An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Allegheny Pennsylvania Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian In Allegheny, Pennsylvania, the demand for accounting from a fiduciary such as an executor, conservator, trustee, or legal guardian is of significant importance. The demand for accounting ensures transparency, accountability, and the protection of interests of beneficiaries or wards. Fiduciaries are entrusted with managing financial affairs and making decisions on behalf of others, and demanding accounting helps to prevent mismanagement or potential misconduct. Types of Allegheny Pennsylvania Demand for Accounting: 1. Executor's Demand for Accounting: An executor is responsible for administering the estate of a deceased person according to the terms of their will. Beneficiaries or interested parties can file a demand for accounting to ensure adequate management and distribution of assets by the executor. 2. Conservator's Demand for Accounting: A conservator is appointed to handle the financial affairs of an incapacitated individual, known as the ward. If there are concerns about the conservator's handling of the ward's assets, a demand for accounting can be made to assess the financial transactions and ensure the ward's interests are protected. 3. Trustee's Demand for Accounting: A trustee is responsible for managing a trust and its assets for the benefit of beneficiaries. Beneficiaries have the right to demand accounting to verify the trustee's actions, review financial records, and ensure that the trust is being managed in their best interests. 4. Legal Guardian's Demand for Accounting: A legal guardian is appointed by the court to make decisions for an incapacitated individual, often referred to as the ward. The guardian is entrusted with managing the ward's affairs, and a demand for accounting can be made to ensure transparency and proper handling of financial matters. The demand for accounting generally involves a formal request submitted to the relevant court. It may include an analysis of financial records, documentation of income and expenses, assets and liabilities, as well as explanations for any transactions conducted by the fiduciary. This process allows beneficiaries, wards, or interested parties to evaluate the fiduciary's actions and detect any potential impropriety or mismanagement promptly. In Allegheny, Pennsylvania, the demand for accounting from a fiduciary plays a crucial role in promoting the fair administration of estates, trusts, and guardianship. It ensures that beneficiaries or wards are protected and that the fiduciaries uphold their duties in accordance with the law.Allegheny Pennsylvania Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian In Allegheny, Pennsylvania, the demand for accounting from a fiduciary such as an executor, conservator, trustee, or legal guardian is of significant importance. The demand for accounting ensures transparency, accountability, and the protection of interests of beneficiaries or wards. Fiduciaries are entrusted with managing financial affairs and making decisions on behalf of others, and demanding accounting helps to prevent mismanagement or potential misconduct. Types of Allegheny Pennsylvania Demand for Accounting: 1. Executor's Demand for Accounting: An executor is responsible for administering the estate of a deceased person according to the terms of their will. Beneficiaries or interested parties can file a demand for accounting to ensure adequate management and distribution of assets by the executor. 2. Conservator's Demand for Accounting: A conservator is appointed to handle the financial affairs of an incapacitated individual, known as the ward. If there are concerns about the conservator's handling of the ward's assets, a demand for accounting can be made to assess the financial transactions and ensure the ward's interests are protected. 3. Trustee's Demand for Accounting: A trustee is responsible for managing a trust and its assets for the benefit of beneficiaries. Beneficiaries have the right to demand accounting to verify the trustee's actions, review financial records, and ensure that the trust is being managed in their best interests. 4. Legal Guardian's Demand for Accounting: A legal guardian is appointed by the court to make decisions for an incapacitated individual, often referred to as the ward. The guardian is entrusted with managing the ward's affairs, and a demand for accounting can be made to ensure transparency and proper handling of financial matters. The demand for accounting generally involves a formal request submitted to the relevant court. It may include an analysis of financial records, documentation of income and expenses, assets and liabilities, as well as explanations for any transactions conducted by the fiduciary. This process allows beneficiaries, wards, or interested parties to evaluate the fiduciary's actions and detect any potential impropriety or mismanagement promptly. In Allegheny, Pennsylvania, the demand for accounting from a fiduciary plays a crucial role in promoting the fair administration of estates, trusts, and guardianship. It ensures that beneficiaries or wards are protected and that the fiduciaries uphold their duties in accordance with the law.

