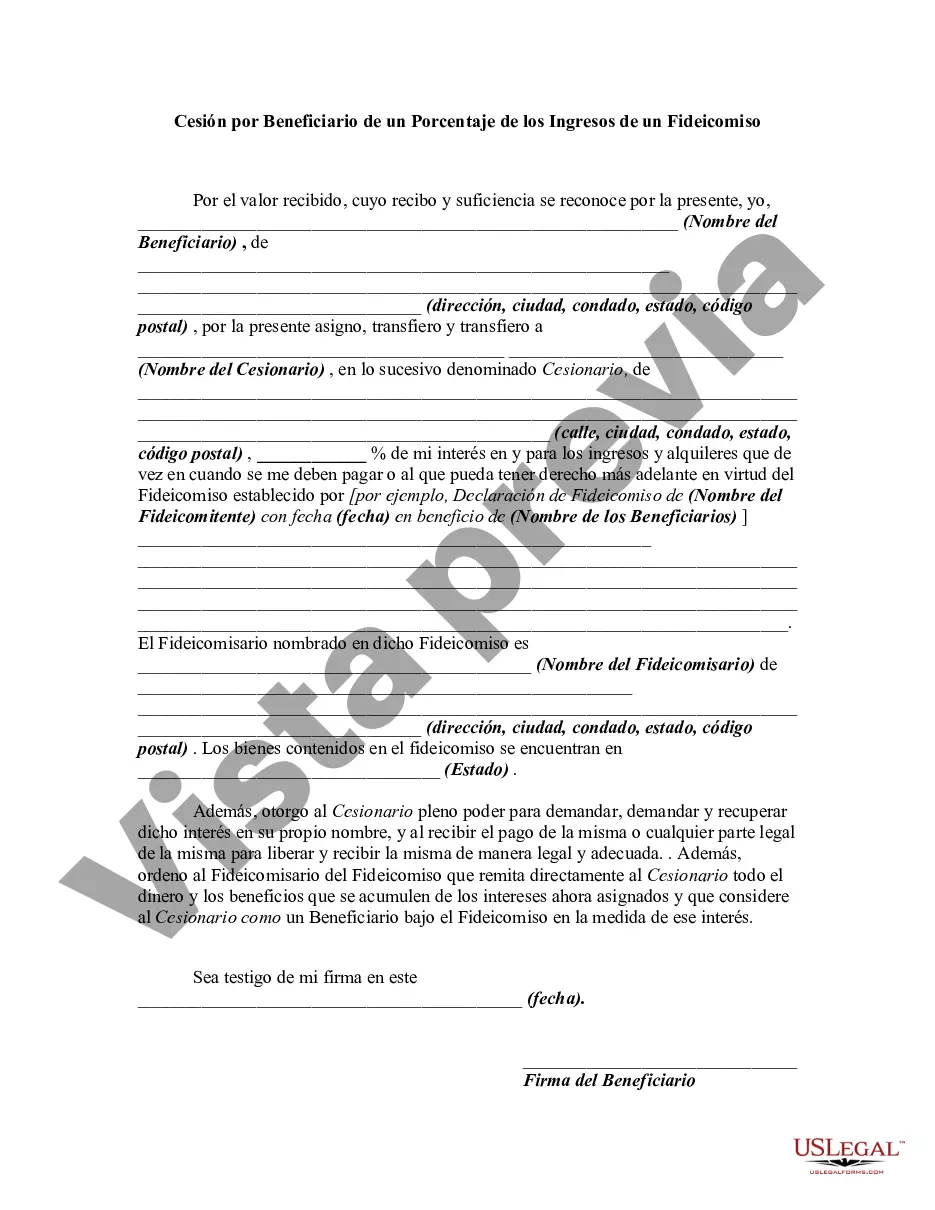

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust Explained In Wayne, Michigan, when beneficiaries are entitled to a portion of the income generated by a trust, they may choose to assign or transfer their assigned percentage to another party. This process is known as a Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust. This assignment allows beneficiaries to distribute or redirect their share of the trust's income, providing them with flexibility and control over their financial resources. It essentially enables beneficiaries to designate someone else to receive their specific portion of income from the trust. Different Types of Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust: 1. Inter Vivos Assignment: This refers to an assignment that takes place during the lifetime of the beneficiary. It allows individuals to transfer their assigned percentage of income to another individual or a charitable organization while they are still alive. 2. Testamentary Assignment: This type of assignment occurs after the death of the beneficiary. It involves the beneficiary designating in their will that their assigned percentage of income should be transferred to another individual or entity. This ensures that the income from the trust continues to benefit the designated recipient even after the beneficiary's demise. 3. Partial Assignment: Beneficiaries have the option to assign only a portion or percentage of their assigned income, rather than the entirety. This flexibility provides them with the ability to retain some income while directing the remaining portion elsewhere. 4. Revocable Assignment: Beneficiaries can choose to make a revocable assignment, meaning they have the power to revoke or cancel the assignment at any time. This allows them to modify their decision if their circumstances change or if they wish to transfer the income to a different recipient. 5. Irrevocable Assignment: On the other hand, beneficiaries may opt for an irrevocable assignment, which cannot be changed or revoked once it is made. This type of assignment provides stability and guarantees that the assigned income will be received by the designated recipient. In conclusion, a Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust empowers beneficiaries in Wayne, Michigan, to transfer or allocate their assigned share of income from a trust to another party. Whether it is an inter vivos or testamentary assignment, partial or complete, revocable or irrevocable, this arrangement offers beneficiaries control and flexibility in managing their financial resources to support their chosen recipients or organizations.Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust Explained In Wayne, Michigan, when beneficiaries are entitled to a portion of the income generated by a trust, they may choose to assign or transfer their assigned percentage to another party. This process is known as a Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust. This assignment allows beneficiaries to distribute or redirect their share of the trust's income, providing them with flexibility and control over their financial resources. It essentially enables beneficiaries to designate someone else to receive their specific portion of income from the trust. Different Types of Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust: 1. Inter Vivos Assignment: This refers to an assignment that takes place during the lifetime of the beneficiary. It allows individuals to transfer their assigned percentage of income to another individual or a charitable organization while they are still alive. 2. Testamentary Assignment: This type of assignment occurs after the death of the beneficiary. It involves the beneficiary designating in their will that their assigned percentage of income should be transferred to another individual or entity. This ensures that the income from the trust continues to benefit the designated recipient even after the beneficiary's demise. 3. Partial Assignment: Beneficiaries have the option to assign only a portion or percentage of their assigned income, rather than the entirety. This flexibility provides them with the ability to retain some income while directing the remaining portion elsewhere. 4. Revocable Assignment: Beneficiaries can choose to make a revocable assignment, meaning they have the power to revoke or cancel the assignment at any time. This allows them to modify their decision if their circumstances change or if they wish to transfer the income to a different recipient. 5. Irrevocable Assignment: On the other hand, beneficiaries may opt for an irrevocable assignment, which cannot be changed or revoked once it is made. This type of assignment provides stability and guarantees that the assigned income will be received by the designated recipient. In conclusion, a Wayne Michigan Assignment by Beneficiary of a Percentage of the Income of a Trust empowers beneficiaries in Wayne, Michigan, to transfer or allocate their assigned share of income from a trust to another party. Whether it is an inter vivos or testamentary assignment, partial or complete, revocable or irrevocable, this arrangement offers beneficiaries control and flexibility in managing their financial resources to support their chosen recipients or organizations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.