An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Title: Houston Texas Demand for Accounting by a Fiduciary: Understanding Executor, Conservator, Trustee, and Legal Guardian Responsibilities Introduction: In Houston, Texas, demanding accounting from fiduciaries such as Executors, Conservators, Trustees, or Legal Guardians is a crucial process ensuring transparency and accountability in managing financial matters and assets. This article will delve into the comprehensive description of Houston Texas Demand for Accounting from these fiduciaries, explaining their roles and responsibilities, the legal framework supporting demand for accounting, and the different types of fiduciaries involved. 1. Understanding Fiduciaries in Houston, Texas: Fiduciaries are individuals entrusted with managing another person's affairs or assets. In Houston, Texas, the following titles represent distinct fiduciary roles: — Executor: An individual appointed by the deceased's will to settle the estate affairs, including paying debts, distributing assets, and filing tax returns. — Conservator: A person appointed to manage the financial affairs and protect the best interests of an incapacitated adult or a minor. — Trustee: Responsible for managing and administering assets held in a trust according to the trust's terms and the beneficiaries' best interests. — Legal Guardian: An individual assuming responsibility for the personal affairs and well-being of a minor or incapacitated adult. 2. The Importance of Demand for Accounting: Demanding accounting from fiduciaries helps ensure transparency and accountability in their roles. It allows beneficiaries or interested parties to review financial transactions, ensure adherence to legal obligations, verify accuracy, identify potential mismanagement or fraud, and assess proper asset distribution. 3. Legal Framework Supporting Demand for Accounting: Houston, Texas, operates under various laws and regulations governing fiduciaries' accountability, including but not limited to: — The Texas Estates Code: Defines the responsibilities of Executors and their duty to provide accounts upon demand. — The Texas Trust Code: Outlines Trustee responsibilities and the right of beneficiaries to request periodic accounting. — The Texas Guardianship Code: Sets standards for Conservators and Legal Guardians, including their obligation to provide financial accounting. 4. Types of Houston Texas Demand for Accounting: Demand for accounting from fiduciaries can take different forms, depending on the specific fiduciary and their role: — Executor's Accounting: Beneficiaries may request a detailed account of an estate's assets, income, expenses, and distribution to ensure fair execution. — Conservator's Accounting: Requesting an accounting report on the financial activities and management of an incapacitated person's assets by the Conservator. — Trustee's Accounting: Beneficiaries can demand periodic or final accounting, ensuring transparency in trust management, expense distribution, and asset records. — Guardian's Accounting: Seeking financial reports and records from a Legal Guardian responsible for managing an incapacitated person's personal and financial affairs. Conclusion: Demanding accounting from fiduciaries in Houston, Texas, plays a significant role in safeguarding beneficiaries' interests, ensuring adherence to legal obligations, and promoting transparency. Executors, Conservators, Trustees, and Legal Guardians have distinct responsibilities, and beneficiaries can request specific types of accounting reports to ensure proper management, fair distribution, and accountability within their defined roles.Title: Houston Texas Demand for Accounting by a Fiduciary: Understanding Executor, Conservator, Trustee, and Legal Guardian Responsibilities Introduction: In Houston, Texas, demanding accounting from fiduciaries such as Executors, Conservators, Trustees, or Legal Guardians is a crucial process ensuring transparency and accountability in managing financial matters and assets. This article will delve into the comprehensive description of Houston Texas Demand for Accounting from these fiduciaries, explaining their roles and responsibilities, the legal framework supporting demand for accounting, and the different types of fiduciaries involved. 1. Understanding Fiduciaries in Houston, Texas: Fiduciaries are individuals entrusted with managing another person's affairs or assets. In Houston, Texas, the following titles represent distinct fiduciary roles: — Executor: An individual appointed by the deceased's will to settle the estate affairs, including paying debts, distributing assets, and filing tax returns. — Conservator: A person appointed to manage the financial affairs and protect the best interests of an incapacitated adult or a minor. — Trustee: Responsible for managing and administering assets held in a trust according to the trust's terms and the beneficiaries' best interests. — Legal Guardian: An individual assuming responsibility for the personal affairs and well-being of a minor or incapacitated adult. 2. The Importance of Demand for Accounting: Demanding accounting from fiduciaries helps ensure transparency and accountability in their roles. It allows beneficiaries or interested parties to review financial transactions, ensure adherence to legal obligations, verify accuracy, identify potential mismanagement or fraud, and assess proper asset distribution. 3. Legal Framework Supporting Demand for Accounting: Houston, Texas, operates under various laws and regulations governing fiduciaries' accountability, including but not limited to: — The Texas Estates Code: Defines the responsibilities of Executors and their duty to provide accounts upon demand. — The Texas Trust Code: Outlines Trustee responsibilities and the right of beneficiaries to request periodic accounting. — The Texas Guardianship Code: Sets standards for Conservators and Legal Guardians, including their obligation to provide financial accounting. 4. Types of Houston Texas Demand for Accounting: Demand for accounting from fiduciaries can take different forms, depending on the specific fiduciary and their role: — Executor's Accounting: Beneficiaries may request a detailed account of an estate's assets, income, expenses, and distribution to ensure fair execution. — Conservator's Accounting: Requesting an accounting report on the financial activities and management of an incapacitated person's assets by the Conservator. — Trustee's Accounting: Beneficiaries can demand periodic or final accounting, ensuring transparency in trust management, expense distribution, and asset records. — Guardian's Accounting: Seeking financial reports and records from a Legal Guardian responsible for managing an incapacitated person's personal and financial affairs. Conclusion: Demanding accounting from fiduciaries in Houston, Texas, plays a significant role in safeguarding beneficiaries' interests, ensuring adherence to legal obligations, and promoting transparency. Executors, Conservators, Trustees, and Legal Guardians have distinct responsibilities, and beneficiaries can request specific types of accounting reports to ensure proper management, fair distribution, and accountability within their defined roles.

