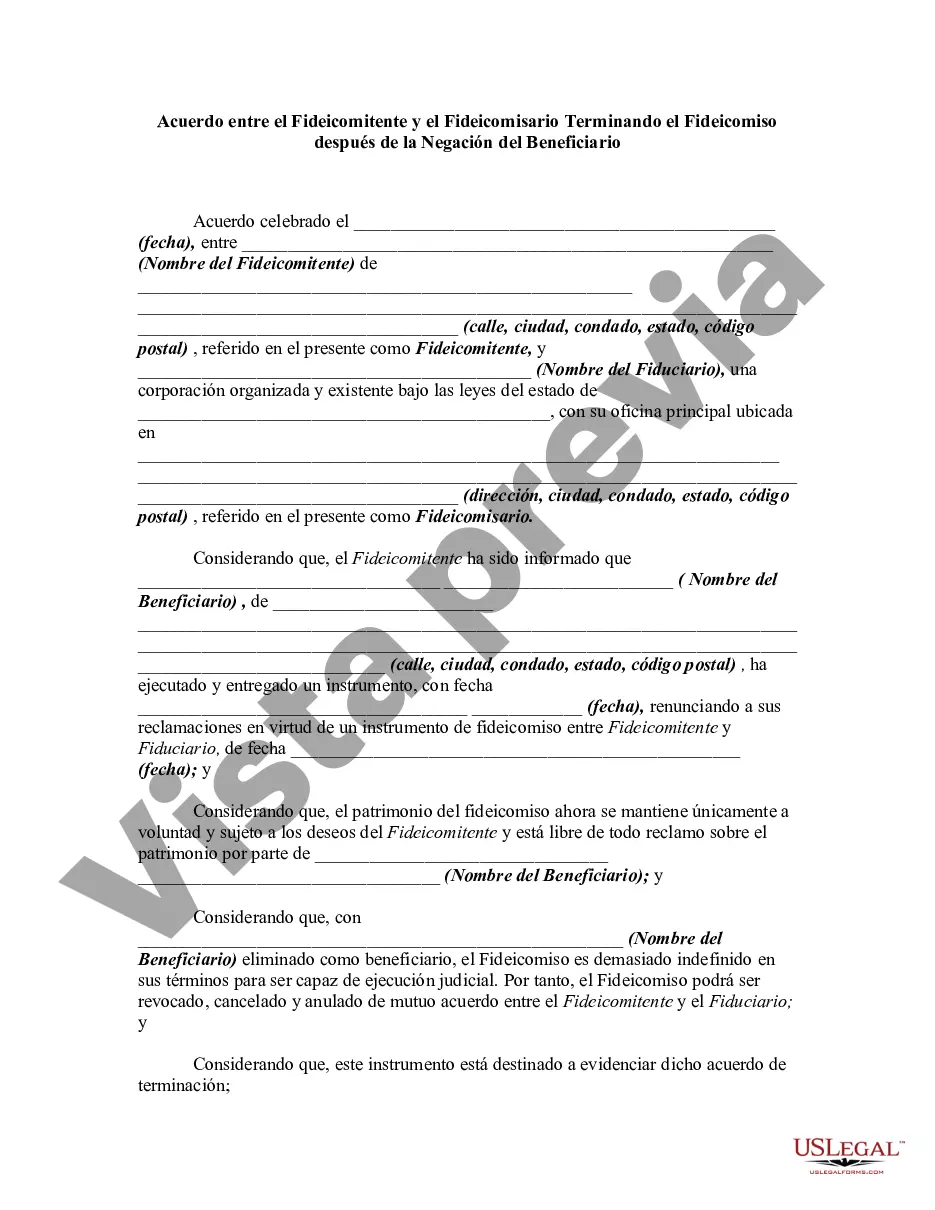

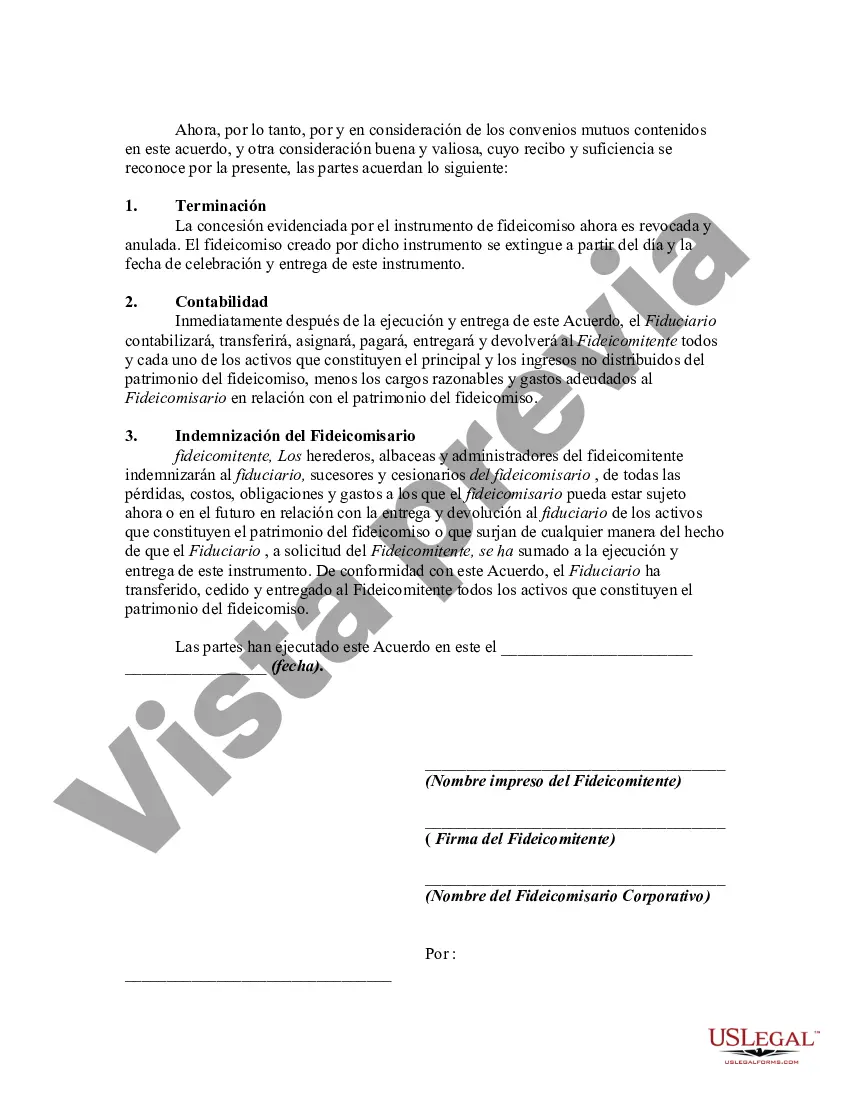

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

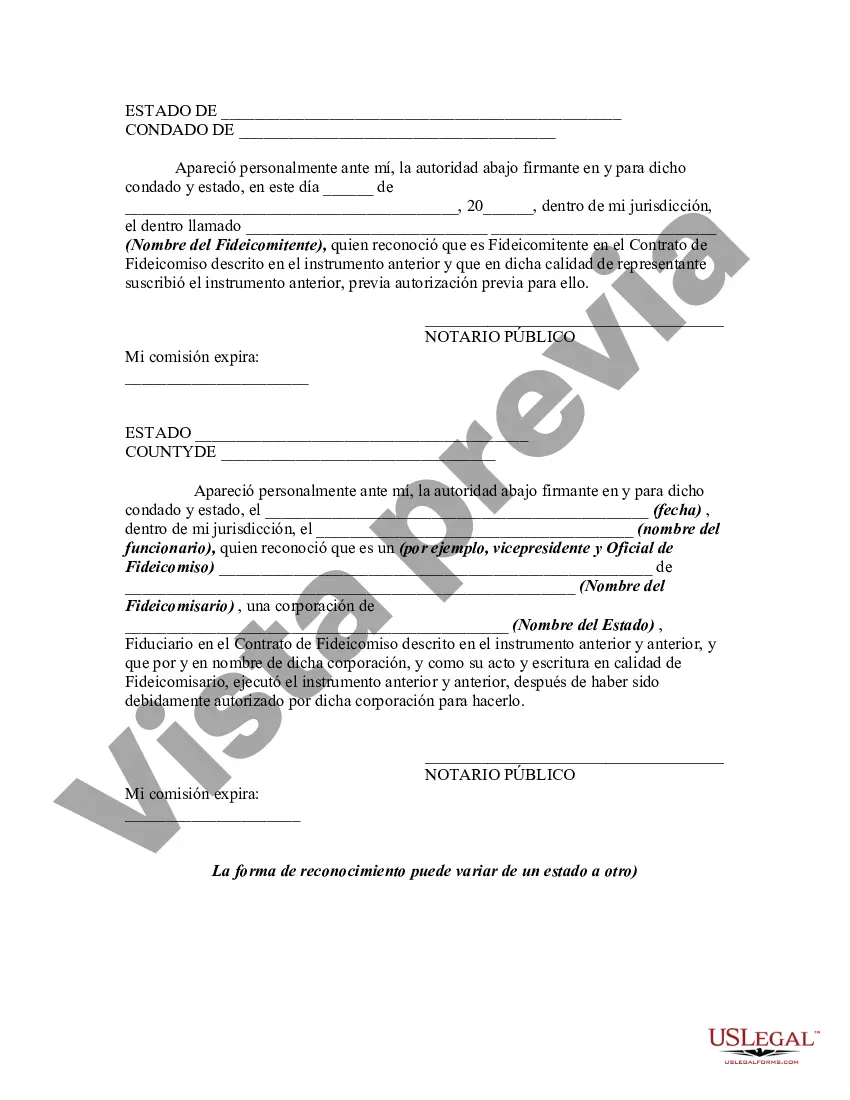

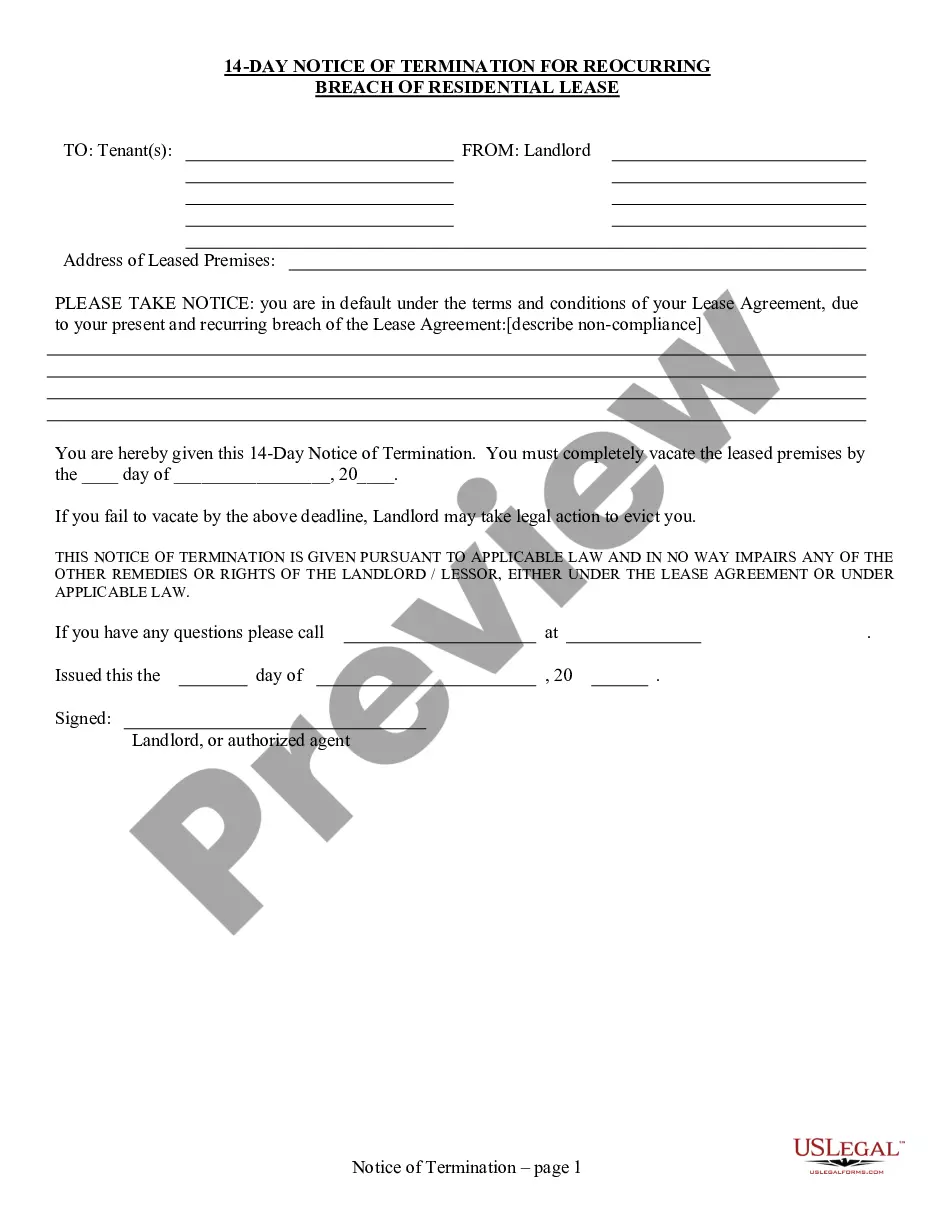

A Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary is a legal document that outlines the termination process of a trust following the beneficiary's disclaimer of their interest in the trust. This agreement serves as an essential tool to formalize the termination and distribution of the trust assets. Within the context of estate planning, trusts are often created to protect and manage assets for designated beneficiaries. However, there may be instances where a beneficiary wishes to waive or disclaim their rights to the assets held within the trust. In such cases, this agreement between the trust or (the creator of the trust) and the trustee (the party responsible for managing the trust) becomes crucial. The Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary must include essential components to ensure a legally binding and well-documented process. These components may include: 1. Identification of Parties: The agreement should clearly identify the trust or, trustee, and beneficiary involved in the termination process. Legal names, addresses, and contact information should be provided. 2. Disclaimer by Beneficiary: The beneficiary's disclaimer should be clearly stated and acknowledged by both parties. It is important to indicate the specific assets or interest being disclaimed. 3. Termination Procedures: The procedures for terminating the trust must be detailed, including any requirements set forth by Illinois state law. This may involve obtaining necessary court approvals or filing relevant documents with the appropriate authorities. 