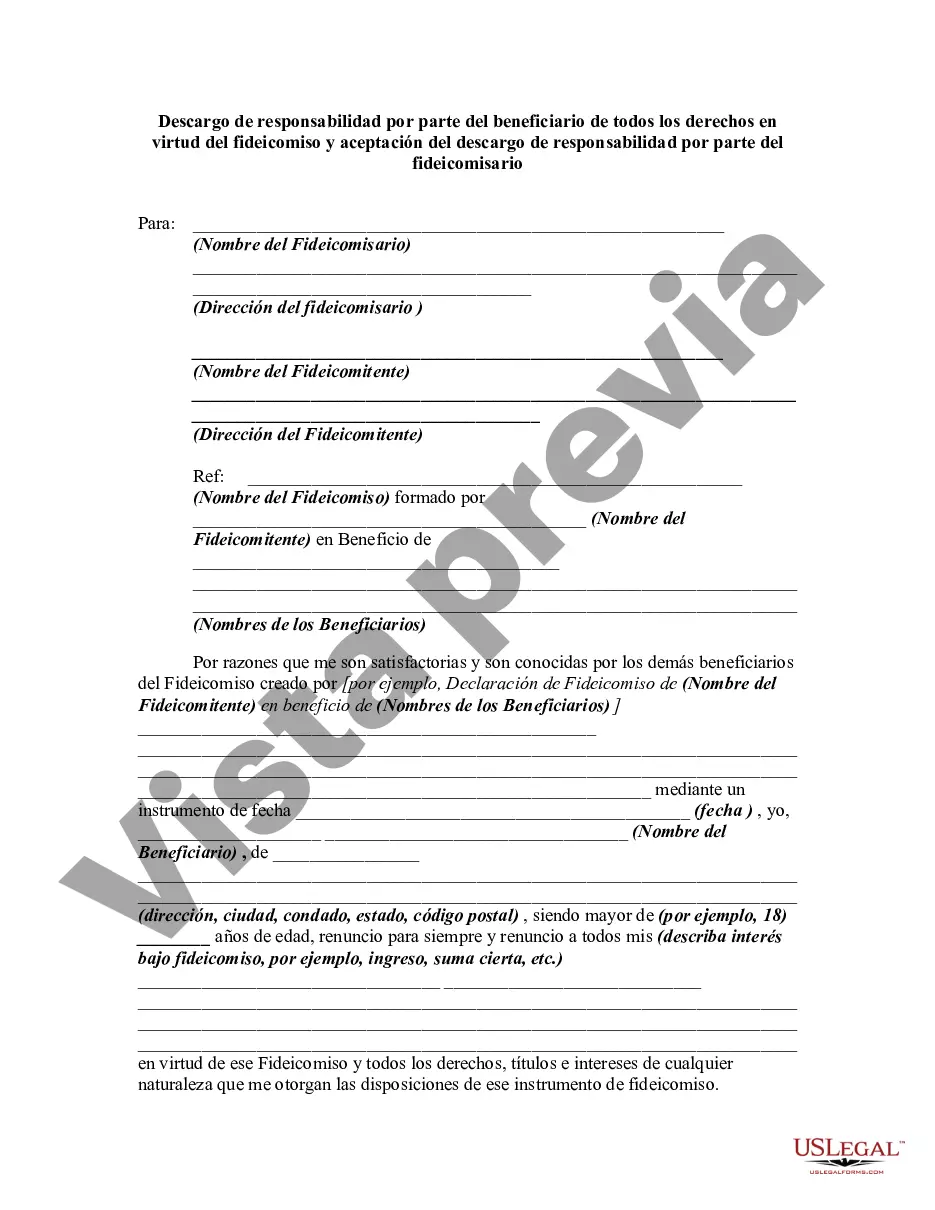

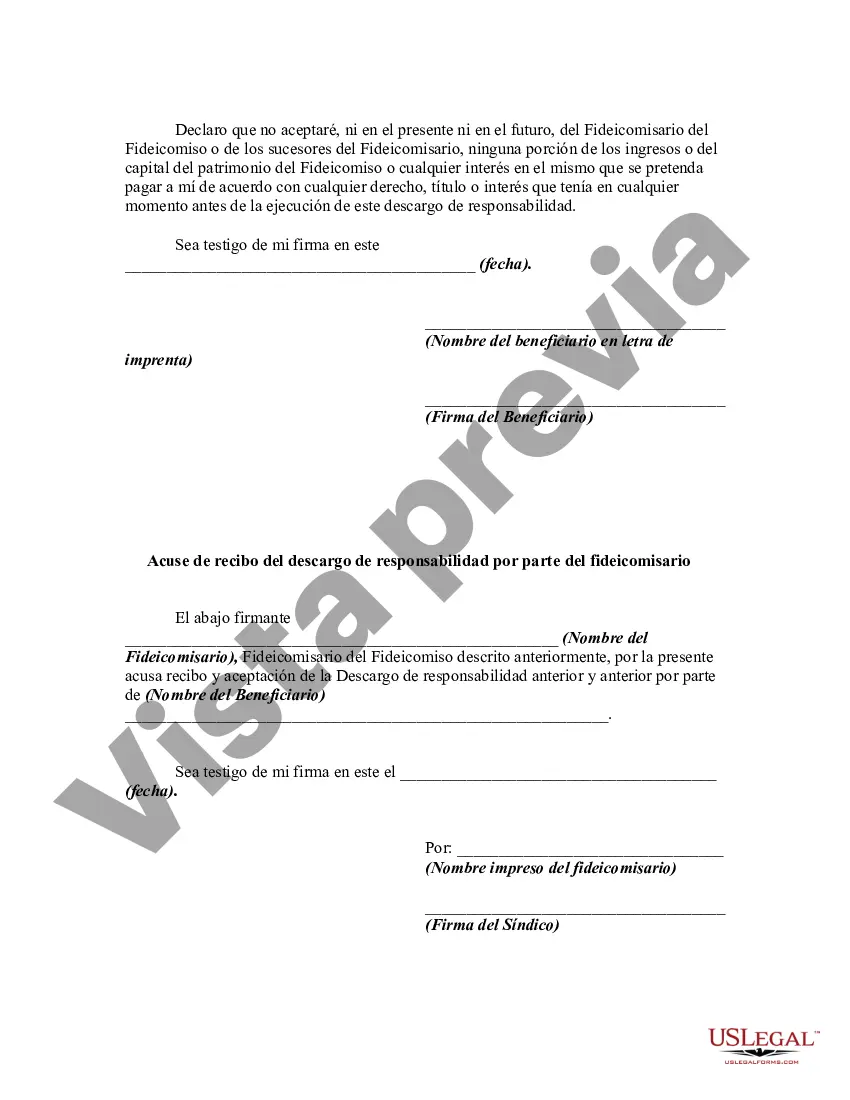

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: A Comprehensive Guide In the realm of estate planning and trusts, the Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee plays a crucial role. This legal provision allows beneficiaries to renounce their entitlement to assets or rights bestowed upon them through a trust, and the trustee to acknowledge and accept this disclaimer. This article aims to provide a detailed description of what this disclaimer entails, its significance, and its various types. A disclaimer serves as a legally binding statement made by a beneficiary, declaring their intention to refuse an inheritance or any benefits conferred by a trust established for their benefit. In Nassau New York, this disclaimer must adhere to specific legal requirements and be executed within a designated timeframe to be considered valid. The purpose of the disclaimer is to allow beneficiaries to redirect assets that they may not need or desire, thereby optimizing the estate plan or trust structure to align better with their personal circumstances, financial goals, or tax planning strategies. By disclaiming their rights or interests, beneficiaries can, in essence, redirect the assets to alternate beneficiaries or entities named in the trust document. When a beneficiary voluntarily relinquishes their rights through a disclaimer, the trustee must play a crucial role. The trustee has the responsibility to accept the disclaimer and ensure compliance with the legal requirements, such as the time limit to file the disclaimer with the appropriate authorities, and ensure proper documentation is in place. Various types of Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee exist to cater to unique scenarios and legal considerations. These may include: 1. Unqualified Disclaimer: This is the most common form of disclaimer, whereby the beneficiary completely renounces their right and interest in the trust assets, leaving them to be distributed as if the beneficiary had predeceased the granter (person establishing the trust). The trustee would then distribute the assets to the next eligible beneficiary. 2. Partial Disclaimer: In some cases, a beneficiary may not wish to disclaim their entire entitlement but only a portion of it. This partial disclaimer can be useful for beneficiaries who want to direct specific assets to a different beneficiary or to divide the assets between multiple beneficiaries. 