Under the Uniform Commercial Code (UCC) Sec. 2-207(1), A definite expression of acceptance or a written confirmation of an informal agreement may constitute a valid acceptance even if it states terms additional to or different from the offer or informal agreement. The additional or different terms are treated as proposals for addition into the contract under UCC Sec. 2-207(2). Between merchants, such terms become part of the contract unless: a)the offer expressly limits acceptance to the terms of the offer, b)material alteration of the contract results, c)notification of objection to the additional/different terms are given in a reasonable time after notice of them is received.

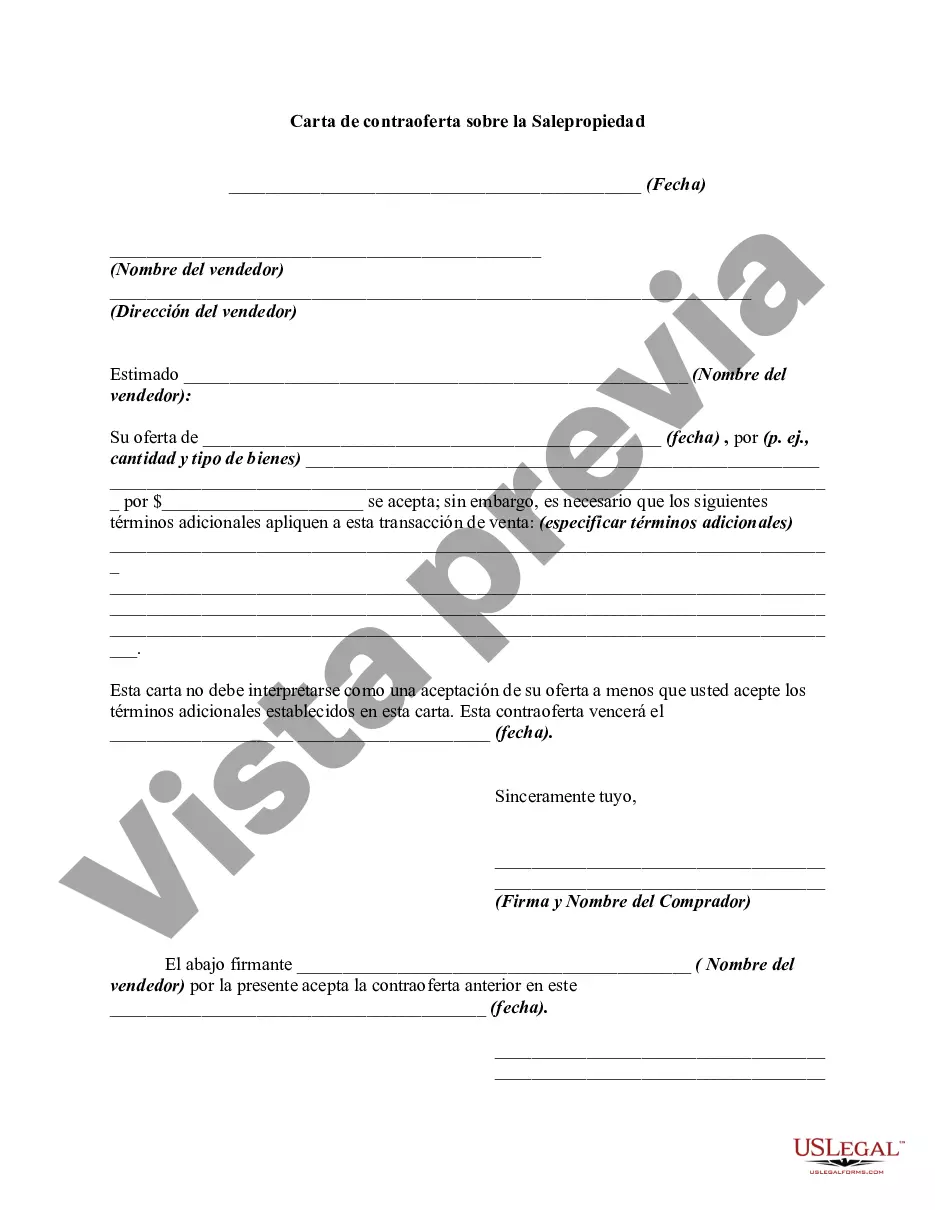

A Nassau New York Counter Offer Letter Regarding Sale of Property is a legal document used in the real estate sector to negotiate the terms and conditions of a property sale between a buyer and a seller in Nassau County, New York. It serves as a response to the original offer made by the buyer, outlining the seller's proposed changes and adjustments to the terms outlined in the initial offer. The Nassau New York Counter Offer Letter Regarding Sale of Property typically includes several crucial details such as the names and contact information of both parties involved, the property address, the date of the original offer, and the proposed changes to the terms of the sale. It outlines the seller's desired adjustments regarding purchase price, down payment, financing terms, closing costs, contingencies, and any other specific conditions that the seller wishes to address. There are various types of Nassau New York Counter Offer Letters Regarding Sale of Property that can be used depending on the specific circumstances. These may include: 1. Price Adjustment Counter Offer: In this type of counter offer, the seller suggests a different purchase price for the property. This may be higher or lower than the original offer, reflecting the seller's assessment of the property's value and market conditions. 2. Financing Terms Counter Offer: Sellers may propose changes to the financing terms mentioned in the initial offer, such as the amount of down payment or the interest rate. This allows the seller to tailor the terms to their financial needs and goals. 3. Contingency Modifications Counter Offer: Contingencies are conditions that must be met for the sale to proceed, such as a satisfactory home inspection or the sale of the buyer's current property. The seller can propose modifications or removal of certain contingencies based on their preferences or market conditions. 4. Closing Costs Counter Offer: This type of counter offer relates to the allocation of closing costs between the buyer and the seller. The seller may propose adjustments to the division of expenses, such as requiring the buyer to cover a larger portion of the closing costs. 