An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Contra Costa California Demand for Accounting: Understanding the Need for Accountability from Fiduciaries In Contra Costa County, California, individuals who serve as fiduciaries, such as Executors, Conservators, Trustees, or Legal Guardians, are legally obligated to provide periodic accounting to interested parties. These accounting ensure transparency, protect beneficiaries, and foster trust in the fiduciary's actions. This article explores the different types of demand for accounting and why they are necessary for each role. Executor Demand for Accounting: When named as an executor in a will, an individual assumes responsibility for managing the deceased person's estate. Executors must maintain detailed records of assets, debts, income, and expenses throughout the probate process until the estate's final distribution. Interested parties, such as beneficiaries or creditors, may request an accounting to ensure that the executor is fulfilling their duties faithfully, protecting the interests of all involved. Conservator Demand for Accounting: When a Conservator is appointed by the court to manage the affairs of a person who is unable to do so themselves, accounting becomes crucial. A Conservator is responsible for tracking and documenting both income and expenses related to the conservative's estate and personal needs. Family members or interested parties may demand an accounting to ensure that the Conservator is acting in the conservative's best interests, managing their finances responsibly, and avoiding any misappropriation of funds. Trustee Demand for Accounting: Trustees are entrusted with managing the assets held in a trust for the benefit of the beneficiaries. They hold a fiduciary duty to handle the trust's finances prudently and disclose relevant financial information to beneficiaries. Trust beneficiaries may demand an accounting to ensure that the trustee is fulfilling their obligations, providing a transparent view of the trust's financial activities, investments, distributions, and expenses. Legal Guardian Demand for Accounting: When appointed as a Legal Guardian by the court, an individual assumes responsibility for the personal and financial affairs of a minor or incapacitated person. A Legal Guardian must maintain accurate records of income, expenses, and investments related to their ward. Interested parties, such as other family members or the ward themselves, may request an accounting to ensure that the Legal Guardian is acting in their best interests, managing their finances appropriately, and preventing any potential financial abuse. Overall, the demand for accounting from fiduciaries, including Executors, Conservators, Trustees, or Legal Guardians, is pivotal for maintaining integrity, protecting beneficiaries' interests, and upholding financial accountability. Interested parties have the right to request accounting as a means to verify that fiduciaries are fulfilling their duties in compliance with the law. These accounting provide a detailed breakdown of financial transactions, allowing concerned parties to address any potential issues and resolve them amicably.Contra Costa California Demand for Accounting: Understanding the Need for Accountability from Fiduciaries In Contra Costa County, California, individuals who serve as fiduciaries, such as Executors, Conservators, Trustees, or Legal Guardians, are legally obligated to provide periodic accounting to interested parties. These accounting ensure transparency, protect beneficiaries, and foster trust in the fiduciary's actions. This article explores the different types of demand for accounting and why they are necessary for each role. Executor Demand for Accounting: When named as an executor in a will, an individual assumes responsibility for managing the deceased person's estate. Executors must maintain detailed records of assets, debts, income, and expenses throughout the probate process until the estate's final distribution. Interested parties, such as beneficiaries or creditors, may request an accounting to ensure that the executor is fulfilling their duties faithfully, protecting the interests of all involved. Conservator Demand for Accounting: When a Conservator is appointed by the court to manage the affairs of a person who is unable to do so themselves, accounting becomes crucial. A Conservator is responsible for tracking and documenting both income and expenses related to the conservative's estate and personal needs. Family members or interested parties may demand an accounting to ensure that the Conservator is acting in the conservative's best interests, managing their finances responsibly, and avoiding any misappropriation of funds. Trustee Demand for Accounting: Trustees are entrusted with managing the assets held in a trust for the benefit of the beneficiaries. They hold a fiduciary duty to handle the trust's finances prudently and disclose relevant financial information to beneficiaries. Trust beneficiaries may demand an accounting to ensure that the trustee is fulfilling their obligations, providing a transparent view of the trust's financial activities, investments, distributions, and expenses. Legal Guardian Demand for Accounting: When appointed as a Legal Guardian by the court, an individual assumes responsibility for the personal and financial affairs of a minor or incapacitated person. A Legal Guardian must maintain accurate records of income, expenses, and investments related to their ward. Interested parties, such as other family members or the ward themselves, may request an accounting to ensure that the Legal Guardian is acting in their best interests, managing their finances appropriately, and preventing any potential financial abuse. Overall, the demand for accounting from fiduciaries, including Executors, Conservators, Trustees, or Legal Guardians, is pivotal for maintaining integrity, protecting beneficiaries' interests, and upholding financial accountability. Interested parties have the right to request accounting as a means to verify that fiduciaries are fulfilling their duties in compliance with the law. These accounting provide a detailed breakdown of financial transactions, allowing concerned parties to address any potential issues and resolve them amicably.