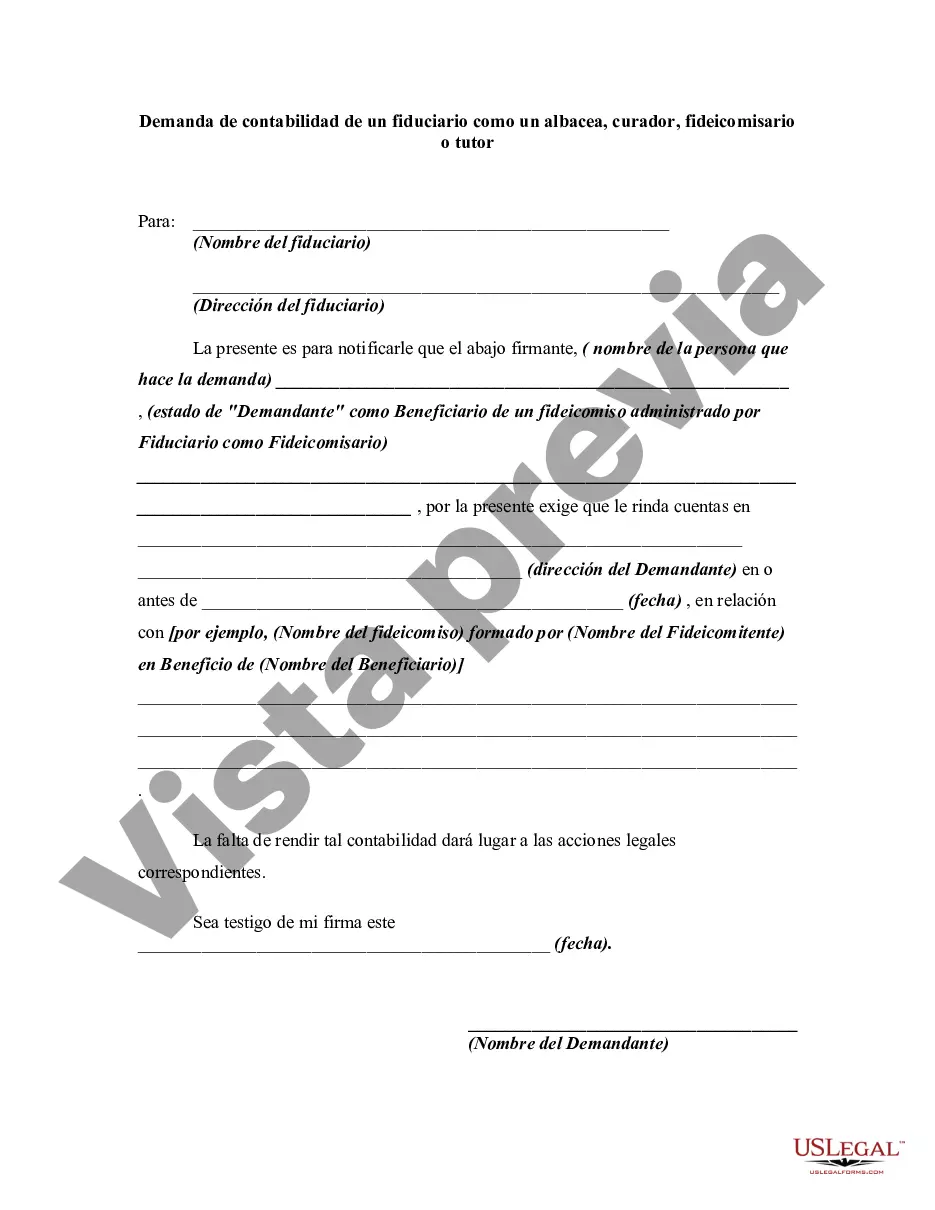

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.