4. Asset Distribution: The agreement should outline how the assets held within the trust will be distributed following its termination. Instructions may be provided by the trust or, or the trustee may be granted discretionary powers to make distribution decisions. 5. Legal Compliance: To ensure compliance with applicable laws and regulations, the agreement should reference the relevant Illinois statutes governing trust terminations, such as the Illinois Trust Code. Types of Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary may include: 1. Revocable Living Trust Termination Agreement: This agreement is used when a beneficiary disclaims their rights to assets held within a revocable living trust, resulting in its termination. 2. Irrevocable Trust Termination Agreement: In cases where an irrevocable trust is established, this agreement outlines the termination process after a beneficiary's disclaimer, adhering to specific rules and regulations governing such trusts. 3. Testamentary Trust Termination Agreement: A testamentary trust is created through a will, and this agreement becomes relevant if a beneficiary wishes to disclaim their interest, leading to the termination of the trust. In conclusion, a Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary is an important legal document that ensures the smooth, lawful termination of a trust following the disclaimer of a beneficiary's interest. It has various types depending on the nature of the trust involved. Seeking professional legal advice is always advisable when engaging in trust termination and drafting the associated agreement.A Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary is a legal document that outlines the termination process of a trust following the beneficiary's disclaimer of their interest in the trust. This agreement serves as an essential tool to formalize the termination and distribution of the trust assets. Within the context of estate planning, trusts are often created to protect and manage assets for designated beneficiaries. However, there may be instances where a beneficiary wishes to waive or disclaim their rights to the assets held within the trust. In such cases, this agreement between the trust or (the creator of the trust) and the trustee (the party responsible for managing the trust) becomes crucial. The Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary must include essential components to ensure a legally binding and well-documented process. These components may include: 1. Identification of Parties: The agreement should clearly identify the trust or, trustee, and beneficiary involved in the termination process. Legal names, addresses, and contact information should be provided. 2. Disclaimer by Beneficiary: The beneficiary's disclaimer should be clearly stated and acknowledged by both parties. It is important to indicate the specific assets or interest being disclaimed. 3. Termination Procedures: The procedures for terminating the trust must be detailed, including any requirements set forth by Illinois state law. This may involve obtaining necessary court approvals or filing relevant documents with the appropriate authorities. 4. Asset Distribution: The agreement should outline how the assets held within the trust will be distributed following its termination. Instructions may be provided by the trust or, or the trustee may be granted discretionary powers to make distribution decisions. 5. Legal Compliance: To ensure compliance with applicable laws and regulations, the agreement should reference the relevant Illinois statutes governing trust terminations, such as the Illinois Trust Code. Types of Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary may include: 1. Revocable Living Trust Termination Agreement: This agreement is used when a beneficiary disclaims their rights to assets held within a revocable living trust, resulting in its termination. 2. Irrevocable Trust Termination Agreement: In cases where an irrevocable trust is established, this agreement outlines the termination process after a beneficiary's disclaimer, adhering to specific rules and regulations governing such trusts. 3. Testamentary Trust Termination Agreement: A testamentary trust is created through a will, and this agreement becomes relevant if a beneficiary wishes to disclaim their interest, leading to the termination of the trust. In conclusion, a Chicago Illinois Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary is an important legal document that ensures the smooth, lawful termination of a trust following the disclaimer of a beneficiary's interest. It has various types depending on the nature of the trust involved. Seeking professional legal advice is always advisable when engaging in trust termination and drafting the associated agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.