An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Franklin Ohio is a vibrant community located in Warren County, in the southwestern part of the state. It is known for its rich history, thriving economy, and beautiful natural surroundings. The demand for accounting services from a fiduciary, including executors, conservators, trustees, and legal guardians, is crucial in this area to ensure transparency, accountability, and proper management of financial affairs. 1. Executor Accounting in Franklin Ohio: As a fiduciary, an executor is responsible for handling the financial matters and assets of a deceased individual's estate. Franklin Ohio demands accurate accounting practices from executors to document all transactions, assets, liabilities, and distributions throughout the estate administration process. This is vital to ensure the fair and appropriate distribution of assets among heirs or beneficiaries. 2. Conservator Accounting in Franklin Ohio: In cases involving individuals who are unable to handle their own financial affairs due to age, disability, or incapacity, a conservator may be appointed by the court to manage their financial matters. The Franklin Ohio community requires meticulous accounting practices from conservators, ensuring that all financial transactions, investments, and disbursements are properly documented and available for review. 3. Trustee Accounting in Franklin Ohio: Trustees play a significant role in managing trusts, which are legal arrangements where assets are held and managed on behalf of beneficiaries. To maintain the beneficiaries' trust and safeguard their interests, Franklin Ohio places importance on accurate accounting from trustees. Trustees must maintain thorough records, including assets, investments, income, expenses, and distributions, assuring beneficiaries that their interests are protected. 4. Legal Guardian Accounting in Franklin Ohio: Legal guardians are often appointed to handle the financial affairs of minors or incapacitated individuals. Franklin Ohio emphasizes the need for transparent accounting practices by legal guardians. These individuals must carefully document financial transactions while ensuring funds are utilized for the welfare and benefit of the individuals under their care. The demand for accounting services from fiduciaries in Franklin Ohio arises from the community's commitment to protecting the interests of beneficiaries and ensuring responsible financial management. Accurate and transparent accounting practices greatly contribute to maintaining the community's trust in these fiduciaries, upholding their ethical and legal obligations.Franklin Ohio is a vibrant community located in Warren County, in the southwestern part of the state. It is known for its rich history, thriving economy, and beautiful natural surroundings. The demand for accounting services from a fiduciary, including executors, conservators, trustees, and legal guardians, is crucial in this area to ensure transparency, accountability, and proper management of financial affairs. 1. Executor Accounting in Franklin Ohio: As a fiduciary, an executor is responsible for handling the financial matters and assets of a deceased individual's estate. Franklin Ohio demands accurate accounting practices from executors to document all transactions, assets, liabilities, and distributions throughout the estate administration process. This is vital to ensure the fair and appropriate distribution of assets among heirs or beneficiaries. 2. Conservator Accounting in Franklin Ohio: In cases involving individuals who are unable to handle their own financial affairs due to age, disability, or incapacity, a conservator may be appointed by the court to manage their financial matters. The Franklin Ohio community requires meticulous accounting practices from conservators, ensuring that all financial transactions, investments, and disbursements are properly documented and available for review. 3. Trustee Accounting in Franklin Ohio: Trustees play a significant role in managing trusts, which are legal arrangements where assets are held and managed on behalf of beneficiaries. To maintain the beneficiaries' trust and safeguard their interests, Franklin Ohio places importance on accurate accounting from trustees. Trustees must maintain thorough records, including assets, investments, income, expenses, and distributions, assuring beneficiaries that their interests are protected. 4. Legal Guardian Accounting in Franklin Ohio: Legal guardians are often appointed to handle the financial affairs of minors or incapacitated individuals. Franklin Ohio emphasizes the need for transparent accounting practices by legal guardians. These individuals must carefully document financial transactions while ensuring funds are utilized for the welfare and benefit of the individuals under their care. The demand for accounting services from fiduciaries in Franklin Ohio arises from the community's commitment to protecting the interests of beneficiaries and ensuring responsible financial management. Accurate and transparent accounting practices greatly contribute to maintaining the community's trust in these fiduciaries, upholding their ethical and legal obligations.