5. Timeframe Modifications Counter Offer: This counter offer focuses on changing the dates mentioned in the initial offer, such as the closing date or the time period for inspections or loan approval. The seller may request extensions or adjustments based on their circumstances or requirements. When drafting a Nassau New York Counter Offer Letter Regarding Sale of Property, it is crucial to consult with a real estate attorney or agent to ensure compliance with local laws and regulations. The content should be clear, concise, and professional, outlining the seller's proposed changes respectfully. The letter also gives the buyer an opportunity to accept, reject, or negotiate further, leading to a potential agreement between the parties involved.A Nassau New York Counter Offer Letter Regarding Sale of Property is a legal document used in the real estate sector to negotiate the terms and conditions of a property sale between a buyer and a seller in Nassau County, New York. It serves as a response to the original offer made by the buyer, outlining the seller's proposed changes and adjustments to the terms outlined in the initial offer. The Nassau New York Counter Offer Letter Regarding Sale of Property typically includes several crucial details such as the names and contact information of both parties involved, the property address, the date of the original offer, and the proposed changes to the terms of the sale. It outlines the seller's desired adjustments regarding purchase price, down payment, financing terms, closing costs, contingencies, and any other specific conditions that the seller wishes to address. There are various types of Nassau New York Counter Offer Letters Regarding Sale of Property that can be used depending on the specific circumstances. These may include: 1. Price Adjustment Counter Offer: In this type of counter offer, the seller suggests a different purchase price for the property. This may be higher or lower than the original offer, reflecting the seller's assessment of the property's value and market conditions. 2. Financing Terms Counter Offer: Sellers may propose changes to the financing terms mentioned in the initial offer, such as the amount of down payment or the interest rate. This allows the seller to tailor the terms to their financial needs and goals. 3. Contingency Modifications Counter Offer: Contingencies are conditions that must be met for the sale to proceed, such as a satisfactory home inspection or the sale of the buyer's current property. The seller can propose modifications or removal of certain contingencies based on their preferences or market conditions. 4. Closing Costs Counter Offer: This type of counter offer relates to the allocation of closing costs between the buyer and the seller. The seller may propose adjustments to the division of expenses, such as requiring the buyer to cover a larger portion of the closing costs. 5. Timeframe Modifications Counter Offer: This counter offer focuses on changing the dates mentioned in the initial offer, such as the closing date or the time period for inspections or loan approval. The seller may request extensions or adjustments based on their circumstances or requirements. When drafting a Nassau New York Counter Offer Letter Regarding Sale of Property, it is crucial to consult with a real estate attorney or agent to ensure compliance with local laws and regulations. The content should be clear, concise, and professional, outlining the seller's proposed changes respectfully. The letter also gives the buyer an opportunity to accept, reject, or negotiate further, leading to a potential agreement between the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.