3. Disclaiming Specific Powers: Occasionally, beneficiaries may wish to relinquish certain powers granted to them under the trust, such as the power to appoint a successor trustee or the authority to make investment decisions. This type of disclaimer allows beneficiaries to surrender specific responsibilities while retaining other rights and interests. It is important to note that the above terminology may vary based on specific legal interpretations or jurisdictions. Therefore, consulting an experienced attorney or estate planning professional who is knowledgeable about Nassau New York laws is highly recommended ensuring compliance and maximize the benefits of utilizing a disclaimer. In conclusion, the Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides a powerful tool for beneficiaries to customize their estate plans and trusts, aligning them with their personal objectives. By thoroughly understanding the different types of disclaimers and working closely with a legal professional, beneficiaries can make informed decisions that safeguard their financial well-being while preserving the intentions of the trust or.Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: A Comprehensive Guide In the realm of estate planning and trusts, the Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee plays a crucial role. This legal provision allows beneficiaries to renounce their entitlement to assets or rights bestowed upon them through a trust, and the trustee to acknowledge and accept this disclaimer. This article aims to provide a detailed description of what this disclaimer entails, its significance, and its various types. A disclaimer serves as a legally binding statement made by a beneficiary, declaring their intention to refuse an inheritance or any benefits conferred by a trust established for their benefit. In Nassau New York, this disclaimer must adhere to specific legal requirements and be executed within a designated timeframe to be considered valid. The purpose of the disclaimer is to allow beneficiaries to redirect assets that they may not need or desire, thereby optimizing the estate plan or trust structure to align better with their personal circumstances, financial goals, or tax planning strategies. By disclaiming their rights or interests, beneficiaries