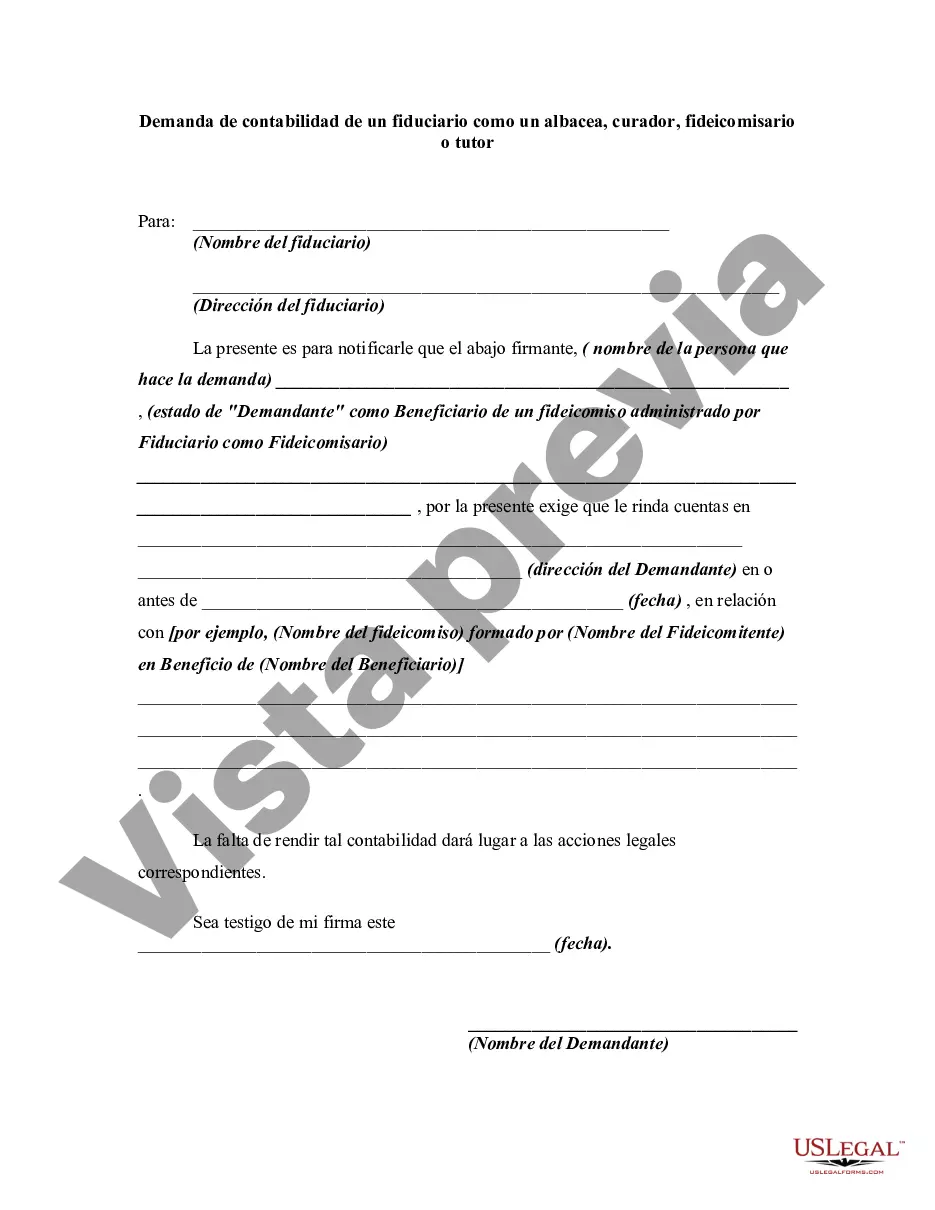

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.