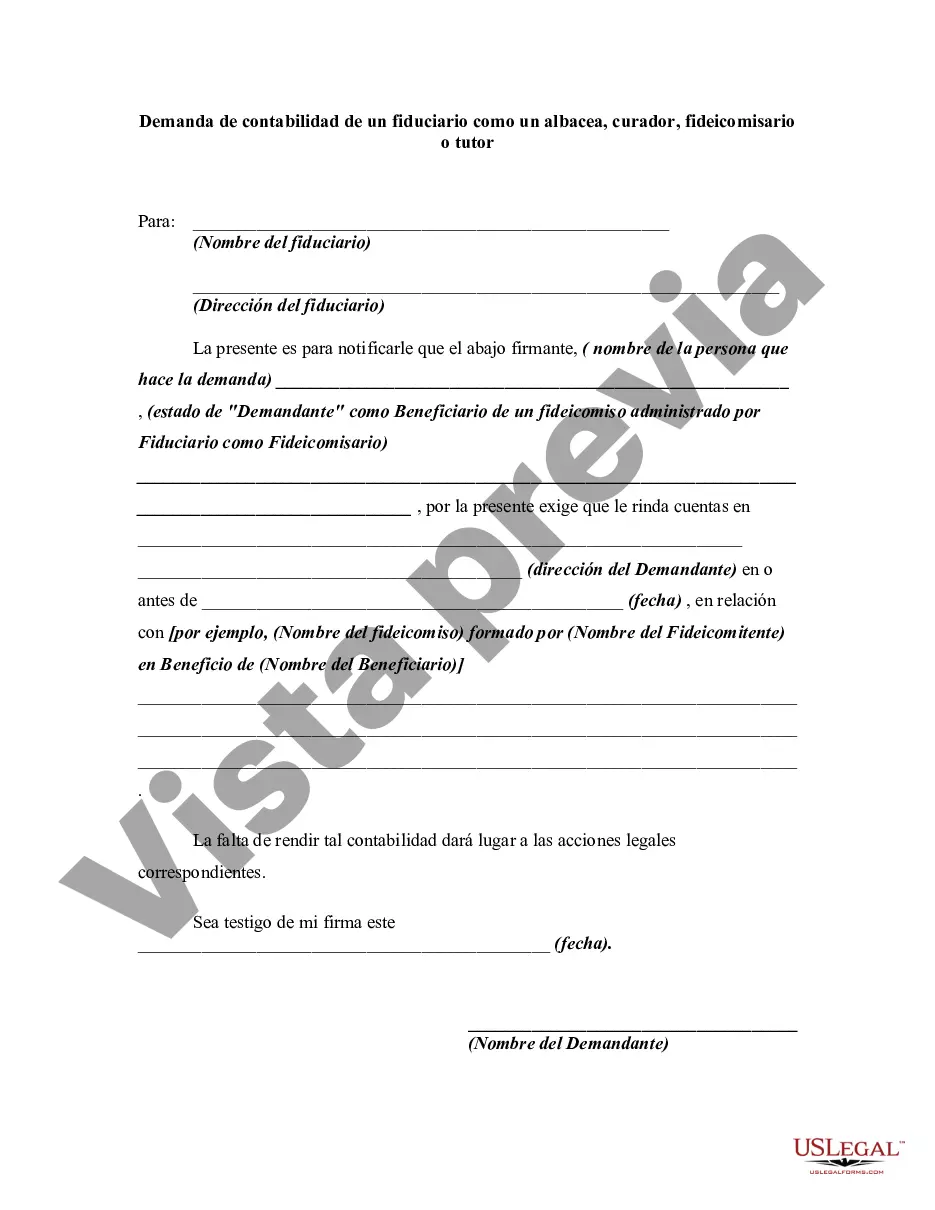

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.