can, in essence, redirect the assets to alternate beneficiaries or entities named in the trust document. When a beneficiary voluntarily relinquishes their rights through a disclaimer, the trustee must play a crucial role. The trustee has the responsibility to accept the disclaimer and ensure compliance with the legal requirements, such as the time limit to file the disclaimer with the appropriate authorities, and ensure proper documentation is in place. Various types of Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee exist to cater to unique scenarios and legal considerations. These may include: 1. Unqualified Disclaimer: This is the most common form of disclaimer, whereby the beneficiary completely renounces their right and interest in the trust assets, leaving them to be distributed as if the beneficiary had predeceased the granter (person establishing the trust). The trustee would then distribute the assets to the next eligible beneficiary. 2. Partial Disclaimer: In some cases, a beneficiary may not wish to disclaim their entire entitlement but only a portion of it. This partial disclaimer can be useful for beneficiaries who want to direct specific assets to a different beneficiary or to divide the assets between multiple beneficiaries. 3. Disclaiming Specific Powers: Occasionally, beneficiaries may wish to relinquish certain powers granted to them under the trust, such as the power to appoint a successor trustee or the authority to make investment decisions. This type of disclaimer allows beneficiaries to surrender specific responsibilities while retaining other rights and interests. It is important to note that the above terminology may vary based on specific legal interpretations or jurisdictions. Therefore, consulting an experienced attorney or estate planning professional who is knowledgeable about Nassau New York laws is highly recommended ensuring compliance and maximize the benefits of utilizing a disclaimer. In conclusion, the Nassau New York Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides a powerful tool for beneficiaries to customize their estate plans and trusts, aligning them with their personal objectives. By thoroughly understanding the different types of disclaimers and working closely with a legal professional, beneficiaries can make informed decisions that safeguard their financial well-being while preserving the intentions of the trust or.

