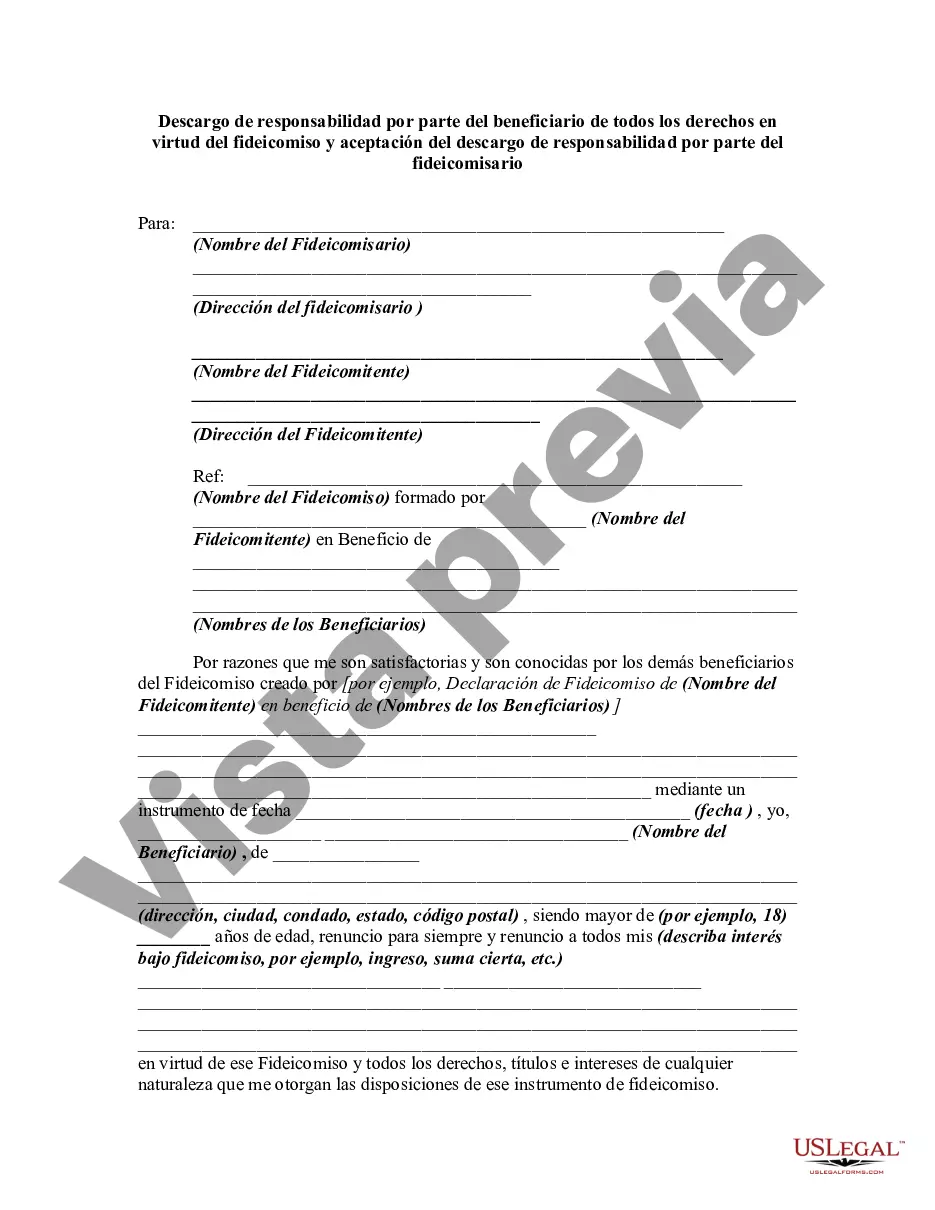

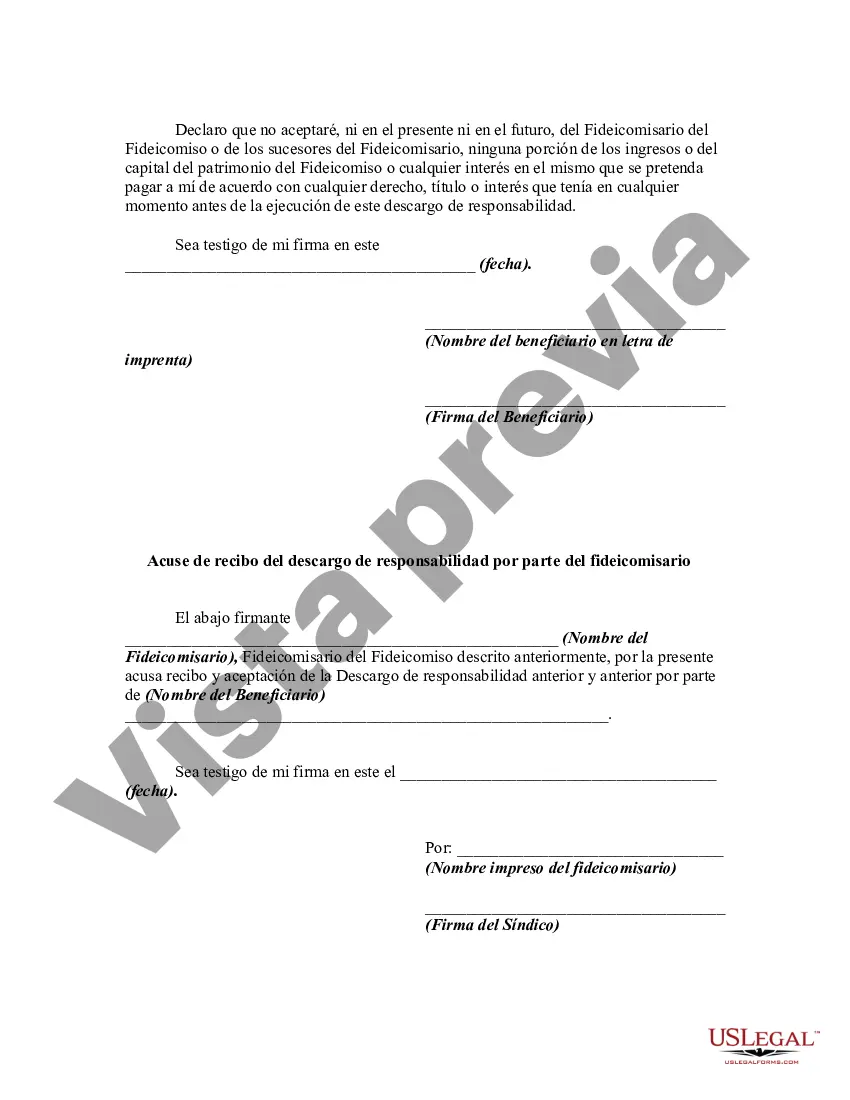

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Hennepin County, Minnesota is one of the most populous counties in the state. Located in the central part of Minnesota, Hennepin County is home to the bustling city of Minneapolis, known for its vibrant culture, thriving arts scene, and beautiful natural surroundings. Within the realm of trusts and estate planning, Hennepin County residents may come across a legal instrument known as the "Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee." This disclaimer refers to a legal document that allows a beneficiary of a trust to renounce or disclaim their rights or interests in the trust assets, thereby allowing those assets to pass to another beneficiary or as directed by the terms of the trust. The Disclaimer by Beneficiary of all Rights under Trust serves as a formal mechanism for beneficiaries who believe that the assets they would receive under the trust may not be in their best interest, or they may have other reasons for not accepting their share. It allows them to formally relinquish their rights, ensuring that the assets are distributed according to the trust's provisions. By accepting the disclaimer, the trustee, who is responsible for managing and distributing the trust assets, acknowledges the beneficiary's decision and assumes the duty to distribute the disclaimed assets according to the terms of the trust. Different types or scenarios where the Disclaimer by Beneficiary of all Rights under Trust may be utilized include: 1. Refusal or disclaimer of an inheritance: In situations where a beneficiary believes that accepting their share of the trust assets may have adverse financial or tax consequences, they can disclaim their inheritance and allow it to pass to an alternate beneficiary or as directed by the trust. 2. Strategic estate planning: Beneficiaries may choose to disclaim their rights under a trust as part of a larger estate planning strategy. This can be done to take advantage of tax planning opportunities or to redirect assets to other family members or charitable organizations. 3. Contingent beneficiaries: In some cases, beneficiaries may not be willing or able to accept their share of the trust assets. By disclaiming their rights, these beneficiaries allow the assets to pass directly to the contingent beneficiaries named in the trust. It is important to note that the exact process and requirements for a Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee may vary depending on the specific laws and regulations of Hennepin County, Minnesota. To ensure compliance and a smooth administration of a trust, it is advisable to seek guidance from a qualified estate planning attorney who can provide precise instructions and recommendations tailored to individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.