An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Chicago, Illinois is a bustling city that is home to a diverse population and a thriving economy. With its rich history, vibrant culture, and stunning architectural landmarks, Chicago is a city that offers something for everyone. One of the key aspects of maintaining a successful financial system in Chicago is the demand for accounting services from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. Executors, also known as personal representatives, play a crucial role in administering a deceased person's estate. Their responsibilities include managing the estate's financial affairs, paying debts and taxes, distributing assets to beneficiaries, and ensuring that the wishes outlined in the individual's will are carried out. The demand for accounting from Executors in Chicago is particularly high due to the city's large population and the prevalence of complex estates. Conservators, on the other hand, are appointed by the court to manage the financial affairs and personal needs of an individual who is unable to do so themselves. This includes individuals with disabilities, minors, or individuals who lack the capacity to handle their own financial matters. Accounting services from Conservators in Chicago are crucial to ensuring that the wealth and assets of these individuals are properly managed and accounted for. Trustees are responsible for managing and distributing assets held in a trust for the benefit of designated beneficiaries. Whether it is a family trust, charitable trust, or business trust, Trustees have a fiduciary duty to act in the best interests of those beneficiaries. The demand for accounting from Trustees in Chicago is substantial, given the city's significant number of trusts and the need for accurate financial reporting. Legal Guardians are individuals appointed by the court to make personal and financial decisions on behalf of minors or individuals who are deemed incapacitated. Guardianship accounting services are essential to account for the financial transactions made on behalf of the individuals under their care and ensure transparency and accountability. In conclusion, Chicago, Illinois, a city known for its vibrant culture and strong financial system, has a high demand for accounting services from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals play indispensable roles in managing and safeguarding the financial affairs of estates, individuals with disabilities, trusts, and minors. With a diverse range of accounting needs, such as estate accounting, trust accounting, and guardianship accounting, it is crucial for fiduciaries in Chicago to obtain accurate accounting services to meet legal requirements and protect the interests of beneficiaries.Chicago, Illinois is a bustling city that is home to a diverse population and a thriving economy. With its rich history, vibrant culture, and stunning architectural landmarks, Chicago is a city that offers something for everyone. One of the key aspects of maintaining a successful financial system in Chicago is the demand for accounting services from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. Executors, also known as personal representatives, play a crucial role in administering a deceased person's estate. Their responsibilities include managing the estate's financial affairs, paying debts and taxes, distributing assets to beneficiaries, and ensuring that the wishes outlined in the individual's will are carried out. The demand for accounting from Executors in Chicago is particularly high due to the city's large population and the prevalence of complex estates. Conservators, on the other hand, are appointed by the court to manage the financial affairs and personal needs of an individual who is unable to do so themselves. This includes individuals with disabilities, minors, or individuals who lack the capacity to handle their own financial matters. Accounting services from Conservators in Chicago are crucial to ensuring that the wealth and assets of these individuals are properly managed and accounted for. Trustees are responsible for managing and distributing assets held in a trust for the benefit of designated beneficiaries. Whether it is a family trust, charitable trust, or business trust, Trustees have a fiduciary duty to act in the best interests of those beneficiaries. The demand for accounting from Trustees in Chicago is substantial, given the city's significant number of trusts and the need for accurate financial reporting. Legal Guardians are individuals appointed by the court to make personal and financial decisions on behalf of minors or individuals who are deemed incapacitated. Guardianship accounting services are essential to account for the financial transactions made on behalf of the individuals under their care and ensure transparency and accountability. In conclusion, Chicago, Illinois, a city known for its vibrant culture and strong financial system, has a high demand for accounting services from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals play indispensable roles in managing and safeguarding the financial affairs of estates, individuals with disabilities, trusts, and minors. With a diverse range of accounting needs, such as estate accounting, trust accounting, and guardianship accounting, it is crucial for fiduciaries in Chicago to obtain accurate accounting services to meet legal requirements and protect the interests of beneficiaries.

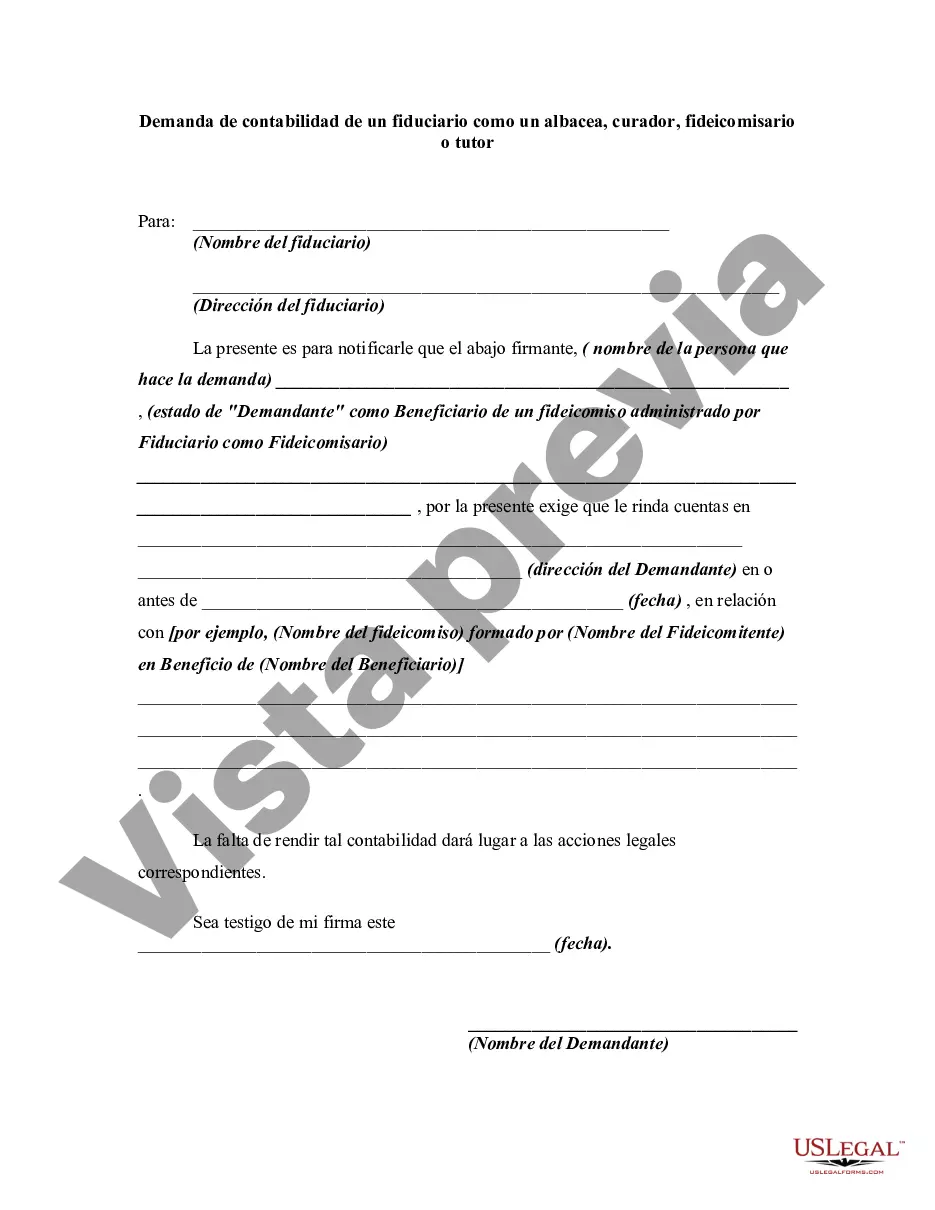

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.