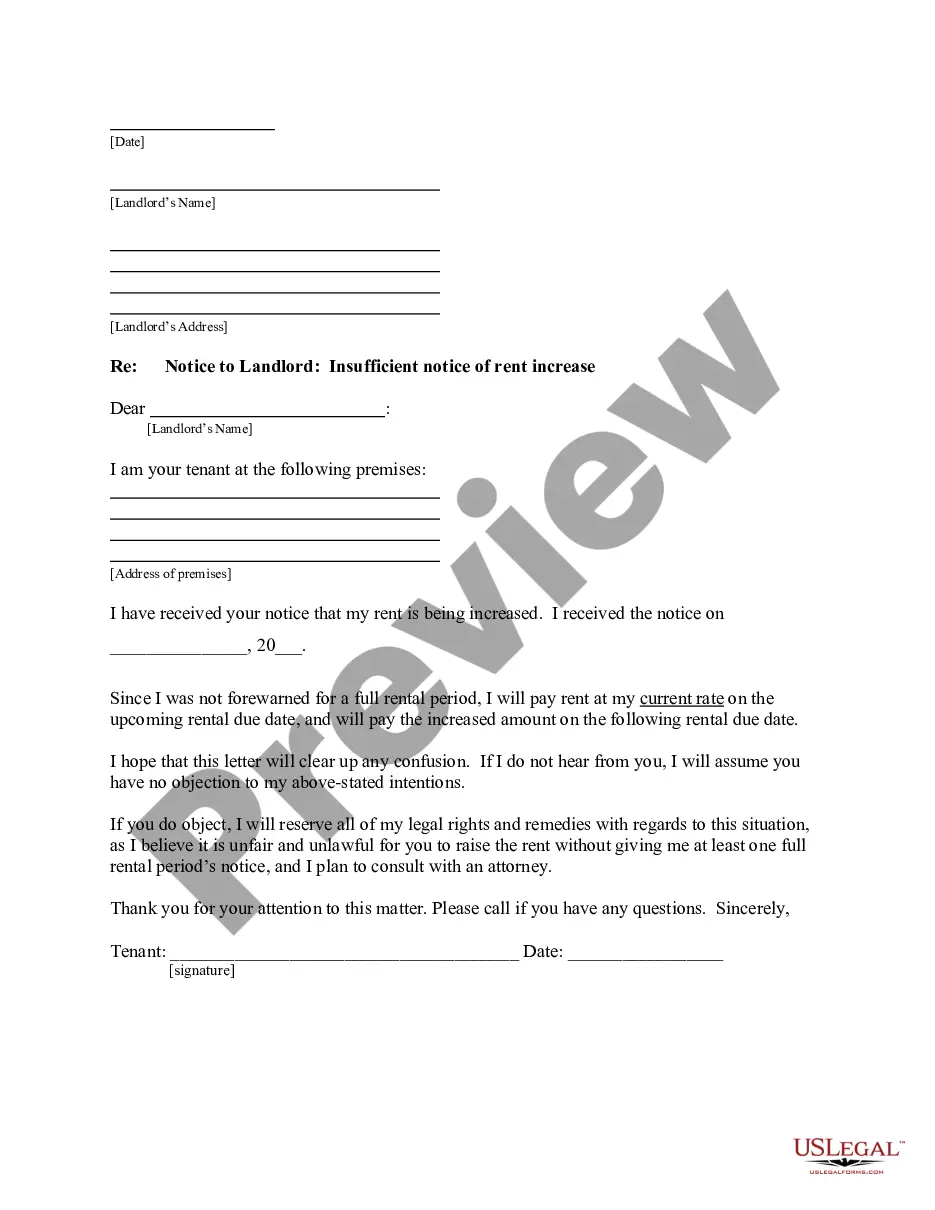

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.