A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

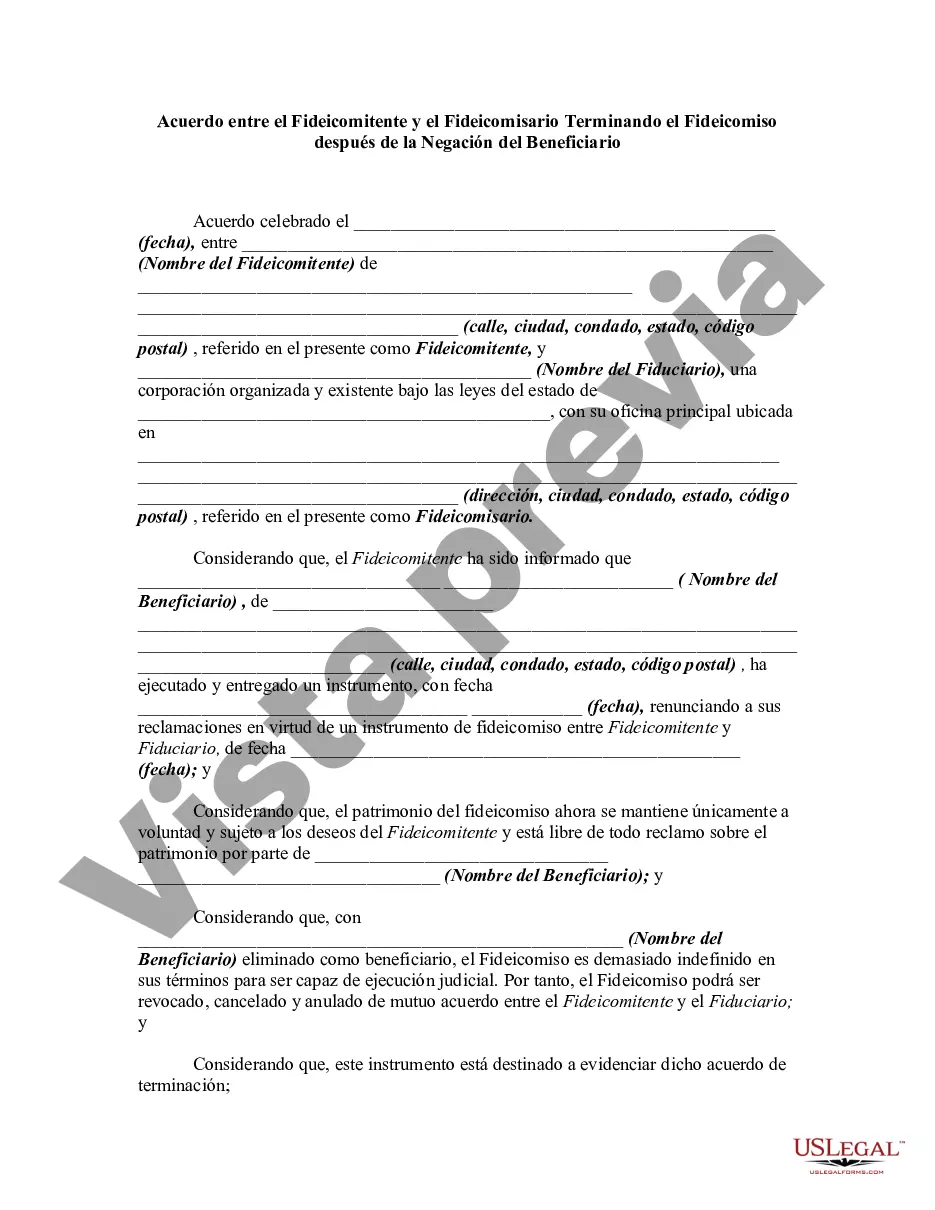

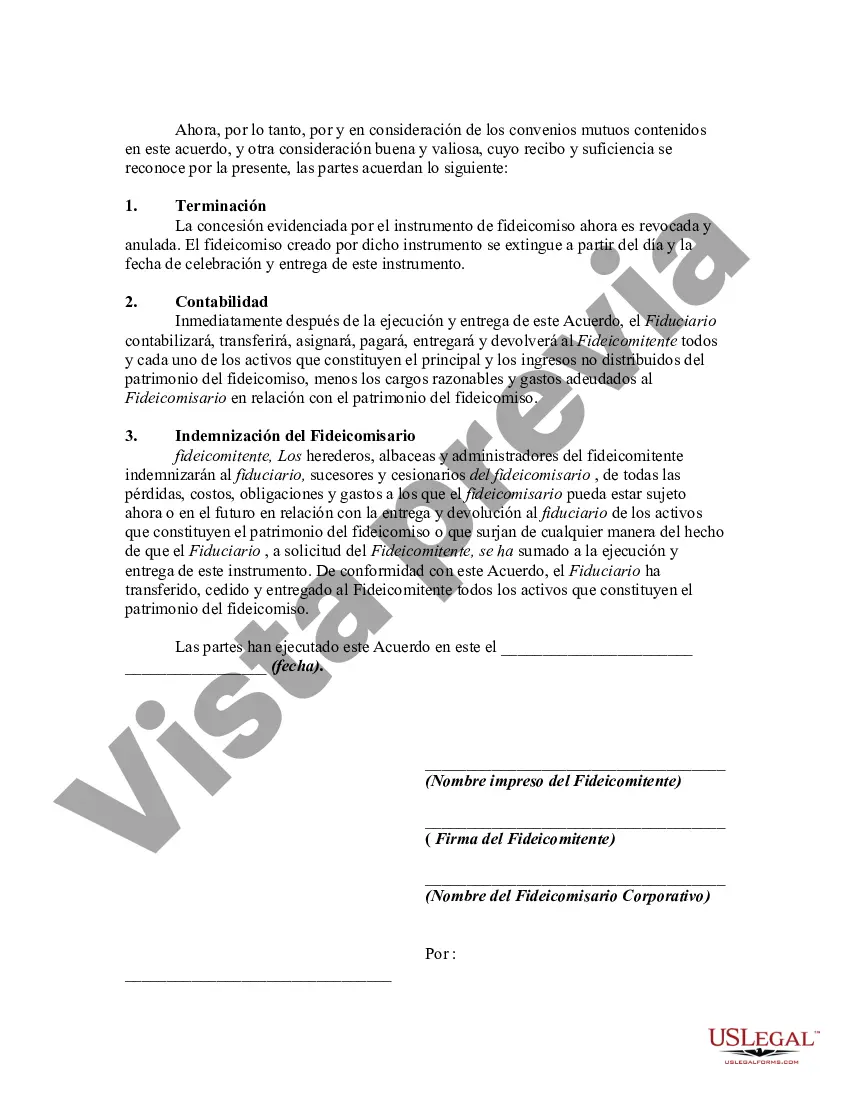

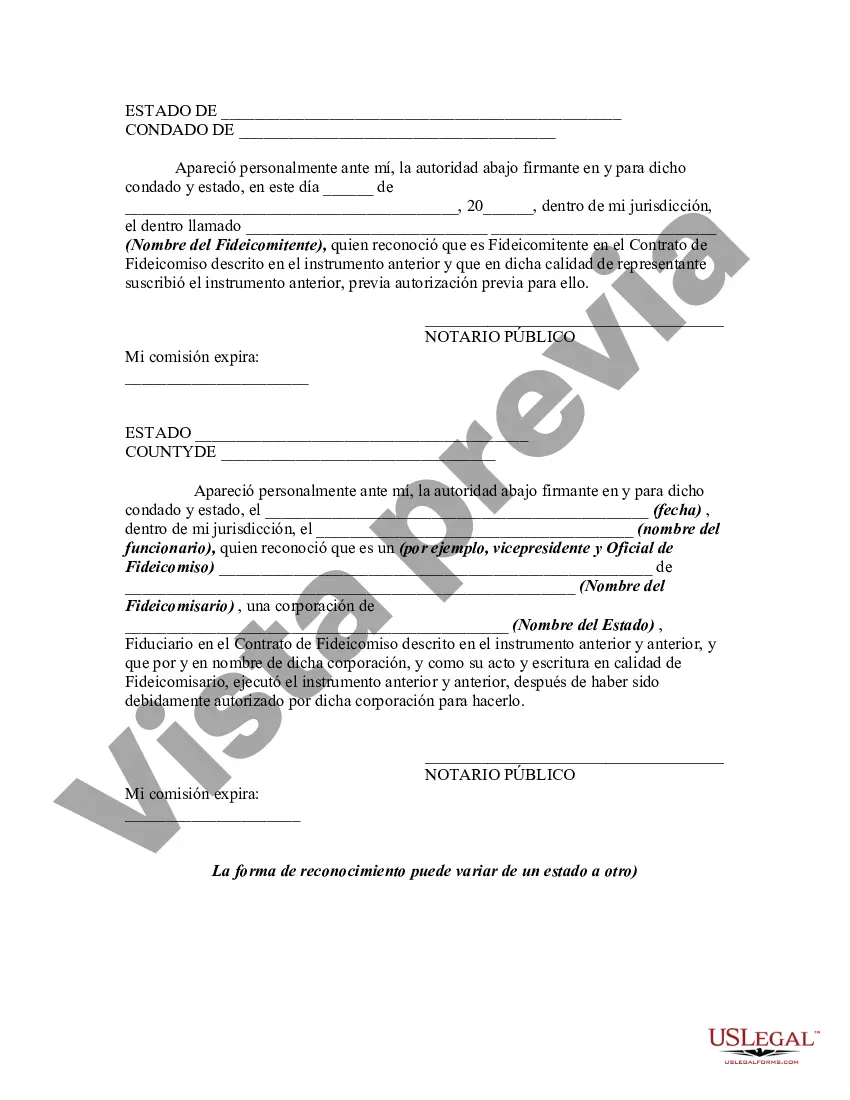

The King's New York Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary is a legal document that outlines the process and conditions for terminating a trust after a beneficiary has renounced or disclaimed their interest in the trust. This agreement ensures a smooth transition of assets and responsibilities between the trust or (creator of the trust) and the trustee (individual or entity responsible for managing the trust). One type of the King's New York Agreement is the Mutual Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary. This type of agreement occurs when both the trust or and the trustee mutually agree to terminate the trust following a beneficiary's disclaimer. This agreement could be used when all parties involved are in agreement and wish to terminate the trust without any conflicts or disputes. Another type is the Court-Ordered Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary. This agreement is initiated when a beneficiary disclaims their interest in the trust, but there are disputes or conflicts among the trust or, trustee, or other beneficiaries regarding the termination process. In such cases, the court intervenes to resolve any disagreements and issue an order to terminate the trust. The King's New York Agreement includes various provisions and clauses to ensure a smooth termination process. It typically includes details such as the effective date of the termination, the method of distributing the trust assets, the release of the trustee from any further responsibilities, and the transfer of any remaining assets to a designated party or parties. Key terms commonly used in this agreement include "disclaimer," which refers to the beneficiary's formal renouncement of their right to receive assets from the trust; "trust or," who is the individual or entity that establishes the trust; "trustee," who is appointed to manage and administer the trust assets; and "termination," which signifies the end of the trust and the distribution of assets to the appropriate beneficiaries or parties. In summary, the King's New York Agreement between Trust or and Trustee Terminating Trust after Disclaimer by Beneficiary is a crucial legal document used to facilitate the termination of a trust. It ensures a clear and concise process for distributing trust assets after a beneficiary's disclaimer, promoting transparency and minimizing conflicts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.