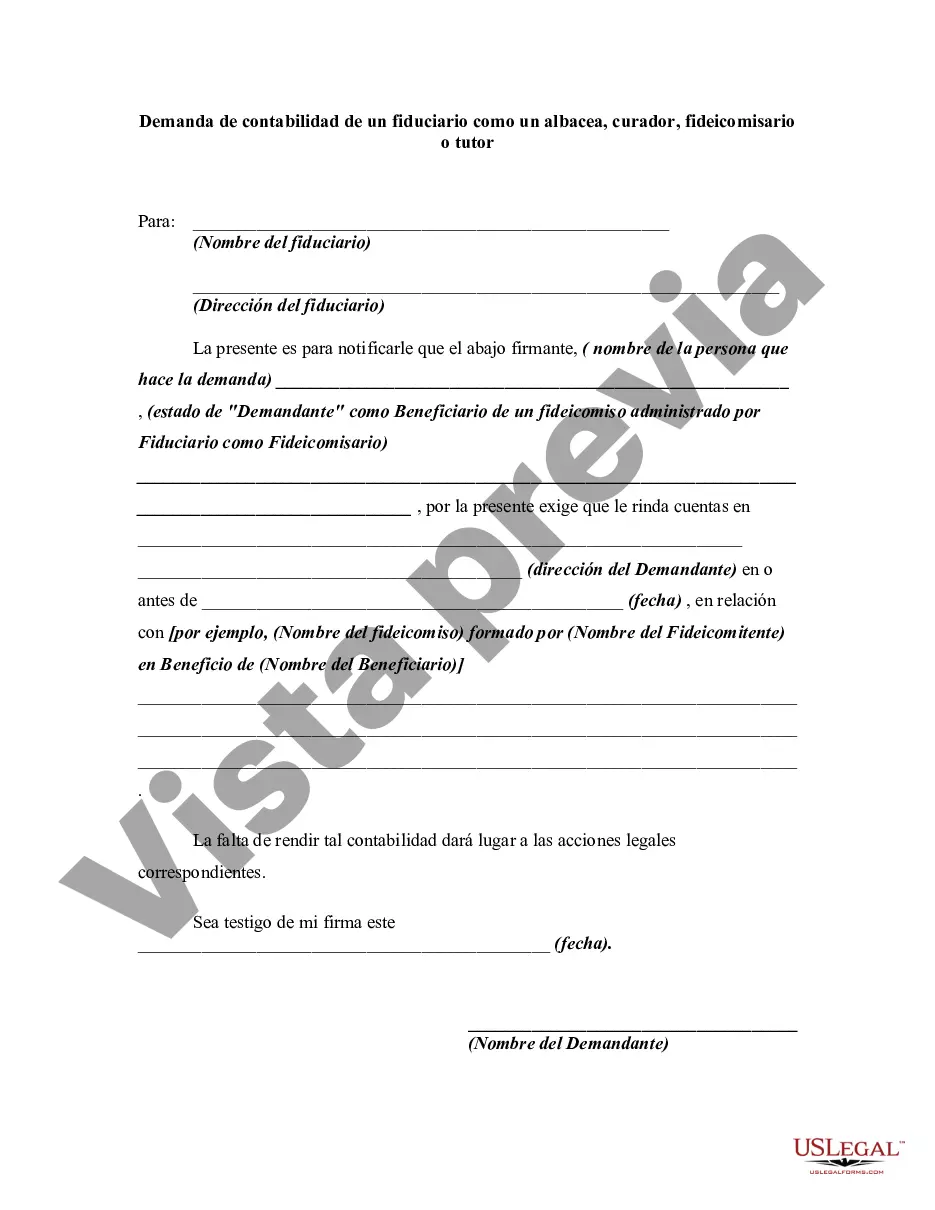

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.